There’s a saying on Wall Street: “Hedge when you can, not when you have to.”

If you wait to hedge until you have to, you’re too late.

The time to hedge is when you can and when it’s cheap.

I don’t know who gets credit for it, but it’s a common saying repeated on CNBC and among hedge fund managers.

Hedging is when you place a trade or group of trades to reduce the overall risk of your portfolio. If you are usually bullish — holding a lot of positions that benefit from a rising market — then a hedge for you would be a trade that benefits as the stock market pulls back.

With the stock market rallying sharply off the lows, now’s the time to add those hedges.

There’s an imbalance between the economy and the market right now. That it gives us a great opportunity to hedge against another possible fall in stocks.

Here’s how to do it.

A Technical Trader’s View of the Market

The S&P 500 Index has experienced a sharp rebound after the massive COVID-19 pandemic sell-off.

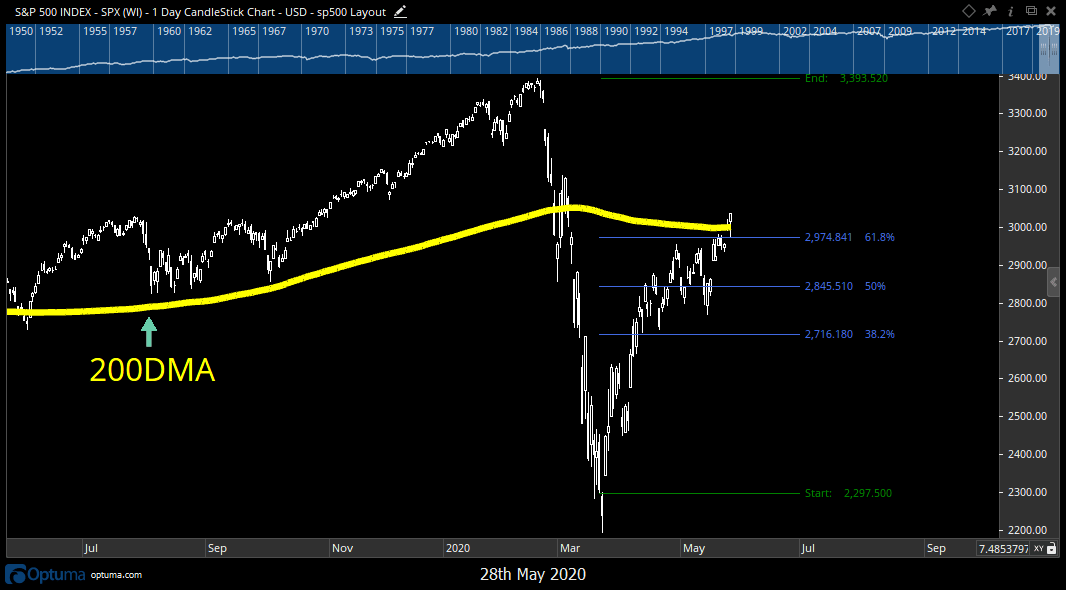

With the index trading above its 200-day moving average (200DMA) — a measure of an index’s long-term performance — for the first time in months, investors are starting to turn even more bullish on the recovery.

But we are also seeing a key resistance level that is common after massive moves for stocks — a Fibonacci retracement point.

The Fibonacci sequence is a series of numbers, where the next number is the sum of the two preceding numbers. While it seems like simple math, these numbers come up often and sometimes unexpectedly in math and in nature. You may have heard of Fibonacci numbers in pop culture — they’re the basis of the golden ratio. These numbers can be found in everything from the places of petals on a flower … to the symmetry of a person’s face.

In technical analysis, we use Fibonacci numbers as key retracement levels after big moves.

Now, when I say retracement, I’m talking about a reversal of a recent move. If the recent jump was higher, then the retracement is a pullback from the highs. But in our case today, the big move was lower. We are looking at a bounce up to one of the key retracement levels.

And with the latest moves in the stock market, the S&P 500 Index is hovering right around one of the last major retracement levels in the Fibonacci sequence — at 61.8%.

Take a look:

The level we are looking at is the 61.8% retracement level — a pullback to this level can often hit resistance. That means it likely won’t rise much further from there.

It’s a key physiological level.

Because what happened in the market was essentially a plunge of roughly 33%. Then we experienced a rally of roughly the same amount of 33%.

That doesn’t get us back to previous levels because we are coming off a lower base. We are about 10% from all-time highs in the S&P 500 Index. But this massive rally has investors excited about the stock market.

The Power of Hedging

That’s why now’s a great opportunity to hedge your existing bullish positions with a simple put option on the SPDR S&P 500 ETF Trust (NYSE: SPY).

Remember, you don’t want to hedge when you have to.

When the stock market starts to turn lower, the cost of adding a hedge becomes very expensive. At that point, everyone is trying to balance out their portfolios. You’d rather be sitting on profits from your hedge already than scrambling around trying to do the same thing as everyone else.

The recent crash was a great example.

Investors who were hedged didn’t feel the need to rush to exit their stocks. They already had a position that rose in value during the sell-off.

With the S&P 500 Index trending at critical levels on its price chart, now’s another excellent time to hedge against the risk of another pullback. While we can — not when we have to.

SPY is an exchange-traded fund (ETF) designed to track the performance of the S&P 500 Index. It’s widely traded and has a ton of liquidity, making it the easiest way to hedge your portfolio.

So, our bonus options trade today is going to be a put option on the SPDR S&P 500 ETF Trust.

Here are the details.

Your Bonus Options Trade

Based on the volatility we have seen, I expect SPY to fall to $260, which is 12.5% below current prices.

The value of the put option I’m recommending today could double as we approach this level in the coming weeks. Remember, put options become more valuable as the stock they’re covering goes down.

As we showed you earlier this week, the historically weak summer months last through September. We want to hedge against that volatility, so we want to pick an expiration date that covers this time frame. We’ll look at the October 16, 2020, date.

The stock is currently trading around $305 a share. We want to pick a strike price that is as close as possible, so we’ll use $305.

That put option is listed as trading at $19.50 per share right now. Since one option contract covers 100 shares, that means it would cost you $1,950 for one contract.

Based on our purchase price and strike price, if the stock falls to $260 as we expect, we will have doubled our money. If it falls further before our option expires, we’ll see even bigger gains.

Since this is a bonus opportunity, we won’t be updating you on what action to take next. Instead, we’ll lay out some guidelines today to help you manage the trade.

I like to set limit orders to sell half of my trade if it hits a 50% gain. That helps lock in gains in case the trade moves against you. For example, if you buy two call options for $19.50, you can place a limit order to sell one at $29.25.

To help limit your downside risk, you can plan to exit the trade if SPY closes above $310 or if your loss hits 50%.

Here’s the table with the trade setup:

That’s all for today.

Reach out to us at winninginvestor@banyanhill.com with your questions or feedback!

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits

P.S.

Interested in options but don’t know where to start? My colleague John Ross put together a video walking you through how to place a trade. You can check it out here.