If you ever have a chance to go to a collector car auction, take it…

The first one I ever attended was back in 2003. The auctioneers rolled a 1958 Mercedes-Benz 300 SL Roadster across the stage. It sold for $153,000! Out would come another classic, and, with a wave of a few paddles in the crowd, another couple hundred grand exchanged hands.

Back then, the late 1960s and early 1970s vintage American muscle cars — Pontiac GTOs, Chevy Camaros, Dodge Barracudas — were just starting to catch on.

A decade and a half later, and such vehicles are some of the hottest collector cars to own — and it just might be an indicator of a frothy economy primed to downshift into a lower gear…

Every January, car collectors from around the world gather in Scottsdale, Arizona, for a week-long series of auctions from the likes of Sotheby’s, Barrett-Jackson and other high-end auction houses.

The bidding is carefully watched and analyzed. Just how much will someone pay to acquire one of these chrome and steel works of vintage mechanical art?

If the January auctions were a standard piece of economic data, we’d say the “headline number” was OK — not quite $260 million worth of vehicles changed hands, the second largest in the event’s history.

Big-Money Buyers Heading for the Exits?

But dig down just a little, and the results look a little less inspiring … perhaps even worrying.

Auctioneers sold more than 3,400 vehicles. But the average selling price per vehicle ($89,601) was 11% lower than last year.

“The upper-middle market ($250,000 to $1 million) is softening,” was the assessment of analysts at Hagerty.

At the $250,000 to $1 million price range, we’re talking about relatively rare cars in good or better condition — think of a rare muscle car like a 1970 Plymouth Superbird with a V-8 hemi engine or a 1957 Rolls-Royce Silver Cloud (only a few thousand such vehicles exist today), or perhaps a 1969 Toyota 2000GT (fewer than 400 were built).

Hagerty also noted a “sustained pause” over the past year to its Blue Chip car index (which averages the values of 25 of the most sought-after collectible cars in the post-WW2 era).

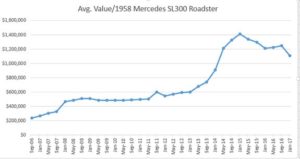

Remember that ’58 Benz Roadster I mentioned earlier? Its soaring value over the past decade appears to have peaked at $1.4 million a few years ago according to Hagerty’s data:

Is it possible that the “smart money” in collector cars is moving to the sidelines?

Perhaps more disturbing is Hagerty’s assessment from the Arizona auctions that “the bottom of the market remains strong” — collector cars priced at $100,000 or less.

At those prices, we’re talking about also-ran muscle cars, 1970s era SUVs, restored pickup trucks and the like. Nice to drive, nice to look at.

But not exactly rare.

As Hagerty noted, vehicles in that price range “were the most likely segments to sell above condition-appropriate prices” in today’s market.

When I read that, I can’t help but think of late-to-the-party house flippers in 2007, or day traders just before the tech bubble collapsed in 2000.

Kind regards,

JL Yastine

Editorial Director