Markets went haywire this week (and last) in response to a double whammy: Omicron’s appearance on the COVID stage and a suddenly hawkish Fed.

Stocks dropped across the board … but some dropped more than others.

That confirms what I’ve been saying for most of 2021: The market increasingly prefers quality and consistent earnings growth to speculative growth stocks.

On the other hand, many respected Wall Street analysts point out that Omicron may actually be the end of the pandemic, rather than a fresh wave.

How can that be?

In today’s video, I review the evidence from my home country, South Africa, to explain.

I also show why this might be your best opportunity yet to buy into the right type of companies.

Click here to watch.

Red Herring or Red Alert?

Data out of South Africa — home to some of the best virologists, epidemiologists and genome sequencing skills on the planet — shows that Omicron may be more contagious than Delta, but not as dangerous.

What does that mean for investors? I present my take in today’s video.

Click here to watch or click on the image below:

(Click here to watch video. Or read the full transcript below)

Video Transcript

I sound like a stock record, don’t I?

Basically, it seems like every time I see you on a Friday, I’m talking about how volatile markets are, how things just go up and down, back and forth, not necessarily lacking direction, but certainly lacking any sense of where to turn next.

Now, that may seem contradictory, but you know, the reality is that the markets are following a direction based on external signals like the Fed, like the COVID pandemic, but their signals keep changing. So it’s like a cat with those laser pointers that it chases all over the place. That’s what the markets have been like lately.

Today I’m going to do something I don’t usually do and that’s talk a little bit about the epidemiology behind the recent outbreak of Omicron in my home country of South Africa, which I’m not going to be able to visit sadly in December, as I was planning to do, because of this outbreak.

But I think that there’s a silver lining in the market today, it seems to be picking up on that. I’m recording this on Thursday. Before we do that, let’s just go back and look at a couple of charts just to show you how wild the action has been over the last couple of days. The first thing we want to talk about before we look at the market is to look at what’s going on at the Fed because there really are two currents going on right now in the thinking of investors. One is Omicron, the other is the Fed.

The Current Thinking

Now here’s a chart that shows the current thinking about when the Fed or how the Fed is going to delay or rather implement ceasing to buy U.S. Treasuries and mortgage back securities out of the market, which it’s been doing really almost continuously since 2009, but which accelerated dramatically last year.

Now, the Feds plan is to have everything finished by May next year. In other words, by that point, they will no longer be buying these assets out of the market, but Goldman and Deutsche Bank, and others see the Fed actually bringing that pace forward and actually wrapping up everything by March next year.

Now, the reason why this is important is that the Fed is essentially signaling to the market that they’re not going to raise rates until they have finished buying these assets out of the market.

In order to be able to raise rates, they need to be able to say that they’re no longer manipulating bond and more mortgage-backed security markets by active trading. So if they move it forward to March, that tells us that we’re looking probably at an interest rate hike in the second quarter.

Now, here’s why I think that’s important for stock markets and particularly for growth stocks. Here’s a chart that shows the current real return rate on the five-year bond.

But looking at the break even in other words, also what the current percentage is. That’s on the left hand end side with the fraction. The way it’s running, the five-year bond is currently returning almost negative 1.8%. And that’s even with a real interest rate above three. In other words, the yield is 3.1.

So, if the Fed were to proceed with an interest rate hike, we would expect to see, well, first of all, that red line’s going to go higher, but we would then see also that black line go higher, which will make bonds relatively more attractive than growth stocks, which is really the big driver of the short term trading in those kinds of companies that are not making money in the present, but will do in the future.

Now, here’s a chart of the overall yield curve.

This shows dramatic changes in the yield curve since the beginning of October, the blue columns are where rates were at the beginning of October. The orange columns are where they are now. And here’s the fascinating thing, the intermediate-term rates are rising. Basically, everything from the six months up to the seven-year bond, which is a pretty lightly traded one, are rising pretty rapidly.

The biggest rises are coming in the two and three year, which tells us that the market expects the Fed to raise rates in the short-term, but they do not expect high rates in the longer term. That’s the blue line that I’ve drawn over on the right-hand side indicating where those rates are actually falling. Since the beginning of October, the rates on the 10, 20, and 30, in particular, have all fallen dramatically.

What does that mean for markets?

Well, basically what it means is that the market is pricing in short-term interest rate hikes, probably to try to slow down the rate of consumption in the economy in order to try to get a handle on inflation. It’s a dangerous move because if you engineer a recession in order to decrease demand in the face of constrained supply, it’s called tightening into a downturn, which can be very dangerous. It’s also known as a policy mistake.

But if the economy continues to grow rapidly under its own steam, and we’ll talk about that in a minute, then the Fed can safely tighten in the short-term and the market believes that in the long term economic growth will be fine and the Fed will not need to hike rates over the longer term, which is why those long-term rates are falling.

Nevertheless, here’s what the problem is: the impact of Omicron in the short-term has really thrown a loop into the markets. And to a certain extent, I tend to think that some people were waiting for an excuse to take profits on some stocks, but let’s first look at the evidence.

Here’s a chart that shows the U.S. dollar.

Over the last three months, the dollar has been rising quite strongly against the basket of foreign currencies, but it peaked right around Thanksgiving, that’s right where the green lines are. But then look, it’s fallen significantly since then. And that tells us that people are becoming less concerned about Omicron than they were at Thanksgiving. That’s a pattern we’re going to see in all of the charts I’m going to show you.

Here’s a chart that shows the movement in stocks leading up to the beginning of December, basically highlighting what happened around Thanksgiving.

You can see that the old world index moved sharply lower, even more sharply lower than it did back in September in response to the threat of Omicron. And we saw the volatility index rise, the VIX spiking, actually over 30 for some time.

Now, here’s another chart that shows volatility. This is the volatility of VIX itself. In other words, how volatile VIX is in relation to its previous movements.

We’ve seen some of the biggest spikes in volatility since the beginning of the year. I mean, we haven’t seen a spike in volatility like this since January which led to a big pullback in stocks. But the big question is where it goes from here?

Now, the impact on stocks themselves, let’s just review that quickly.

Here is the Nasdaq composite.

We know that we had a big pullback in October, just like the ones we saw in April and March. Arguably, I think some of the pullbacks we saw earlier this year were due to options market hedging activity and unloading of hedging and that sort of thing. But this time after Thanksgiving, we’ve seen just a solid drop in the Nasdaq. The Nasdaq is the one that’s taken the biggest hit out of the three major indices, the S&P 500, the Dow, and the Nasdaq. The Nasdaq is the one that has fallen off the most sharply. And, of course, that’s because it’s where all the growth stocks, the technology stocks, the stocks of the future America 2.0 … that’s where they’re all located.

But there’s another subset of stocks that’s taken it on the chin even harder than that.

This is the Russell 2000, the small caps, look at that chart.

Basically, since the beginning of this year, the small cap universe really did well until February. And it’s been trading just up and down, up and down. I mean, if you imagine watching somebody on a trampoline and the trampoline was on a train going past, that’s what it would look like, right? Because of the up and down, up and down, up and down, but now look what happened. We started to recover. Later in October, we began to see hope for the future. We began to see as the idea that the Fed was finally going to take a decision, whichever one it was, whether raise rates or not raise rates, but basically the decision to tell the market, hey, we’re going to start raising rates, we might even accelerate our taper.

Look at what this did to small caps. They just fell off a cliff. That’s a way bigger drop than we’ve seen any other time this year. Now, the reason that’s important of course, is because that’s where a lot of the stocks that people like me particularly, where we look for high growth stocks, that’ll return triple digits over a two or three year period. That’s where we go fishing for them because you’re unlikely to see those kinds of returns from very large cap stocks.

Now, this is obviously bad for us. It’s bad for the people who buy these stocks, but the critical thing is, this too shall pass.

Making Excuses

I mentioned earlier that I think that there may have been some excuse-making to sell off in this universe, the Nasdaq and the Russell 2000 small cap universe. And here it is. This is a composite chart that shows P/E ratios, price to sales, price to book, and price to free cash flow.

I’ve got them going back over different time periods. The P/E ratio one is for this year’s owning. I mean, that’s a pretty significant jump in price-to-earnings ratios, by the way, this is all for the Nasdaq. So the average price-to-earnings ratio on the Nasdaq has risen from a low of around 22 earlier this year to around 29, which is a pretty big jump during the course of the year. And that means that the multiples are expanding. That is not based on increasing earnings. That’s based primarily on multiple expansion, which means that people are willing to place bets on the future earnings of their companies. Of course, that’s the interest rate-sensitive part of it.

Now, look at price to sales. I’ve got this going back 15 years. And right here, you can see that the price to sales ratios were gradually rising up until about 2020. They pulled back a little bit, stabilized, but look at this year. Look at that big spike on the upper right-hand corner of that pane second from the top. That shows you that people are willing to pay a great deal more money for the given amount of revenue that a company brings in. That is not a sustainable scenario. I mean, essentially the higher you get there, the more you are basically saying we’re willing to pay for future earnings of this company because we acknowledge that they’re not making enough right now to justify it, but we’ll wait. It’s okay. But again, this is a very interest-rate-sensitive thing to do.

The next one you’ve got is the price to book. That is, again, going back quite a long way, and you can see that the price to book ratio has risen dramatically as well. And that again is just an indication that people are willing to pay a great deal more for any given company.

Let’s look at the price to free cash flow price. Price to free cash flow also spiked dramatically. It’s pulled back a little bit since the beginning of the year, but it’s way higher than it’s been for the last 10 years.

My point is that, regardless of what the Fed said, regardless of what is happening with Omicron, I believe that a lot of, particularly big, traders were looking for excuses to dump some stocks that have become seriously overvalued.

So it means that it’s going to take a while for those stocks to get back to the point where they break even to where they were before. If you just bought them now, that’s bad luck. But again, there are all kinds of things that can happen in between, and one of the critical questions is what happens with the pandemic?

So let’s start and ask ourselves, well, what is happening?

Well, one of the first things that caught my eye…

Here’s my Twitter post about the Moderna.

You know, my first thought was when this guy, this is the CEO of Moderna, he comes out and says looking at this new Omicron, I can tell that our vaccine’s not going to be so effective against it. And what happened on that day? Boom, their stock price jumped up by 7%, which I thought was kind of a cheap shot because we all know that’s the case, but it almost feels like a little bit of extortion going on there saying hey, you guys are going to need us.

Remember, this is a company that’s involved in patent disputes, not just with another company, Arbutus therapeutics over its drug, it’s mRNA technique, but also with the United States government. So I took it cynically, to put it that way.

But the critical thing is that it led to a huge drop in the stock market on Tuesday when he made that statement, which we’ve basically recovered yesterday and we’re back up today (Thursday).

What does that mean for where we’re going in the future?

Well, the first thing I want to emphasize is that all year, as I’ve been saying, and go back and look at my previous videos to confirm this, I’ve been saying that quality firms are going to outperform the growth stocks, particularly in the small cap space. Here’s a chart that proves my point.

The IWO is an ETF that concentrates on small cap growth stocks in the Russell 2000. In other words, the stocks that are classified as growth, they have rapid growth in earnings, but not necessarily in margins because they’re trying to establish themselves. QUAL is an ETF that holds quality stocks. And it basically beat small cap growth for most of this year. But the critical thing here that I want to point out is that we saw the big pullback after Thanksgiving and look who really died. It was the small cap growth stocks. They took the biggest dive. QUAL pulled back a little bit, but it’s starting to rebound already.

So my point here is that I still believe that the best thing to do right now is to focus on companies that have strong cashflow, that generate profits, regardless of what’s going on in the broader economy. You know who they are. They include some big companies like Amazon, Google and others, but they also include a lot of less glamorous stocks like real estate investment trusts.

Even some industrial companies that operate need or must have things like, for example, wholesale and retail suppliers into the groceries, all that kind of stuff, the Walmart’s, all these companies. These are companies that are going to do well regardless.

But the big question is, what’s going to happen to Omicron? And here I’m going to play amateur virologists.

Here’s a headline from this morning from Bloomberg.

The reason I flashed that is because it’s something I’ve been paying close attention to because, as a South African, as somebody who wanted to go home to see my family and friends over December, and I had to cancel my flight and I had family here in the States saying, “hey, you’d be crazy to go” … but it’s starting to look like what’s happened here is that this mutation is actually one that’s easier to catch, but doesn’t do much to you.

In fact, some people have said it. I saw it on Twitter somewhere. It’s funny. He said, basically, if you’ve got a vaccination, it’s going to be like a bad case of the sniffles and maybe you will need to hang out in bed for a couple of days. Now, we don’t know that for sure at all. But if it turns out that Omicron is an overblown concern, then this is a buy-the-dip opportunity. That’s precisely what JP Morgan has said about this scenario. Their advice is buy-the-dip folks, because it looks as though this is a more contagious variant, but it’s not one that is going to be any deadlier. And in fact, it may even be just more like a common cold.

Now, there’s good reason to think that that’s the case if you read on virology. The best thing for a virus to do is to become more contagious, but less deadly. That way it increases its likelihood of replication. If it’s too deadly, it kills off its host before it can spread. So in a sense, this goes back to what was predicted at the very beginning of the pandemic when people said, “the best thing that could happen is for this thing to mutate into a form that’s more contagious, but less deadly.” Now, that seems to be maybe what has happened.

Here is a chart that I pulled from The Economist that shows when this Omicron variant broke off from the rest of the variants of COVID and look when it happened…

It happened probably in September or October last year, in other words, 2020. In other words, this variant of COVID has actually been in existence since then, right? But it’s only now gotten out into the wild.

The speculation as to why that would be the case is that probably it was mutating inside the body of somebody who was immunocompromised like HIV because, of course HIV, the highest rates of HIV are in Southern Africa, in South Africa, Botswana, and other countries in that region. And the likelihood is that somebody, maybe even one person that caught COVID was able to survive it, but was not able to clear the virus entirely out of their system. And so the virus kept mutating. It’s what they call a workout gym for viruses. That’s what one virologist calls it when that happens. And so that allowed it to accumulate a whole bunch of mutations, but it didn’t kill. Maybe it killed, but clearly, it’s had a long enough time to mutate that it probably stayed in that person’s body for a long time.

So in a sense, what we’re saying here, and again, and I’m not a virologist, but I’m trying to understand what could happen to the stock, there’s a very good reason to think that this particular variant is the one that is not going to necessarily be the next big spike in the pandemic, but could actually bring us closer to the end of the pandemic.

If we get to a situation where we have a virus or variant of COVID that replicates quickly, and lots of people catch it and get natural antibodies against it, but it doesn’t cause severe disease, then that’s where we want to be. Because basically that means we are at the point where further variants of COVID are going to be variations on this theme, basically less deadly, but more contagious, which of course is the case with most viruses like a common cold.

What about the on-the-ground evidence of this? Well, again, I’m going to lean on South African data because that’s where it’s happening. What they found is that first of all, positivity rates have risen from about 2% in mid-November to about 24% today. So in other words, of every hundred tests that South African medical personnel conduct, about 24 people turn out positive as opposed to two people back in mid-November.

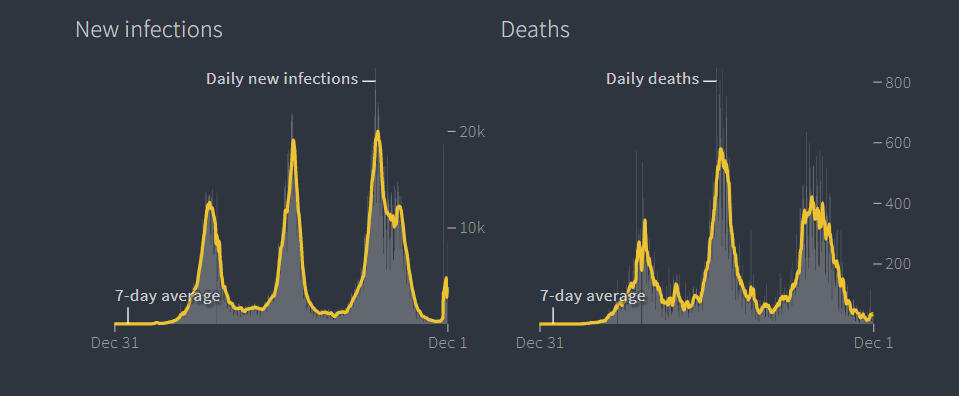

But here’s the thing. The hospital admissions are much lower now than they were at a similar point in the most recent wave of Corona and the third wave of Corona in South Africa. Here is a chart that shows daily new infections and on the right-hand deaths.

And as you can see, there’s a big spike in positivity tests around the beginning of December, but not a big spike in deaths. That’s an important consideration because if it means that the virus is more contagious, but not as deadly, that’s exactly what we want to see.

Some other factors from southern Africa say that the hospital admissions are much lower than they normally are in people who are below the age of 40. They tend to be the ones who are not vaccinated in that region. It’s mainly older people who have got vaccinated. Amongst older people in South Africa who are more likely to be vaccinated, hospital admissions are much lower than they have been in previous waves as is the case also with deaths.

So the overall picture here, if it turns out that this is the case, is the market reaction to Omicron has possibly been overblown. Maybe like my reaction to canceling my flight to South Africa, who knows? Better safe than sorry. Right? But if that’s the case, this is a buy-the-dip scenario.

There’s another reason why I think that’s an important thing to think about. And this is because the world is getting better at handling COVID. Here’s another chart from the economists showing that the level of intensity of lockdowns around the world in reaction to different types of COVID viruses.

Now, the big lockdowns occur obviously at the end of December, beginning of 2020, but in the next two waves, when the alpha variant spread through Europe and when the Delta spread outside of India, the lockdowns were not as severe. And they continued to decline.

Why Is That Important?

Because it means that the world’s learning how to deal with COVID. And we’ve also learned that lockdowns are not all that effective. The only thing that really stops the spread of COVID is to get a vaccination and basically to take reasonable precautions when you are out and about. Wear a mask, all that kind of stuff.

Now, I know some of you out there don’t believe all this stuff, just don’t even bother to comment on it. I’m not interested in talking about it. I believe the science, I believe the vaccine works. I’ve taken it myself. So has my family. And so does everybody that I know, it hasn’t hurt any of them, but it has stopped the spread of the virus very clearly amongst people who are vaccinated. Now, the point of all of this is that if the economy is growing, if Omicron turns out to be a red herring, if the Fed is going to go ahead and tighten because they understand this — they are looking at the same data we are — that means that it’s not going to be a good time to be hanging onto very speculative growth stocks that have earnings in the future.

Instead, you’re going to want to look at stocks that are in the real economy. That means cyclicals. That means reopening stocks. That means commodities. That means stocks for example, in the travel and leisure sector.

Here is a screenshot I pulled from an email this morning from Seeking Alpha, showing airlines, hotel and lodging, and other travel stocks.

Look at that, right across the board, just big jumps. I mean, America, up by six. Delta is up by eight, United six, Southwest six, Hawaiian seven, Jet blue seven, right across the board. Same thing with hotel and lodging and all that kind of stuff.

Now, this is the punchline of my video today.

If you want to gamble on something right now, don’t gamble on meme stocks, don’t gamble on lockdown stocks, and don’t gamble on speculative growth stocks that people think are going to be the next big thing. Particularly, the ones that are not making money.

And I’m here and I’m looking at you, Uber. I wrote about you not long ago. DoorDash is another one. They still haven’t figured out how to make a profit. Anyway, I’ve told you my story about those.

Look at the companies that are going to benefit from a stronger economy and one where inflation is starting to moderate and where people are going out and spending money. Because if it turns out that Omicron is not the big threat, we thought it was going to be, that’s where you want your money to be, and that’s where I’m putting mine.

Remember to keep in touch. Like today’s video and either leave a comment or email us at BaumanDaily@BanyanHill.com.

Kind regards,

Ted Bauman

Editor, The Bauman Letter