The dollar bears have a logical argument: When the dollar falls, imports become more expensive. This leads to inflation. And because gold also tends to rise when the dollar falls, gold is a logical inflation hedge.

There’s just one problem with the theory: It doesn’t work.

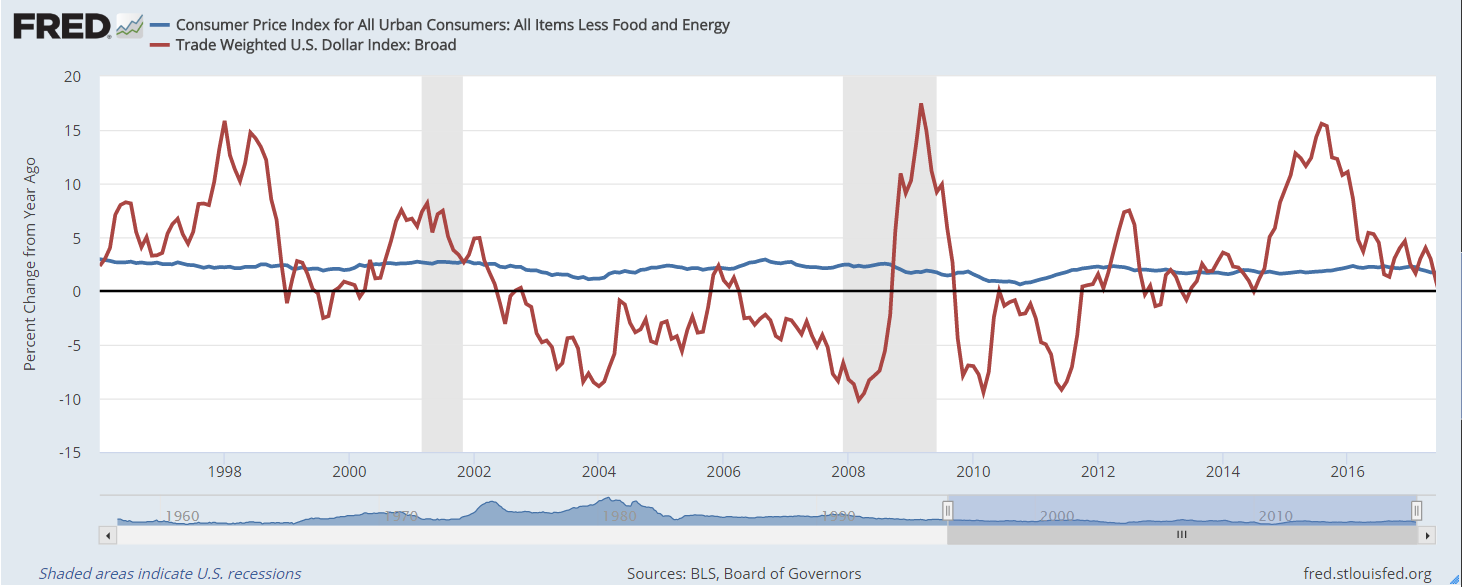

The chart below shows changes in inflation as the blue line. Inflation is relatively stable. The value of the dollar (the red line) makes wide-ranging moves every year. But changes in one seem to have nothing to do with the other.

(Source: Federal Reserve)

The bears are concerned that the dollar has fallen about 7% this year. In an average full year, the dollar index moves about 8% to 10%. So this year might be a little more volatile than average.

The bears worry that a decline in the dollar make imports more expensive. German cars are an example. The price German manufacturers charge in euros doesn’t change. But U.S. consumers need more dollars to pay in euros. Logically, a lower dollar increases inflation.

But the logic breaks down in the face of data. In a research note, the Wells Fargo economics team noted: “Whereas the prices of most imports are affected by changes in the value of the dollar, not all of the goods that are consumed in the United States are directly affected by exchange rate changes.”

About 75% of the goods purchased by American consumers are made in America. About 94% of services are U.S.-based.

The overwhelming majority of consumer spending is not directly affected by changes in the value of the dollar. The dollar has little effect on inflation. The impact can be large for specific companies or items, but the dollar isn’t something the average consumer should worry about.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader