Markets behave certain ways at certain times. This is especially true at tops and bottoms in the stock market.

Tops tend to be slow. Prices make little progress for weeks. Then, suddenly, they fall. Bottoms tend to look like a “V,” with a bottom forming in a single day at times.

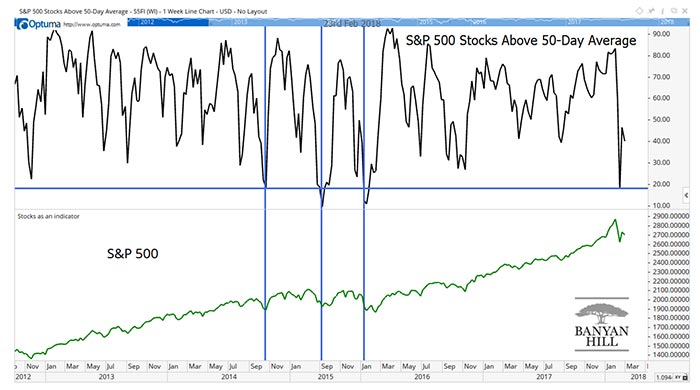

This pattern is especially visible in breadth indicators, as the chart below shows.

Breadth indicators measure how many stocks are participating in a trend. Each stock gets one vote. These indicators show the strength of the trend.

The top part of the chart shows the percent of stocks in the S&P 500 Index that are above their 50-day moving average (MA). That MA shows the intermediate-term trend of stocks.

Short-term trends unfold in days. Long-term trends develop for months. The intermediate-term trend covers a few weeks.

A sharp drop and sudden reversal in the indicator signals an important bottom in the S&P 500 Index. The index is at the bottom of the chart.

The horizontal blue line shows the recent low in this indicator. We don’t get this low very often. Vertical blue lines show just three previous instances in more than five years. The S&P 500 rallied in each of those cases.

The quick drop in so many stocks that pushes this indicator down shows that traders are anxious to sell. They seem to be closing out positions in everything. Then, something triggers them to buy.

Buying could reflect the realization that everyone else is panicking. Or, it could mean traders are finding bargains.

The reason for the buying isn’t important. Knowing that the selling stopped tells us to expect additional gains. That’s where we are right now.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader