I’ve seen the rising levels of disbelief and skepticism in the current market rally.

But I think it will keep going for longer than many expect.

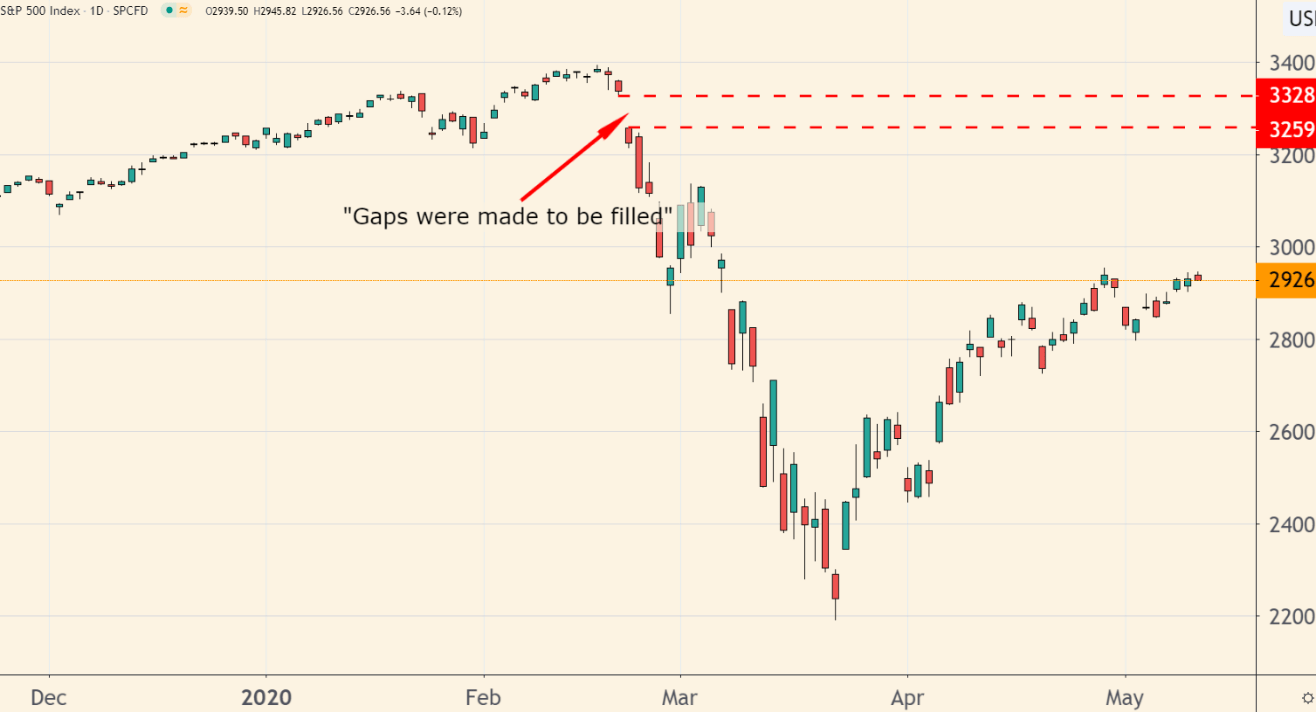

Below is an updated version of the chart I shared with my Total Wealth Insider readers weeks ago.

As you can tell from this chart of the S&P 500 Index, there’s a huge gap — an open space in the pricing from one session to another — about 70 points wide between Friday, February 21, and Monday, February 24.

The S&P 500 Moves Closer to Its February Gap

(Source: TradingView.com)

The point of the chart goes back to what I was taught by old-time traders, back in my days as a financial journalist: “Gaps are made to be filled.”

The idea is that stocks tend to be drawn to these gaps like a magnet.

It doesn’t always happen that way, though. Nor does it have to happen quickly, as the current market rally would imply.

But I’ve seen stocks that I own unexpectedly tear higher and (not coincidentally) fill chart gaps created months or years earlier.

The S&P 500 Will Fill the Gap by June

The best way I know how to describe the price action is “unfinished business.”

It’s only when a gap is filled — when prices trade through the open space on the chart — that we know whether a stock, or in this case the S&P 500, is ready to keep moving in its present direction.

If I’m right, then the S&P 500 will continue to move higher — either a little or a lot each week, in defiance of every market bear in existence — until the gap is filled.

It sounds crazy, I know. Completely illogical.

But as we all know (or should know), the market is ruled just as much by emotion as by numbers and logic.

My guess is the S&P 500 will fill the gap sometime in June, unless the index happens to explode higher between now and say, Memorial Day.

If that happens, stocks will soar more than 11% above their current levels — and get close to the all-time highs they made in February.

That’s why my Total Wealth Insider readers are seizing the moment with a pair of new stock picks.

Both companies have strong track records of profitability and little debt. And both will do exceedingly well as investors reconsider where the big opportunities are for the future.

Best of Good Buys,

Editor, Total Wealth Insider