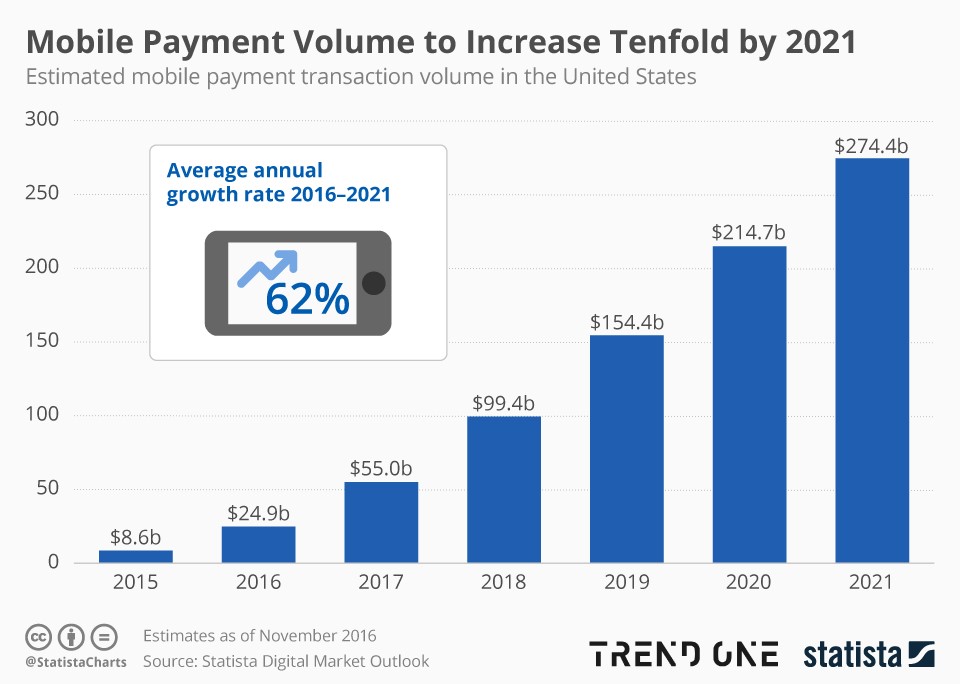

No matter where you go, you are bound to see people constantly looking down at their phones. They could be texting, but more than likely they’re on social media, which is full of advertisements. Those advertisements will, at some point, surely lead to a purchase by just about everyone, spawning rapid growth in the mobile payments industry.

All sorts of companies are embracing this trend. Now that everyone spends hours a day on their phones, we’re being flooded with advertisements, as you may have noticed. Any company trying to stay afloat nowadays, especially retail companies going up against Amazon, will have its own app that has an easy mobile payment option. Otherwise, people may look elsewhere to buy.

Mobile payments are also relatively safe. Your phone is always with you, so it will not be stolen like cash or credit cards in an event such as a break-in. These payments are also password-protected and encrypted, so even if someone does get ahold of your phone, your information is secure.

There is also no issue with having insufficient funds, which is a risk of credit card and check payments. When you pay for something on your phone, the payment platform makes sure that you have the funds available to pay before the transaction is complete.

One of the leading mobile payment processors is Square Inc. (NYSE: SQ), which charges about 2% to 3% per transaction. Right now, it’s the leader in its field, and as this industry continues to grow, mobile payment processors and digital wallets will continue to overtake traditional cash and card payment systems.

Regards,

Ian Dyer

Internal Analyst, Banyan Hill Publishing