The locals call it Vaca Muerta, Spanish for “Dead Cow.”

That name perfectly captures the essence of the place, too.

The Vaca Muerta formation is a harsh South American wasteland…

…7.4 million acres of sprawling rocky desert, where the animal you’ll most likely encounter is (you guessed it) a dead cow.

Gazing out over the Patagonian horizon, you’d never realize you were staring at one of the world’s most valuable energy assets.

16 billion barrels of oil.

308 trillion cubic feet of natural gas.

All locked away in shale rock formations some 9,500 feet below the desert’s windswept surface.

Add it all up, and the Vaca Muerta formation (located in the Neuquen Basin) is the world’s second-largest shale gas reserve. It’s fourth-largest for oil.

(From NaturalGasIntel: The massive Vaca Muerta formation in Argentina’s Nequen Basin.)

These reserves were a total secret to the world until 2010, when a rogue exploration team from a domestic oil company started testing the area.

It expected to find some mineral reserves, but never on this scale.

Instead, it made a discovery that could transform the global balance of power as Vaca Muerta’s output comes online.

There’s just one catch…

Vaca Muerta is located in Argentina.

Patagonia’s Lost Mineral Treasure

Argentina’s economy is an unmitigated disaster, ravaged by decades of disastrous political policies.

Last month, the country’s official inflation rate hit a record 142%.

The government is also carrying $400 billion in foreign debt, and it’s desperately short on foreign currency reserves.

Those same political policies have also kept the country from cashing in on Vaca Muerta’s massive mineral wealth since its discovery in 2010.

Extracting oil from Vaca Muerta’s rich shale will require substantial investment. It’ll need to use slant drilling rigs, hydraulic fracturing — technology that’s still cutting edge and priced at a premium.

Argentina’s government can’t afford to make that investment.

And since officials also nationalized key energy industries, foreigners don’t want to make that investment.

The country also set internal price caps on oil and natural gas, effectively limiting profit potential for its own domestic industry.

Which means Argentina’s domestic energy companies can’t afford to make that investment either.

So despite being one of the world’s richest shale oil fields, Vaca Muerta only produces about a quarter-million barrels of oil per day.

That’s compared to 1.3 million per day for West Texas’ Permian Basin (America’s largest shale play) and a tremendous 4 million barrels per day for Saudi Arabia’s Ghawar Field.

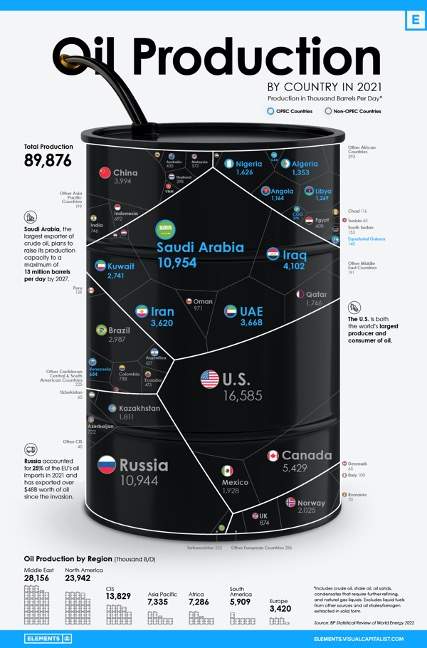

(From VisualCapitalist: Despite some of the world’s largest shale gas and oil reserves, Argentina’s oil output makes up only a minuscule fraction of the global market.)

Obviously, unlocking Vaca Muerta’s true potential could be transformative for Argentina’s economy.

And that’s exactly what President-Elect Javier Milei has in mind…

Kick-Starting Argentina’s Economy

Javier Milei is probably best known for his quirky personality and his colorful campaign stunts.

You’ve likely already seen images of Milei brandishing a chainsaw at speeches, or smashing a model of the central bank with a sledgehammer in a popular video clip.

But despite his lighthearted antics, Milei is deadly serious about the state of Argentina’s economy (as we saw in last Friday’s Banyan Edge).

In an interview with Argentina’s popular Neural Media, Milei said frankly: “There’s no money. If we don’t make a fiscal adjustment, we’re headed for hyperinflation.”

His words echo those of his personal hero, Margaret Thatcher, who famously said: “The problem with socialism is you eventually run out of other peoples’ money.”

Milei promises to dismantle the country’s central bank, which he claims to be “non-negotiable.”

He also plans to spark a wave of privatization that could kick-start entire industries that have been under government control for decades.

Everything from airlines and railways to energy, utilities and pension funds could potentially be open to investment and development.

His policies would effectively re-open the national economy, embracing the kind of “free market” approach that appeals to investors and could transform the country’s economy.

Even Milei admits his proposals are “drastic.”

But given the current state of its economy — and a currency that’s teetering on the edge — Milei’s “shock therapy” could be exactly what the country needs.

(From NBC News: Already a controversial figure, President-Elect Javier Milei could give Argentina a fighting chance to turn the economy around … before it’s too late.)

The market seems to agree, too…

Shares of Argentinian stocks shot up as soon as Milei’s election was finalized, with Global X MSCI Argentina ETF (NYSE: ARGT) booking the biggest intraday gain in the ETF’s history.

Do I expect Javier Milei to be the first politician in history who keeps all his campaign promises?

Of course not. Even though there’s a first time for everything.

I do believe that Milei’s administration represents a powerful consensus on behalf of Argentina’s electorate.

Even if Milei is only marginally successful in opening up Argentina’s economy, it would still be a massive leap forward.

And he may also succeed in bringing the Vaca Muerta shale reserves online during one of the most critical moments in the history of the global energy industry…

A $6 Trillion Global Transformation

The ongoing “energy war” between fossil fuels and renewable resources is arguably the biggest mega trend in the history of modern investing.

It’s a story that will span multiple generations, affect every person on the planet and completely transform our entire global energy industry, valued at over $6 trillion per year.

As a result, it’s creating some of the most powerful tailwinds investors have ever seen.

And while most of the spotlight seems to be on renewable resources like wind and solar, demand for fossil fuels is higher than ever.

So as the global economy begins to pick back up over the next few months and years, oil and gas assets like the Vaca Muerta will become more valuable than ever.

That’s why I’m recommending all my readers review their current energy investments and make sure they’re positioned for a potential “Super Bull” market that sends oil surging as high as $500/barrel…

Which will send a few key stocks soaring for 100% gains in as little as 100 days.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets