Central bankers have a complicated relationship with inflation. They want some inflation, usually around 2%, because they believe that is good, but any higher than that is bad. For some reason, central bankers seem to believe they can control inflation and keep it under 2%. They fear inflation above that level because they aren’t certain they can control it.

To control inflation, central bankers try to tell us what to think. As long as we believe inflation will remain low, we tend to spend in ways that keep inflation low. If we believe inflation is rising, we may start stockpiling goods while prices are low, creating short-term pressure on prices and unleashing even higher inflation.

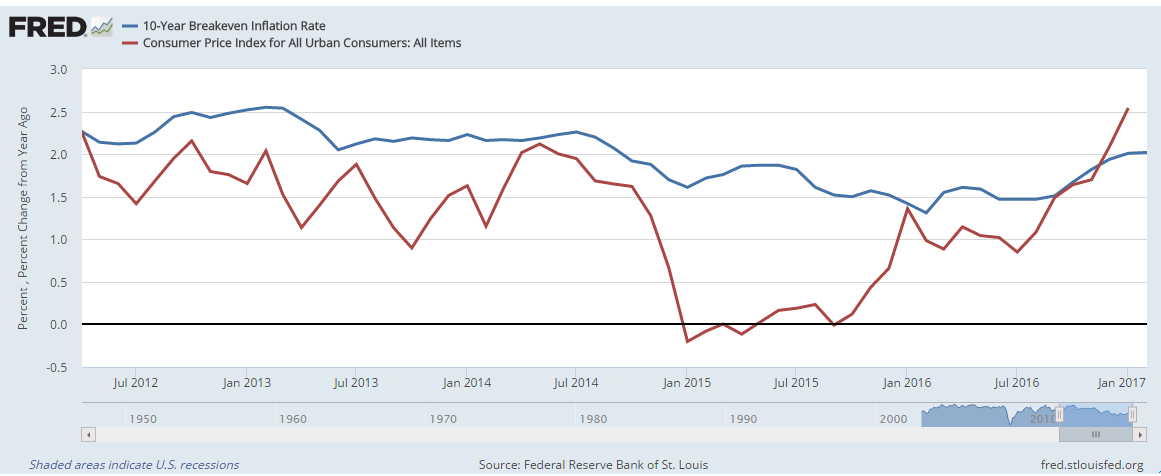

The chart below shows that inflation is now rising too fast, and the Federal Reserve needs to reverse this trend by raising rates.

(Source: Federal Reserve)

The red line in the chart shows the year-over-year change in the Consumer Price Index (CPI), the most widely followed measure of inflation. The blue line is what investors in 10-year bonds expect inflation to be in the future. This value can be calculated based on bond prices.

As long as inflation is below expectations, the Fed can keep interest rates low. If the CPI moves above expectations, the Fed needs to take action to either lower inflation or increase expectations of inflation. Failing to act can lead to an inflationary spiral like we experienced in the late 1970s when inflation peaked at 14.6%. In other countries, the spiral has resulted in triple- and even quadruple-digit hyperinflation.

By raising rates, the Fed hopes to encourage saving and reduced spending, which should keep prices low as demand declines. If the Fed fails to act, inflation should continue to accelerate, expectations of future inflation should rise, and an inflationary spiral is likely to develop.

Knowing the risks, Fed Chair Janet Yellen is likely to act on inflation later this month.

Regards,

Michael Carr, CMT