Note from Charles Sizemore, Chief Editor: Today in The Banyan Edge, we have a special guest contributor joining us.

His name is Keith Kaplan, founder and CEO of TradeSmith — a company with a powerful software that I personally consider to be an essential tool for every investor.

In fact, I believe there’s no better way to boost your returns (while limiting losses) then with the software Keith and his team have developed. With years like 2022, and what’s likely to be another humdinger in 2023, the timing couldn’t be better to see the great work the TradeSmith team is doing.

That’s why Ian King is sitting down with Keith on Tuesday evening to put on a special event they’re calling THE 1000% PROJECT. There, you can learn how Keith and his team can put you in the best position to land 1,000% winners — even in this bear market.

And to give you an idea of the work Keith is doing, check out the great article below. I think you’ll really enjoy it.

The Risks of Being a Human Investor in 2023

If you saw the news in late December about Cathie Wood, CEO of Ark Invest and portfolio manager of the Ark Innovation ETF (ARKK), you’d have heard that ARKK was down as much as 65% last year.

Or how Wood spent most of last year doubling down on stocks that just kept sinking further.

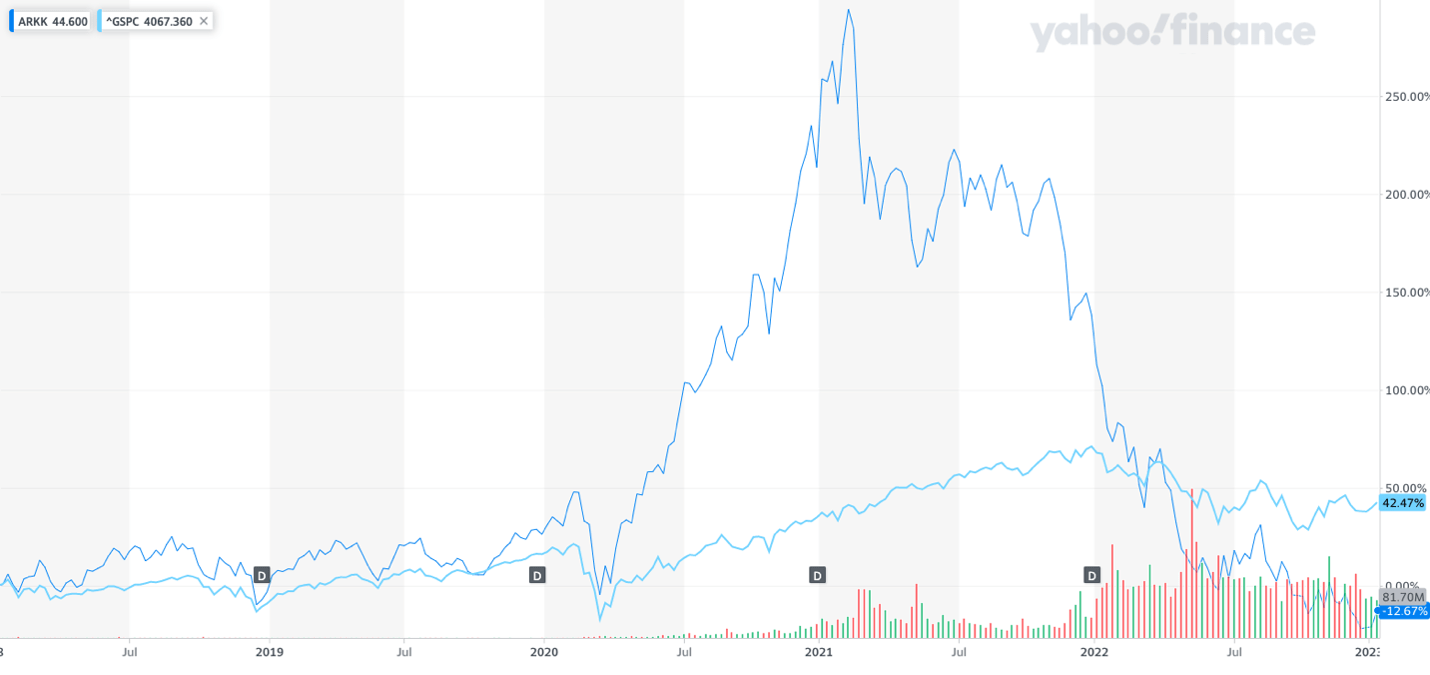

Or how over the last five years, the S&P 500, which started tracking 500 stocks in 1957 and could be considered a “senior citizen” at 65 years old, has performed better (42.47%) than ARKK (-12.67%), a fund that focuses on investing in new and disruptive technology.

But what you’re not hearing is why this has happened.

I’m not here to personally pick on Wood. I could talk about her genius side, and that she could probably be doing 98% of things right.

What I want to talk about is the 2% that she has done wrong, because it’s that part of her decision-making process that sent the ARKK price plummeting from a high of $156.58 on February 5, 2021, to an opening price Friday of $35.33.

Woods’ problem is that she’s acting human. And when you’re managing $7.5 billion in assets (just for ARKK, not her other ETFs), you need to be a machine.

Machines are calculated, work within a set framework and have no emotion. They are programmed for one job and execute it.

In comparison, humans are flawed and emotional. We sell too early, we buy too high and we throw in the towel when stocks sink.

We can’t manage our emotions … and it leads us to doing the exact opposite of what we need to be doing in the stock market.

Fortunately for us, we have tools at TradeSmith that let us execute like machines, taking the emotion out of investing and finding the best times to buy and sell.

What Cathie Wood Did Wrong

Wood has made one of the most classic investor mistakes: not having an exit strategy. That comes from not having a fully formed plan that considers what to do when things go south.

Had she just installed a trailing stop on all her winning positions, her results could’ve been much different (and, I suspect, far more lucrative).

A trailing stop is a stop price set at a defined percentage below the current market price of the position. That stop also rises along with the stock price, locking in your gains.

At TradeSmith, we tie our trailing stops on any stock to something we call its Volatility Quotient (VQ), our proprietary measure of each stock’s inherent risk.

These smart trailing stops help us take advantage of the natural ebb and flow of price movement, to maximize any gains while ensuring we don’t get stopped out too soon.

Looking at the top holdings in ARKK, I see that five of the biggest positions after Tesla all hit the red zone, or their stop-loss point. However, Wood kept them in the fund, where they continue to lose money to this day.

See for yourself:

- Zoom Video Communications Inc. (ZM) — entered the Red Zone on Sept. 15, 2021, at $279.12; and has since fallen 76.6% to $65.36.

- Roku Inc. (ROKU) — entered the red zone on Nov. 23, 2021, at $226.06; and has since fallen 82.8% to $38.80.

- Block Inc. (SQ) — entered the red zone on Dec. 20, 2021, at $158.30; and has since fallen 67.4% to $51.51.

- Shopify Inc. (SHOP) — entered the red zone on Jan. 21, 2022 at $88.21; and has since fallen 70.9% to $25.67.

- Teladoc Health Inc. (TDOC) — entered the red zone on May 3, 2021 at $163.21; and has since fallen 86.3% to $22.29.

Note: All loss percentages are for the period between the date of red zone entry and January 12, 2023.

My guess is that Wood believes they will eventually turn around, as do all investors who are clinging to these stocks and hoping for a rebound.

That’s the human aspect of investing and trading that we want to avoid.

We want to use tools like trailing stops and our VQ system instead of our emotions.

With that in mind, let’s put ARKK under the microscope of our system to see how we can use tools and strategies to our advantage.

ARKK Gets the TradeSmith Treatment

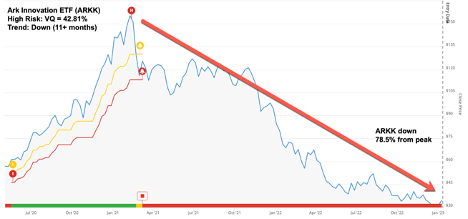

ARKK triggered an entry signal on May 22, 2020, at $61.27. From there, it soared to $155.30 before tumbling to its stop-loss at $109.36 on March 8, 2021 — managing a gain of 78.5%.

Currently, ARKK remains in the red zone and has been in a downtrend since January 19, 2022, so further losses may be on the way. Our timing algorithms suggest that ARKK is in a peak zone, confirming a bearish outlook.

With a VQ of 42.94%, it’s a high-risk opportunity, but taking the trend and peak turn area into account, it’s likely not worth any potential reward at this point.

None of the high-profile billionaires we track in the Billionaires Club hold this ETF, nor does it match any strategies in the TradeSmith Ideas Lab.

If you’re drawn to this fund because you believe in its mission of bundling innovative, disruptive companies, like Tesla, Zoom and Roku, I’d suggest putting it on a watchlist and waiting for another entry signal.

Cathie Wood and Ark Invest serve as a cautionary tale that no one, no matter how brilliant, is immune from emotions and the impact they have on our money.

Staying in stocks with the hopes they’ll turn around is tantamount to throwing darts in the dark; if all you’re relying on is a gut instinct, your probability of success tapers significantly.

You want to know what to buy, when to buy it and most importantly, when to sell it.

At TradeSmith, we have the tools to help you in each of these three crucial areas.

That’s why I encourage you to join me Tuesday for my interview with Ian King.

There, I’ll show off our newest innovation …

A new investment method that can put you in the best position to make 1,000% gains while mitigating your risk as much as possible.

Sign up right here. And if you add your phone number to my VIP list, you’ll receive my brand-new special report — When to Sell the 50 Most Popular Stocks — 100% free.

Sincerely,

Keith Kaplan

CEO, TradeSmith