We all know 2020 was wild for the stock market.

We started the year with a quick 30% plunge … followed by a record setting rally.

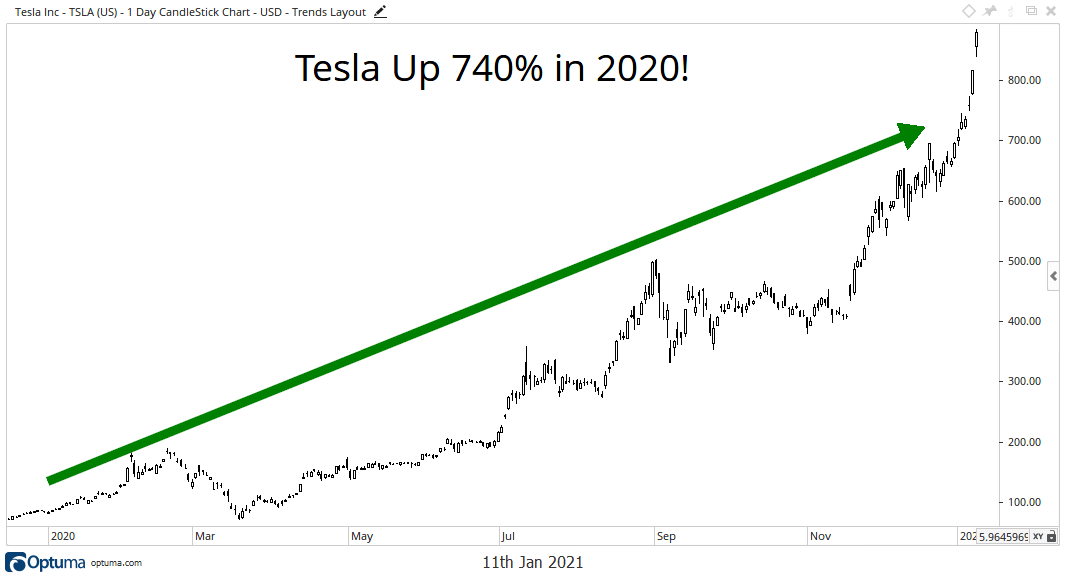

But one stock stood out head and shoulders above the rest — Tesla (Nasdaq: TSLA).

Shares plunged 60% during the pandemic. They fell another 30% when the market rally stalled at the beginning of September.

All that did nothing to disrupt Tesla’s performance for the year.

Shares rocketed 740% in 2020 alone.

If you missed out on this rally, you are not alone.

Only the diehard Tesla fans were able to ride out this surge. And we have to congratulate anyone who allowed Tesla to carry their fortunes higher. This has been a banner year for the stock.

The surging stock helped Elon Musk, Tesla’s CEO, become the richest person on the planet with a $185 billion net worth.

Since the company went public in 2010, it has never had a better year.

I even sat out on the run Tesla has gone through for the most part. I only had exposure to Tesla for 65 days — less than 20% of the year.

But those trades still racked up returns of 670%!

Let me show you how that’s possible…

Tesla Made Real Gains

We talk a lot about mispricing in American Investor Today. It means that there’s a gap between a stock’s price and where it should be. Sometimes the market behaves irrationally, and that gives us a chance to profit.

Look, I don’t know why Tesla’s share price is up that much. I also don’t know if its fundamentals will ever justify its share price. That doesn’t mean Tesla can’t keep going higher from here.

To me, none of that matters. I made 670% from the stock last year by simply following my favorite strategy.

It told me when to get in and when to get out of the stock four different times last year — in January, May, July and October, after the company reported earnings.

I’ve developed a short list of 73 stocks that experience what’s known as “the post earnings drift.” It’s a period of up to two months after a company reports earnings where the stock is mispriced.

Tesla hit this “Profit Trigger” four times last year — when its stock was mispriced in the market. Remember, this is a short-term situation. The trades lasted anywhere from four days to 35 days. In total, we were exposed to the share price for 65 days of the year…

And with just over two months of time, we managed to nearly replicate what took the stock the entire year to achieve.

My readers had the chance to walk away with cumulative gains of 670% from four trades on Tesla based on where we exited the second halves of our opportunities.

Here’s how we did it…

We Capitalized With Less Risk

We used options.

With the power of options, we didn’t have to hold through all of Tesla’s ups and downs to reap the benefits.

In just a fraction of the time, we were able to use options to leverage our returns for the year — and we never deviated from our overall strategy or took any unnecessary risks.

That’s the beauty of it. We weren’t chasing a hot stock — we simply stuck to our approach. When the mispricing was over, we exited.

I tip my hat to everyone who was able to hold on the entire year, even with the stock’s 60% drop and 30% drop.

I just don’t invest like that. I stick to my approach and use options to leverage our returns in a short period of time.

Again, once the mispricing we spot has played out, we exit. We preserve our gains and move on to the next trade. It’s that simple.

Since options are what make my approach possible, I’ve been helping thousands master trading options each week with my Weekly Options Corner.

Every Friday, I offer my insights into trading options to help everyone become a better trader.

If you ever wanted to learn more about options, or take options to the next level, then join us each week at no cost.

Regards,

Editor, Quick Hit Profits