The Fed Stands Alone

If you read the news today … oh, boy.

Four thousand cases in Blackburn, Arizona. And though the cases were rather small, no case is small when it’s the ‘ronaaaa.

I don’t want to turn you off, but the Dow dropped nearly 800 points during the day. The rest of the market plunged 3% across the board. (Yes, I know there’s no Blackburn, Arizona. I was riffing on Beatles lyrics. Cut me some slack.)

According to the mainstream financial media, Wall Street is worried about the latest spike in U.S. COVID-19 cases. More than 31,000 cases were reported on Monday, with California accounting for 6,000 of those. Over in the great state of Texas, hospitalizations have set new records for 12 days in a row.

Not to be callous, but I don’t buy this reasoning. So far, Wall Street ignored the rising infection rates. Why should today’s news be any different?

The real reason investors worried today is that signs emerged that the U.S. government is moving on from the crisis — right as cases rebound sharply.

Increased pandemic unemployment benefits, eviction reprieves and cash for small businesses are all slated to expire at the end of next month. Funding for additional COVID-19 testing expires next week. The Senate continues to stall on the idea of additional stimulus payments.

At every turn, Washington is backing away from its initial flood of support for the U.S. economy.

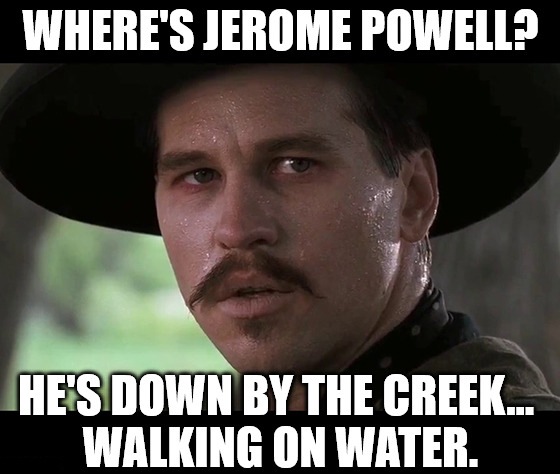

But, that’s OK, right? We still have the Federal Reserve! Jerome Powell is our savior!

Fed Chairman Powell’s unlimited stimulus plan has, so far, supported the massive rebound from March’s lows.

But, as Ted Bauman, editor of The Bauman Letter, notes, “there are reasons to doubt that the Fed can continue to perform this financial Wedding at Cana miracle indefinitely.”

In his latest article, Ted details the “Holy Trinity” of this supposed new bull market … for which the Fed’s continued financial support is key. Powell is already buying hand-over-fist to support the market — a buying spree that now includes corporate debt, which may or may not be legal. As Ted notes, a legal challenge to this behavior could have a massive chilling effect.

Furthermore, with the government backing away from economic stimulus, the Fed is now the last bastion of support for the market. With government stimulus dying out, how long will it take before pressure builds on the Fed to directly support Main Street in the same manner that it supports Wall Street?

The Fed may have deep pockets, but they aren’t as unlimited as Powell would like to think.

How long can Powell walk on water? How long can the Fed turn that water into bull market gains?

As an investor, those are the questions you should ask yourself right now. With the U.S. government backing away from the crisis, the Fed stands alone.

Of course, if you’re a Great Stuff reader, you’re never alone! We can’t trust Wall Street to see the writing on the propped-market wall, but you can trust that Ted will.

He’s brought his readers insights on how to survive and thrive in volatile situations for years. When the Fed’s backstop backs out … Ted’s straight-shooter trade research is what you want to have in your corner.

Going: Dell or High Water

Dell Technologies Inc. (NYSE: DELL) was among the few bright spots in the market today. And, as you might suspect in this market, the rally was all speculation driven.

Dell is reportedly mulling a VMware Inc. (NYSE: VMW) spinoff … or buying out the remaining 19% of VMware it doesn’t own … or doing nothing. Yes, that’s it. That’s the exciting speculation that saw DELL rally 7% while the rest of the market tanked.

The company might do something with VMware. It might not. That’s all it took to get the analyst community buzzing:

- Morgan Stanley said the pair was “better together.”

- Wedbush believes that Dell is an “albatross around the VMware story.”

- Evercore ISI thinks VMware is holding Dell back “Our valuation suggests Dell could be worth a significant premium vs. its current trading price.”

- Citi thinks both would be better off on their own, deleveraging Dell and removing poor corporate governance from VMware.

In the end, nobody can agree on anything — not whether Dell is making a move with VMware, and not whether any such move would be good for either company.

Great Stuff’s suggestion? Don’t chase Dell or VMware on today’s news. It really is nothing.

Going: It’s a Gas, Gas, Gas

Hydrogen, the most abundant element in the universe, is making a comeback … and Plug Power Inc. (Nasdaq: PLUG) is leading the way.

Plug was a shining star in the market today. The purveyor of hydrogen engines received no less than seven price target increases. And that’s not just hot air. Plug lifted its long-term revenue outlook and completed key industry acquisitions.

Yesterday, the company announced it finalized its purchases of United Hydrogen Group and Giner ELX. As a result, Plug lifted its 2024 revenue projections from $1 billion to $1.2 billion.

Hydrogen has seen a resurgence of interest lately, due in part to the rise of Nikola Corp. (Nasdaq: NKLA) and its line of hydrogen-fueled semitrucks.

“Plug Power is one of the few viable renewable energy companies that offers an alternative to the mainstream alternatives (solar and wind),” Barclays analyst Moses Sutton said in a research note.

If you’re looking to PLUG that alternative energy hole in your portfolio, don’t chase today’s rally. Wait for a pullback to the $7 area or better to maximize your returns.

Besides, if you ask Paul , there’s a better energy revolution coming our way right now. Click here for the scoop.

Gone: Rivals Closed? Game on.

Analysts peddled two upgrades for Peloton Interactive Inc. (Nasdaq: PTON) this week. On Monday, Stifel analyst Scott Devitt raised his price target from $55 to $62, echoed by a Cowen upgrade today from analyst John Blackledge.

Now, I’m pretty indifferent on PTON. I think it’s a niche industry leader, but I can easily see others undercutting virtually everything that Peloton does. What really yanks my stationary bike chain is more “totally a tech company” tripe…

Analyst Blackledge wrote to clients that “the company should be viewed not as a fitness brand but rather as a direct to consumer tech company that is leveraging the internet to reach customers during an inflection point for the industry.”

Right. If Peloton is a tech company, then so is Jim Bob’s Chicken Shack. It’s a local business just down the road from me that’s “leveraging the internet to reach customers.” For the last time, Peloton isn’t a flipping tech company.

Ahem … as for the inflection point, the one where Peloton’s competition is mostly closed. Yes, I know people started to revisit their local gyms for workouts now … but the bulk of PTON’s surge has been while the rest of the fitness industry is practically stuck home doing situps in the dining room.

If you’re one of many who haven’t braved the Great Reopening yet … most people’s current exercise decision, if it gets to that point, consists of: “Gee, should I bicep curl the Yorkie again or hunt down that Wii Fit thing from last decade?”

After yesterday’s second upgrade, PTON shares were up about 10% for the week, but today’s volatility kept most gains stationary. My bottom line is that, if you’re in, let it … ride until the unlicensed music stops? Just know that Peloton sits on a throne of easy breaks with good timing and a whole lot of shuttered competition.

It’s time we turn once again to the Poll of the Week!

I know, you’ve probably seen scare-mongering headlines…

Total lockdowns! Business closures! Empty streets — reopening’s over!

Great Stuff knows that recent resurgences in COVID-19 cases are different from town to town, county to county and especially state to state. And we won’t even start down the rabbit hole of international reactions…

That said, we want to know what you think about another wave of business closures or lockdowns. Today, you are our “boots on the ground” source, sharing the lowdown from your side of Main Street. So click the icon below and tell us:

Yeah, we’re picking up our broad brush and talking general here. Why? Frankly, the Great Stuff fan base is wider than the Fed’s appetite for junk corporate debt. We have folks writing in from all over the globe, and if there’s more you’d like to say, by all means, say it!

Reach out to GreatStuffToday@BanyanHill.com with your personal and local lockdown stories — if you’re comfortable sharing, that is.

Great Stuff: Past Polls, Smashing Goals

By the way, last week’s Poll was a hoot and a half — y’all seem to love Great Stuff Picks!

Yes … if you were one of the roughly 21% wondering about Great Stuff Picks, we love to share any must-have stock recommendations with you. It’s not all just free laughs and memes around here. We have bang-up profit opportunities too!

Another 45% of you have invested in our trades (congrats), and 33% (give or take) have yet to revel in the trade-happy action. Either way, thank you for answering our Poll! We’ll keep the trades coming, but see, you never know when the perfect setup will waltz into our stock market saloon…

I guess you’ll just have to stay tuned then! You don’t want to miss out on our next triple-digit gain, after all.

Though, you can always check us out on Facebook, Instagram and Twitter.

Until next time, stay Great.

Joseph Hargett

Editor, Great Stuff