Friday Four Play: The “Fighting for Optimism” Edition

How bad does Wall Street want a U.S.-China trade deal?

So bad that the markets are rallying (once again) on reports that a trade deal is close. Last night, White House economic advisor Lawrence Kudlow said that the two sides were making “very good progress” on a phase one deal.

Kudlow went on to say that although President Trump “likes what he sees, he’s not ready to make a commitment, he hasn’t signed off on a commitment for phase one, we have no agreement just yet for phase one.”

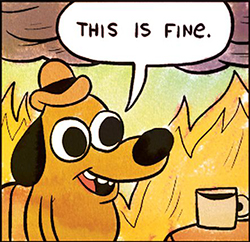

To sum things up on the trade war front: There is no deal. Trump isn’t ready to commit. Progress is being made.

Meanwhile, U.S. retail sales rebounded in October. Well, gasoline prices did, anyway. Retail sales rose 0.3%, reversing September’s 0.3% drop. Rising gasoline prices provided much of the boost, as consumers scaled back purchases of big-ticket and household items.

My friends … I’m trying. I’m trying really hard to be the shepherd for you. But the path of the righteous man is beset on all sides by what passes for bullish market sentiment these days.

Rising gas prices and promises of trade war progress do not a bull market make. Unlike Billie Eilish, I don’t want to be the bad guy.

But I feel it is my duty to point these things out. With the financial media eating up every little promise of progress and hope, someone has to keep you grounded.

Are there opportunities in this market? Sure there are.

For instance, subscribers to Banyan Hill expert Chad Shoop’s Quick Hit Profits have seen at least 18 different triple-digit winners so far. (Click here to find out how!)

But calling higher gasoline prices a recovery in retail sales is not one of them. Neither is “very good progress” — how many times have we heard that exact phrase in the past year? — in the U.S.-China trade war after a week of “he said, she said” on tariff rollbacks.

And yet, the markets continue to hit new highs. I would like to say this fact alone proves me wrong and undermines my warnings. However, all it does is confirm one of my favorite stock market quotes from John Maynard Keynes: “Markets can stay irrational longer than you can stay solvent.”

And now for something completely different, here’s your Friday Four Play:

No. 1: Aurora Gets Stoned

Following on that Keynes quote, my colleague Michael Carr once told me: “You can be right, or you can make money.”

When it comes to Aurora Cannabis Inc. (NYSE: ACB), I still believe I’m right … but that belief has come at the expense of Great Stuff readers.

Last night, Aurora reported revenue of $56.8 million, down about 24% from the previous quarter and below expectations. Earnings came in at $0.01 per share, beating the consensus target of a loss of $0.12 per share.

Distribution continues to be a major drag on the Canadian cannabis market, with a lack of retail locations resulting in a decline in recreational sales for Aurora. In short, Aurora and the rest of the Canadian cannabis market expanded at a pace that outstripped the market’s ability to unload that supply.

As a result, Aurora is now cutting back on expansion spending, putting several key projects on hold — such as production facilities in Denmark and the Aurora Sun facility in Canada.

These are positive moves for a company that has a history of solid corporate management. What’s more, Aurora and the rest of the cannabis market have acknowledged that this isn’t a consumer-demand issue, but a distribution one.

That said, waiting for distribution issues to right themselves could take some time — especially with Canada’s slow pace for approving pot shop licenses.

The bottom line: If you have the patience and the financial wherewithal to ride out the current cannabis bear market, you will eventually be rewarded. However, for readers’ sakes, I’m pulling Aurora Cannabis from the Great Stuff recommendation list.

Sell ACB at your convenience.

No. 2: No More Dips in Chips

The downturn in the semiconductor cycle appears to be over … at least if Applied Materials Inc. (Nasdaq: AMAT) has anything to say about it.

The semiconductor equipment maker beat earnings and revenue expectations this morning, citing a “healthy uptick in demand.” Earnings topped the consensus by $0.04 per share, and revenue was $7 million better than expected.

Applied Materials also put current-quarter guidance well above Wall Street’s expectations. The company forecast earnings of $0.91 per share on revenue of $4.1 billion, versus the average analyst target of $0.72 per share and $3.7 billion in sales.

Chipmakers are poised to have a banner year in 2020. 5G wireless will finally hit broad-market reach, leading to smartphone handset upgrades, and several new gaming consoles (including the new PlayStation and Xbox systems) should help spur consumer growth.

And that’s not even taking into account the continued ramp up in cloud computing — or the growing impact of blockchain — and the computing power needed to implement these technological game changers.

Overall, 2020 is shaping up to be a booming time for the semiconductor market. To learn how to take full advantage of this potentially trillion-dollar opportunity, click here now!

No. 3: Find a Penney, Pick It Up?

Is there hope for mall-based retailer J.C. Penney Co. (NYSE: JCP)?

According to Wall Street analysts, there is … somehow.

In its latest trip to the earnings confessional, Penney reported a loss of $0.30 per share on $2.4 billion in sales. Same-store sales fell 9.3%.

Only one of those numbers beat the Street’s estimates, with analysts anticipating a loss of $0.56 per share. The rest missed widely.

But that was apparently enough to send JCP shares soaring more than 9% today.

“The past quarter was an exciting and energizing time at J.C. Penney as we made significant progress on our efforts to return JCPenney to sustainable, profitable growth,” CEO Jill Soltau told investors in an earnings call.

I guess if investors expect you to fold completely, narrowing your losses to just $0.30 per share is a win. Personally, I’m waiting to see more of this “sustainable, profitable growth” before I pass judgment.

No. 4: Fish Oil Salesman

Biotech firm Amarin Corp. PLC (Nasdaq: AMRN) is soaring today … well, not just today. The stock is up more than 56% since the beginning of October.

Why all the excitement? Fish.

It’s not just what’s for dinner — it’s also good for your heart. The U.S. Food and Drug Administration (FDA) voted unanimously yesterday to recommend Vascepa — Amarin’s fish oil-based drug designed to reduce the risk of heart attacks and stroke.

Cardiovascular disease is the No. 1 cause of death in the U.S., and Amarin’s Vascepa is looking to take that risk head-on.

“Today we moved an important step closer to potentially helping millions of patients who are at risk for cardiovascular events despite being on standard-of-care statin therapy,” said CEO John Thero.

The FDA still needs to make a final decision on expanding Vascepa’s label — i.e., how it can be prescribed. That decision is due by the end of next month.

Great Stuff: Help Your Friends Make Billions!

Are you hoarding all this Great Stuff for yourself?

I don’t blame you. If I had a financial e-zine with a trading chart that could help me make billions, I’d keep it quiet too.

But no … no! Shame on you for not sharing!

Where’s your holiday spirit?

Sharing is caring, and Great Stuff cares.

So, if you have a friend who still gets their daily financial news in that dry, Waspy old format from the major financial publications, forward them today’s copy of Great Stuff.

Liven up their day. Help them make billions too!

They’ll thank you for it.

Finally, don’t forget to like and follow Great Stuff on Facebook, Twitter and Instagram!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing