In 2017, the S&P 500 had a “perfect year,” in which it rose nearly 20%. It was the first year since 1990 that the S&P 500 rose 12 months in a row.

However, three unloved and overlooked metals beat that performance soundly.

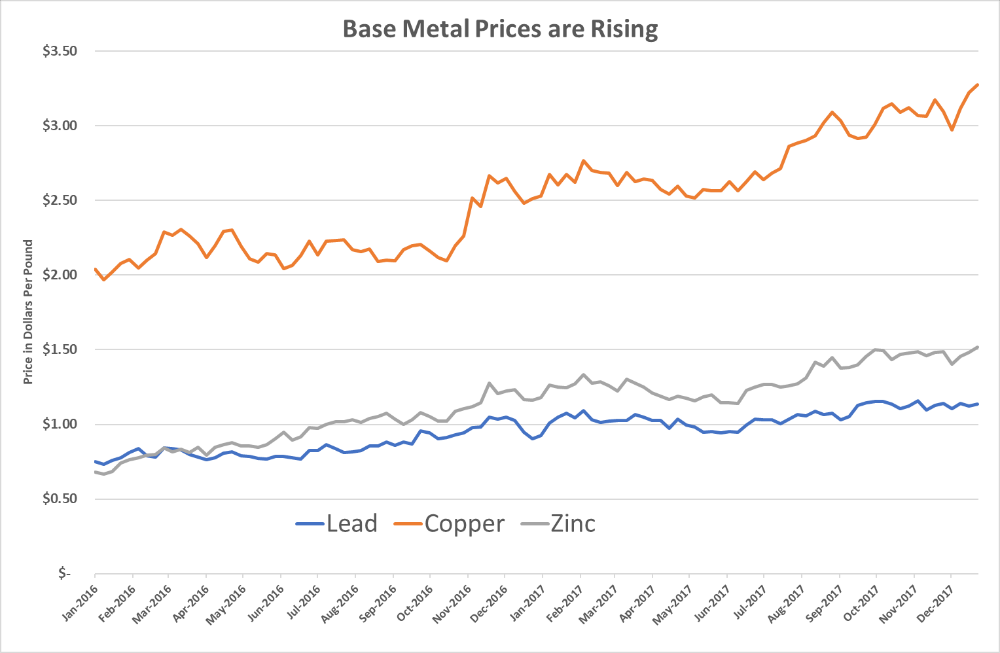

Lead, zinc and copper all had outstanding years in 2017. They returned 26%, 30% and 30%, respectively.

However, most investors had zero exposure to the sector last year. The base metals space spent the five years from 2011 to 2015 in a brutal bear market…

…until 2016, when the sector began to show signs of life.

Shrinking Supply

You can see what I mean from the chart below:

As you can see, these metals are heading higher. In 2018, we should see them continue their uptrend.

The reason is simple: lack of supply.

Thanks to those five bad years, mining companies had to shut down mines all over the world. They stopped investing in expansion because they needed the cash to keep the lights on.

However, a mine is like a loaf of bread. There are only so many slices and then it’s gone.

The mining industry today is like a sandwich shop that stopped buying bread. We’re down to the last few loaves … and while more bread is coming, it won’t be here soon.

Three Base Metals

Lead and zinc prices should rise even further.

In 2016, zinc outperformed all the base metals. It rose 64% in just 12 months. The supply and demand situation continues to look good for 2018.

The International Lead and Zinc Study Group forecasts zinc supply to fall by 1.4% this year. At the same time, demand should continue to rise. The group expects the zinc price to hit $3,600 per ton in 2018 — about $1.64 per pound.

Industry analysts expect the lead price to hit $2,900 per metric ton this year — about $1.32 per pound. That’s because, like zinc, there won’t be enough lead to meet demand for most of 2018.

The metal that could outshine both lead and zinc this year is copper. The copper price hit a three-year high due to supply disruption in China. The world’s largest copper producer, Codelco, expects copper prices to reach $10,000 per metric ton — about $4.55 per pound.

If that happens in 2018, copper miners will be the best investment this year. If you don’t have exposure to base metal miners yet, do it now. It looks like 2018 will be a banner year for unloved base metals.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist