My wife and I moved to the Florida Keys the year after we married. We were chasing our dream — a stilted concrete-block house in Islamorada (the best spot in the Keys, hands-down).

At first, we couldn’t find anything in that tiny real estate market, so we settled for Little Torch Key. Halfway between Islamorada and Key West, it’s essentially no-man’s land.

Our first week there, I perused the local paper’s classified ads for a tow-trailer to store our overflow stuff in. An ad, titled “Not for the Faint of Heart,” caught my eye.

It was for a “customized” ‘92 Chevrolet Monte Carlo. It had an engine that poked up through the hood … twin exhaust pipes … nitrous oxide … and no muffler. The seller was generous in his disclaimer: “Fishtails easily.”

That phrase “not for the faint of heart,” quickly became our favorite inside joke.

Then … we started living the joke.

A Tin Can Blown Halfway to Cuba

Our home in Torch Key was a “pre-fab” double-wide trailer on a concrete slab. Before we signed the lease, we’d somehow overlooked how close we were to the gin-clear water you can only find in the Keys and the Bahamas. We were 9 meters away, and just 9 inches above the surface.

The winter that followed brought unusually fierce winds — 30 to 40 knots sustained, with gusts double that. All month long, Corinne would wake up in the middle of the night to look at the trees bending outside. She was convinced our “tin can” would detach and send us halfway to Cuba.

We were locked into our lease, so all I could do was keep it light … “You know, Corinne, this is ‘not for the faint of heart.’”

Ultimately, our tin can never got blown to sea. We dodged the next year’s hurricane season. And eventually, we found the stilted concrete-block house in Islamorada that we were searching for.

It was scary as hell living in a trailer a stone’s throw from the seawall. “Not for the faint of heart,” indeed.

Regardless, that year on Little Torch was so far the happiest year of our 20-year relationship.

We’d sip cocktails and watch the stars most nights from that seawall (once the January winds had passed). Every morning as the sun pulled off the horizon, we’d drop our paddleboards off the edge and head out for the mangrove islands to spot baby nurse sharks, eagle rays and rainbow parrot fish.

We were 30 miles from a decent grocery store, but that didn’t matter since I only had to jump that seawall and dive the 15-foot channel where the lobsters lived.

I struggle to put into words just how magical that place is. How awe-inspiring our daily life was. The magnitude and quality of the “reward” we earned for braving the tin can.

There’s nothing wrong with a little risk now and again. Especially when the risk is calculated … and the potential rewards trounce any momentary discomfort.

As investors, we should take this lesson to heart, cliché as it may be. With no risk comes no reward.

I like to think I’ve been calculating risk exceedingly well lately, despite this bear market.

Here’s how…

For the Bravest Among Us — Trade Options with “Wednesday Windfalls”

For the past two years, I’ve been using a strategy that can best be described the same way as the “custom” ‘92 Monte Carlo and my Torch Key tin can.

In short, I buy call options every Monday afternoon — a mere four days ‘til expiration — with the goal of selling them for a profit Wednesday afternoon.

Mike Carr shared yesterday why this strategy actually puts the odds well in your favor. But generally speaking, if you don’t know what you’re doing, buying these types of options is a good way to lose money fast.

Some weeks, though … and when you use a strategy that mitigates as much needless risk as possible while keeping you open for huge rewards…

It’s just as good a way to make money fast … a lot of money.

If you consider yourself one of the brave traders among us, and are ready to capitalize on this volatility which is clearly not going away anytime soon, listen closely.

Because what I’m about to say could lead you to some of the quickest, most profitable trading you’ve ever witnessed.

My Wednesday Windfalls strategy boils down to three key steps:

- First, we take advantage of the tendency for stocks to fall on Monday, then enjoy their two best days of the week: Tuesday and Wednesday.

- Second, I use a custom algorithm I developed for identifying which stocks are in a short-term pullback and most likely to snap back higher over the following two days. These specific setups are what give us the biggest chance at quick gains.

- Third, I scan the options market in search the underpriced contracts that will give us the absolute most “bang for our buck.”

This process and trade don’t always work out, of course.

But when it does … the results can be fantastic!

Since I started recommending Wednesday Windfalls trades, initially to a small group of trusted contacts, the average trade result is a 9.4% gain since inception. The average winner is 102%.

And it’s produced standout winners of 192%, 220% and 262%.

There were some dogs along the way, no doubt about that. That’s to be expected when you trade options.

But so long as you win more than you lose … and those winners outweigh your losers … then you’re golden.

And that’s exactly what we’re doing.

So, yes, Wednesday Windfalls is certainly not for the faint of heart. It’s not something you want to put your grandkid’s college fund into … and probably no more than a small percentage of your overall portfolio.

Many of the weekly results are binary — we either lose most of our initial investment, or we make a multiple of it — 100%, 200% or even 300%.

And that means, as the weeks go by, the volatility will be something fierce. Something like that fishtailing Monte Carlo must’ve been.

Statisticians say it takes 30 individual data points before you can conclude anything significant about anything.

That’s why a trader must not draw conclusions from the results of his last 2, 10 or even 20 trades.

And it’s why systematic investors run “back tests” — to see the expected outcome of a trade when done 30 times … or, better, 300 or 3,000 times.

All told, the volatility in our week-to-week results proves to be not for the faint of heart. Though, I’ve seen the long-run performance of our trade to be highly profitable — offering us a reward that’s certainly worth it — particularly in this volatile, bear market environment.

If Wednesday Windfalls sounds like it’s up your alley, I invite you to watch this unscripted conversation I recently had with my chief analyst, Matt Clark, detailing how it all works. You can access it right here.

Regards, Adam O’DellChief Investment Strategist, Money & Markets

Adam O’DellChief Investment Strategist, Money & Markets

P.S. Before you run, I have an important question for you…

With all this market volatility, many prefer to simply stick to safe “for the faint of heart” assets, like gold.

I, alongside Charles Sizemore, Mike Carr and Amber Lancaster, am going to discuss this in Monday’s Banyan Edge Podcast. And we’d like to know what you think.

Click here to tell me whether you’re bullish or bearish on the shiny yellow metal…

Market Edge: The Debt Ceiling Was Breached: What Now?

Well, it happened…

On Thursday, we officially hit the debt ceiling.

That sounds scary … and it is. But what does it actually mean, and — more importantly — what do we need to do about it?

Each party has their own spin on this, but let’s start with the facts.

The debt ceiling is the maximum amount of debt that the federal government is allowed to carry. Back in 1917, Congress passed the Second Liberty Bond Act, which formally created the debt ceiling. The idea, ironically enough, was to actually make it easier for the government to borrow. Prior to the act, Congress had to approve every bond sale. In theory, it’s evolved in the years that have passed to put a limit on government spending.

Of course, we know that is ridiculous, as every time the government starts to bump up against the limit, Congress simply raises it. Imagine maxing out your credit card … and rather than being forced to cut back, the bank simply raises your limit. That’s essentially what happens.

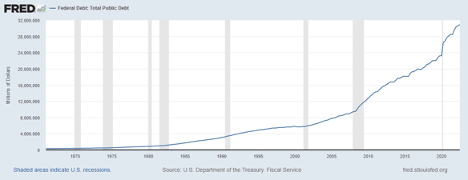

Now, the national debt has more than tripled since 2010, rising through both Democrat and Republican administrations. It now sits at over $31 trillion. Just stop and ponder that for a minute.

For a visual, here’s a chart of the U.S. federal debt. That “up and to the right” trend is only getting steeper.

All this could, theoretically, just keep happening. But this week, for the first time in years, we breached the ceiling and have yet to raise it.

That means the government can’t borrow money. Without the ability to borrow, the government can’t function at full speed and has to cut back nonessential spending. And if this drags on too long, it could seriously cripple the U.S. economy, with the damage accelerating by the day.

Why Is This Time Different?

We’ve seen this movie before, and usually, a concession is made and the federal debt limit is raised.

But this time, House Republicans made a campaign pledge to limit federal spending. Their plan is to use the debt ceiling to negotiate. And after making very loud, very public statements, it’s going to be impossible for them to walk down from them without putting on a good show first.

Congress will raise the debt ceiling… eventually. Our budget deficit is over $400 billion. Failing to raise the debt ceiling would mean that we’d have to immediately cut $400 billion in spending.

Cutting government waste sounds great … and we need to do more of that … but every dollar that gets cut was a dollar previously going somewhere. And whoever was supposed to get that dollar is a potential voter or campaign contributor.

Also remember that Congress has already approved the spending that the debt is needed to cover. So, we effectively have a group of congressmen refusing to fund the spending they already promised. But hey, it gets them retweeted and makes them look important … so here we are.

Again, there is a 0% possibility that the ceiling doesn’t get raised … eventually. Congressmen like their cushy jobs, and they want to keep them.

But House Republicans will absolutely demand at least modest spending cuts in return for raising it. Politically, they can’t afford to walk away with nothing. And until someone blinks … it’s going to get nasty.

What Happens to My Portfolio?

We had a near miss back in 2011. Congress and the White House couldn’t agree to raise the debt ceiling and Standard & Poor’s went as far as downgrading our national credit rating, citing “political brinksmanship” which created instability.

That was a volatile period for stocks … but it passed quickly. Interestingly, bond yields actually fell, despite the credit downgrade. Even with the government at its most dysfunctional, investors perceived Treasurys to be the safest asset to own.

It remains to be seen how this unfolds. The nastier it gets, the more near-term damage we’re likely to see in stocks and the more near-term gains we’re likely to see in bonds.

Gold is also an interesting play here. Gold is viewed by many as an “anti-dollar.” Gold was already interesting as an inflation and dollar hedge … could it also be a debt ceiling hedge?

I’d like to know your views on that. Click here to let me know if you’re bullish or bearish on gold, and we’ll share your answers in Monday’s podcast.

Charles SizemoreChief Editor, The Banyan Edge Charles SizemoreChief Editor, The Banyan Edge |