Tesla Inc.’s (Nasdaq: TSLA) 400% stock surge in the past seven months has left many investors speechless.

Tesla short sellers (those betting against the stock) are in an all-out panic to cover their positions.

As they do, it adds more buying to the frenzy and sends the stock even higher.

That’s created the recent parabolic move, or the exponential increase in the stock price we’ve seen. Even the strongest Tesla bulls question how much higher it can go.

Even if you’re bullish on Tesla, I know it can take a lot of conviction to stick with this stock.

Just before the stock bottomed in June 2019, shares were down over 50% from its previous high.

The short sellers partied … while the long-term bulls held onto their conviction that Tesla was more than a carmaker.

Tesla is also a pioneer in self-driving technology and batteries.

Coupled with its massive “Gigafactories,” which churn out electric vehicle battery packs, it has a strong lead on the next generation of transportation.

Tesla shareholders held through the drop. And now they’re rewarded with new all-time-high prices.

The question is, what happens next?

And for that, I used my latest Bank It or Tank It to break down everything you need to know about the stock — from its key stats and competition to analyst ratings and price charts.

We dive into all this and more to determine whether or not Tesla is a stock to bank on or tank after its massive run higher.

Check out my latest video to get my 12-month price target on this electric vehicle stock:

How to Profit From Tesla’s Price Bubble

After reviewing all the details on Tesla, one thing is certain — this is going to be a volatile stock.

But that’s OK. Tesla is no stranger to volatility.

I gave you my price target and general view on the stock for the next several weeks.

Over the next few months, we’ll see major price swings, pullbacks and surges higher. But that won’t just happen for a stock selling at $750 per share.

Just like it took conviction for the bulls to battle it out to this point, investors will need a strong stomach for the volatility ahead.

This is the stuff I love. I’m excited about the opportunities Tesla’s stock will create.

That’s because I’m not a long-term trader.

I study a stock just for a couple of months, maybe even a few weeks. That’s the period in which I find major trends to jump on.

I recently helped readers grab triple-digit gains on Tesla.

After the stock surged on earnings two weeks ago, my system picked up that it had even further to climb.

Now, most people didn’t want to jump in after the rally. The stock was already up more than 200% in just six months.

It had to top out at some point.

But I had faith in my system, so I didn’t hesitate.

My readers were able to grab call options on the stock after its double-digit surge on earnings — and boy, did it pay off!

Just four days later, my readers were able to close the second half of their positions for gains of more than 400%!

Readers like Debra, who wrote in to share her winning trade:

I am a new member of your Quick Hits Profits team and just sold the second half of my TSLA calls, pocketing $72,386 on my second trade with you. Amazing return on this three-day investment! Words can’t even express my gratitude! I am looking forward to each new trade, and while I know we will have some disappointments as well, this is truly an exciting way to spend each day.

Let me put that massive gain in perspective.

It took Tesla’s stock over six months to climb 400%.

With our strategy, it only took four days to see a 400% move using options.

If you look for quick gain opportunities like this, then check out this video my colleague Matt Badiali put together to tell you all about my strategy.

He lets you know how you can get in on my next potential triple-digit opportunity!

Click here to check it out now.

Before I sign off, I’d like your feedback on Tesla’s stock!

Are you bullish or bearish on this electric car giant? Are you interested in trading Tesla in 2020?

If you’d like to join the conversation, feel free to leave a comment below my video or talk to me over on my Twitter feed.

I know Tesla is a hot topic, so feel free to let me know what you think about my video and share with me what you think about Tesla by telling me whether you’ll #BankIt or #TankIt in 2020.

Tesla: Bank It or Tank It | February 11, 2020

This week, I’m excited to cover Tesla.

We’re going to run through my three step analysis, looking at the fundamentals, the sentiment, and the technicals of the company to figure out where Tesla stands on my Bank It or Tank It list.

Recently, Tesla stock soared to almost $1,000 per share. We won’t be discussing that directly, but it will factor into our future analysis of the stock.

The Fundamentals

When I look at the fundamentals of any company I like to take a look at their key stats. Namely, the net income and revenue.

Net income is negative right now.

Income is below zero on the chart for the 12 months ending in December 2019.

But Tesla expecst income to climb based on analyst’s expectations in 2020 and through 2021, 2022, and beyond.

Of course, that’s a major assumption.

If you followed any of my Bank It or Tank It videos, you know that I don’t like relying on assumptions too much.

The fact is Tesla has not proven that it can turn a profit and sustain it for a year or two yet.

Revenue continues to climb as well.

And I am not skeptical about Tesla’s revenue.

Revenue outlooks jumps drastically from 2019 to 2022.

But this jump is really along the same trend that we’ve been seeing. I really expect to see this play out.

The company is doing all the right things.

Tesla remains at the forefront of cutting edge automobile technology.

The Tesla battery and self-driving technology are really unique. These cars go far beyond just getting you to and from work.

This is really an advanced technological machine that is on the road out there with us, so it will continue to drive revenues in the coming year.

Major car companies enter the race against Tesla.

Ford, General Motors and Chrysler are Tesla’s main competition. And these are major automobile players.

But notice the market cap.

Tesla is the blue chip stock on this list at $160 billion. It’s really incredible.

Tesla has a higher market cap than all of these companies combined and Tesla is still in the growth phase. They have yet to really sustain a profit yet for the market cap but they’re valued at a large cap stock.

Other old school automobile retailers have seen their market caps plunge in their value over the last few years.

While Tesla’s has increased.

Then when we look at short interest as a percent of shares outstanding, this is just telling us how many of those shares are investors betting on the stock to decline from here, and Tesla is the highest at 13.8.

AutoNation, which isn’t a great comparison, is at 8.2, which is pretty high as well. The others are foreign tickers, so they don’t have the short interest rating.

Tesla’s stock is highly shorted.

But all this positive news helps build up the stock, and as it climbs, these short sellers have to buy back their stocks to cut their losses.

So they’re taking massive losses on the stock, but in doing so, they’re adding more buying pressure to the stock, which is raising shares even higher.

Tesla doesn’t have a price to earnings ratio. That’s because they don’t have any earnings yet.

I took a look at their forward earnings and what that meant for the stock, based on what the net income chart that I showed you before, their PE today would be 87 times in 2020.

So clearly, there’s not enough premium in the market for any of these other automobile manufacturers, but Tesla, again, it’s not your ordinary automobile stock.

Tesla is a tech stock, and we see that factored in to the PE.

The table above outlines revenues and net income for Tesla and its competition. This is the compound annual growth rate for Tesla.

We’re looking for trends.

Revenues are up 52% compound average annual growth rate over the last three years.

So that’s a phenomenal track record and Tesla is blowing the competition out of the water.

Tesla has to improve and turn around their net income. Right now Tesla is showing net losses.

The dividend yield is relevant because Tesla is valued as a large cap stock. Tesla’s competitors are not.

But in place of the growth they are missing, old school automobile makers, Tesla’s competition, are increasing dividends to please investors.

The average yield on these stocks is 5.8%. And they are all rather high.

The average dividend yield in the S&P 500 is just around 2%.

Tesla competition is issuing dividends nearly three times the average dividend yield in the S&P 500.

Tesla is on the opposite in of the spectrum, nowhere near trying to cut a dividend in place of its growth.

Instead, the company just continues to innovate, continues to develop new products like it’s Cybertruck to get investors excited, to get the consumers excited, and to continue to fuel growth.

The Sentiment

Our first indicator for sentiment analysis is the analyst rating.

This is based on the S&P Capital IQ which tracks 31 analysts and their ratings of Tesla stock.

Right now, it’s rated as a hold almost dead center of this at 3.24.

But this tells you a lot about the stock, because investors, even after the major run that we’ve seen, all the volatility, there’s still not a consensus here on which direction Tesla stock is going next.

It’s not overrated to buy, it’s not underrated at a sell, it’s just right in the middle.

Investors are still afraid to have any string convictions on the stock.

Tesla stock has been on a recent run, but before that, it dropped 50%.

The Technicals

Above is the basic price chart of Tesla from the IPO to today.

This puts Tesla’s massive run into perspective.

Tesla stock is up over 400%. When you put it on a chart like this, it really looks like a bubble.

If you’re a Tesla bull, it’s hard to stand back and say, “yeah, it’s not a bubble, it’s going to continue to go higher”.

Tesla went on a massive run that almost nobody predicted. If your bullish on a stock, sure, you expected it to go higher. But did you really expect it to surge over 400% in just four months?

Probably not.

Because if you did you could have traded a different way.

I traded options. I did not see this surge coming, but my strategy was able to pinpoint just a few of these moves.

If you really saw this 400% search coming and traded options, let’s just say you wouldn’t have shown up to work this week. You would have made a killing, and you would be retired, sitting on a beach somewhere by now.

At one point. Tesla stock was up 100% over the six-year time span from the peak.

When you look at the logarithmic chart above, you see a 40% decline, and a 30%, then another 40% and finally a 50% decline. These are all in between price jumps.

One thing’s for certain, you should not expect shares to just level off anytime soon.

Tesla is going to continue to be a volatile stock, and it’s going to be a fun one to trade.

So now let’s look at another chart. This one, it’s a little alarming.

This is a real scenario that could play out, and believe it or not, it’s still a bullish scenario.

You can see on the bottom the green trend line. This is an upward sloping trend line showing that if it hits support at this level, it’s still in an uptrend overall, but it’s a massive drop from where shares are trading at today.

That’s more than a 50% drop in the stock still in an uptrend.

That’s the type of volatility that we could see.

I say this is bullish because it has this upward trend line that’s going to find support, and then it’ll bounce, and then it will end up forming a longer term wedge pattern.

Remember the last time the stock surge over 400%, what happened?

It went almost nowhere for six entire years.

It peaked at $200 on its major rally, and then it bottomed at $200 six years later.

It went nowhere for nearly six years. So we can expect the stock, in my opinion, to at least consolidate after this.

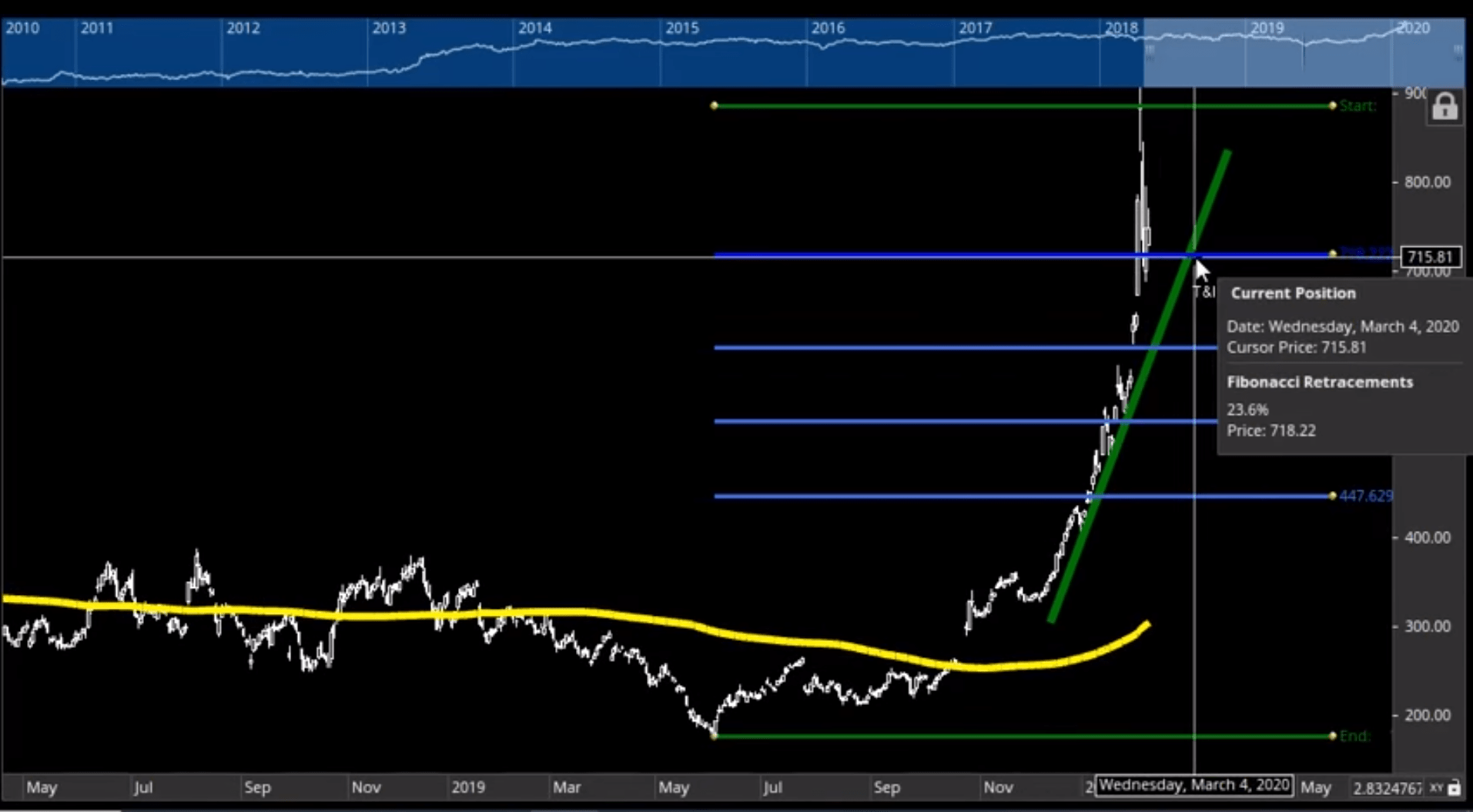

That’s going to bring us to our last chart on Tesla which really gets into these key levels that you can keep an eye on.

The 200 day moving average is in yellow, and no surprise here, the stock is above the 200 day moving average.

The 200 day moving average is trending higher. So that’s a bullish sentiment rating for us. The stock is trending up.

It’s a bullish sign for the company. Even if it’s a massive spike, it’s still trending in the right direction.

I added something different this time called the Fibonacci sequence.

This is a retracement pattern showing what some of the key Fibonacci levels are. You can see this first one already tested.

This is the 23.6% retracement. Then we can expect it to fall to the next level, 38.2% retracement of the price move. Then below that is down to the 50% level, and then the 61.8% level.

These are just some key levels to keep an eye on.

Should You Invest In Tesla?

Fundamentals

Fundamentals

While Tesla revenues are growing at a rapid pace and everything seems solid, the company is yet to turn a profit at a sustainable level.

It’s priced at a large cap stock, but it’s still a volatile stock, trading more like a small cap.

So it’s going to get an X for the fundamentals today.

Sentiment

Analysts are not sure about the stock, but the price was well above the 200 day moving average.

So it’s definitely trending in the right direction and we see that there’s enough buyers out there that are continuing to lift to stock up.

So it’s going to get a check mark for the sentiment today.

Technicals

The price chart was all over the place.

I drew trend lines all over these charts. There are multiple key levels to keep an eye on.

One thing for sure, it’s going to be volatile from here.

But after the major breakout, I expect the trend to be higher. So it’s going to get a check mark on the technical.

Yes: Bank on Tesla

Now, just because Tesla’s on the Bank It list does not mean it’s surging higher from here.

Now, just because Tesla’s on the Bank It list does not mean it’s surging higher from here.

The price charts indicate a possible 30, 40, maybe even 50% pull back once it peaks, and it could have already peaked. We could very well be in pullback area.

Don’t be afraid of Tesla. This is going to be a fun stock to trade.

If you’re buying Tesla stock, you’re thinking longterm.

You’re not trying to buy it and get out over the next pop.

You’re buying and holding for the next 10, 20, 30 years while the company and the CEO, Elon Musk, really continue to brand this stock as a tech stock, not as an automobile manufacturer.

It’s batteries, and it’s solar, and everything is really just going to start clicking and continue to go higher.

Tesla Price Target

I am bullish on Tesla.

I’m actually looking for a $1,200 price target for Tesla which is up 50% from what shares are trading at today.

Until other support areas give me reason to believe otherwise, I think we should be betting on the stock to continue to rise.

I expect to see the stock possibly double from here, or at least reach 50 or 60% price move from where the stock is currently trading.

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits