Welcome to Part 2 of my series this week: “When You Should Invest in Small-Cap Stocks!”

(If you missed Part 1, please find it here.)

Don’t let their market caps fool you. Small-cap stocks can be the mighty wonders of the investing world.

Holding a portion of promising small caps in your portfolio, at the right time, can be the difference between a respectable portfolio total return and a phenomenal return.

In this article, we’ll focus on the telltale signs a small-cap stock is ready to soar, and three ways you can take advantage of it.

3 Mega-Cap Companies That Were Once Small Caps

Amazon. Microsoft. Nvidia.

What do these stocks have in common?

They are mega-cap stocks that were once small caps.

These three companies now have multibillion-dollar (and even trillion-dollar) market capitalizations. But they had humble beginnings.

Imagine taking a ride in a time machine and scooping up shares in these companies when they were just small pickings … but with potential.

Well, I actually don’t have to imagine. I lived it.

How I Got Caught by the Dot-Com Bubble

In 1998, I’d just opened my first brokerage account. I bought shares in about 20 technology stocks because I sensed a change was happening in the economy’s status quo.

New industries like web portals and e-commerce were beginning to change how we communicated and shopped.

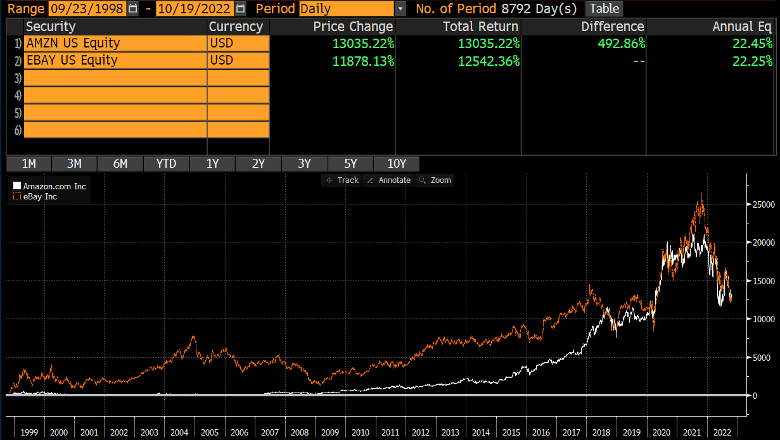

My stock holdings included companies like Amazon and eBay. (They were small potatoes back then.)

Every day after the markets closed, I would use my mom’s landline phone and call the brokerage’s toll-free number to check on my shares’ performance. Yep, it was certainly the ‘90s.

During that time, investing in tech stocks was a mania. A feeding frenzy of sorts — think Shark Week every day.

Headlines like this one from CNNMoney dotted our Netscape internet browsers and captured the moment:

As my gains ramped up, to say I was elated is an understatement.

But then, in March 2000, the tech bubble burst. All my open gains fizzled into next to nothing.

I was deflated, and immediately gave up hope and sold all of my shares.

But that was a rookie investor’s mistake. I honestly regret it to this day, and here’s why:

If I’d just held my shares in Amazon and eBay, I’d be sitting on open gains of 13,000% and 12,000% today.

But we live and we learn. And what I took away from this experience is this:

Investing in promising small-cap stocks, and holding on to those shares through thick and thin, can pay off in the long run.

By their nature, small caps have great growth potential. Like I said in Part 1, these companies have real growth potential vs. large-cap companies, which have less room to grow.

That’s why it’s important to know when it’s a good time to invest in a small caps. So here are a few telling signs.

3 Signs a Small-Cap Stock Is Ready for Launch

-

If it’s a bear market.

Small caps are ideal to invest in during the tail ends of bear markets. This gives them even more room to grow once the new bull market begins. In this way, small-cap stocks have the most growth potential of any market cap.

According to Investopedia, on average:

- Small caps can “beat institutional investors by focusing on growth opportunities.”

- Small caps “historically outperformed large-cap stocks, but have also been more volatile and riskier investments.”

Small caps were the first to decline at the beginning of this bear market — unfairly beaten down. But as the Federal Reserve’s rate hikes eventually slow down, I believe we’ll start to see a great shift in the stock market.

Small-cap share prices could rise with the next bull market.

Today’s market is an ideal buying situation for small-cap stocks if I’ve ever seen one.

-

If a small-cap company has solid fundamentals.

By “fundamentals,” I mean a company’s financial breakdown: cash and equivalents, total debt and revenue projections.

A small-cap company with solid fundamentals in a growing industry is in a good position to capitalize on that growth.

The key is to invest before a bull market run-up. Buy when prices are cheap and hold your shares for the long term.

-

If a small cap has the X-factor.

By X-factor, I mean the potential to beat Wall Street’s estimates.

(From Tenor.)

My colleague Ian King created a four-step system for picking the right stock, small cap or otherwise:

- Tipping point trend: A catalyst that’s going to be bigger than people realize. Something that’s going to impact all industries, like social networks, smartphones and PCs did.

- X-factor: A unique edge that no other company has. For example, an auto parts supplier that’s the only company manufacturing a vital component for autonomous vehicles. Or an e-commerce company located in the fastest-growing country in the world.

- Momentum: The company’s stock must already be going up … trading above its 20- and 50-day moving averages. That means it has momentum behind it. And it’s likely to keep soaring higher.

- Beat the Street: We want to see a company that is consistently beating Wall Street’s earnings estimates. This tells me that “the Street” is underestimating the company’s growth potential.

On your own, you can apply this four-step system to evaluate a stock.

Or with Ian and our team by your side, you can leave the stock picking to us by joining one of our stock investing services, like Extreme Fortunes. There we aim to find the best potential small caps.

These stocks are:

- Hand-selected by our team of analysts.

- Future-forward companies.

- In niche markets, with innovative products/services.

- Ripe for long-term investment.

With Extreme Fortunes, we focus on companies that may not be on everyone’s radar. Their stocks are not only poised for growth, but are also making waves in their respective markets.

3 Ways to Take Advantage of Small-Cap Potential

Now that you have the tools to spot a potential star for your portfolio, here are three ways you can start your small-cap investing journey:

-

Consider buying into a tech small cap.

As we get closer to 2023, new data from Gartner shows 2.0 tech like artificial intelligence, new energy and digital twins are now some of the top 10 initiatives for executives worldwide in the new year.

During economic downturns, companies must seek new forms for operational excellence and accelerate digital transformations.

Now is prime time to consider buying shares in a small-cap company like: Matterport (Nasdaq: MTTR).

With a market cap of about $987 million, Matterport is a small cap that combines the virtual world with the physical world.

More than 100,000 businesses use Matterport’s digital twin technology to create exact virtual copies of physical objects or environments. Businesses can use these to digitally simulate scenarios.

Matterport is essentially doing what Google Maps did for roadways, but for the interior rather than outside. It’s an innovator!

-

Consider buying shares in the Vanguard Small-Cap Growth ETF (NYSEARCA: VBK).

The exchange-traded fund can be volatile, but the VBK ETF tracks stocks that chase future growth. It’s filled with Next Gen stock market leaders.

VBK can help you, as an investor, get access to small-cap leaders at the ground level.

-

Follow our lead — learn even more about small-cap investing.

When this bear market eventually ends and the next bull market begins, we’re going to see a surge of money push into the most innovative growth stocks of 2023.

That’s why Ian and I are hosting a special webinar called “Bear Market Fortunes.”

It releases today, October 20! Ian’s going to share the next huge opportunity in small-cap investing.

You can watch this webinar for free by clicking here!

If you have any more questions for me about investing during a bear market, just @ me on Twitter: @ALancasterGuru.

Until next time,

Director of Investment Research, Strategic Fortunes

Disclaimer: We will not track any stocks in Winning Investor Daily. We are just sharing our opinions, not advice. If you want access to the stocks in our model portfolio with tracking, updates and buy/sell guidance, please check out Strategic Fortunes.