Six out of ten fund managers failed to beat the market benchmarks in 2021.

After 2020 saw record-breaking stock gains, why was this year so difficult?

In this, my last YouTube video for 2021, I explore what happened to the investment game this year.

More importantly, I explain how you can improve your odds of finding investment winners in 2022.

It won’t be easy … but it will be possible.

Click here to watch or click on the image below.

Click on the image to watch the video:

Video Transcript

It’s been a very difficult year in the market. The Bauman Letter itself has done reasonably well, with some picks not having done very well, but we did have a couple of them that saw triple-digit gains just during this calendar year. The more aggressive picks that we reserve for things like my Profit Switch portfolio, and to a certain extent for our options portfolios run by Clint Lee, have had a torrid time of it, particularly in the second half of the year.

I think there’s a story behind that, and it’s one that is going to be increasingly important going forward. Because if things carry on the way they are, it’s difficult to see how ordinary investors are going to be able to identify the kinds of stocks that are going to give the kind of gains that we want, really without doing incredible amounts of analysis. To try to dig deep and find particularly small and microcap stocks that are on the cusp of maybe doing big things.

On the other hand, buying popular names in the market has proved to be a very unprofitable business this year, and here is why. One of the big statistics for this year, one of the things that struck me more than anything else, was the notion that the amount of liquidity that flowed into stocks this year was larger than the previous 19 years combined.

Now, what that means is that the money that flowed into equity funds, which is things like ETFs, mutual funds, and other funds that invest in equities, simply blew everything else away. Part of the reason for that, of course, was because bonds are relatively unattractive because of just super-low interest rates. So, you can blame the Fed for some of this. But there’s another factor behind that, and that’s what some people call a perpetual motion machine in the market.

So let’s start with the fact…

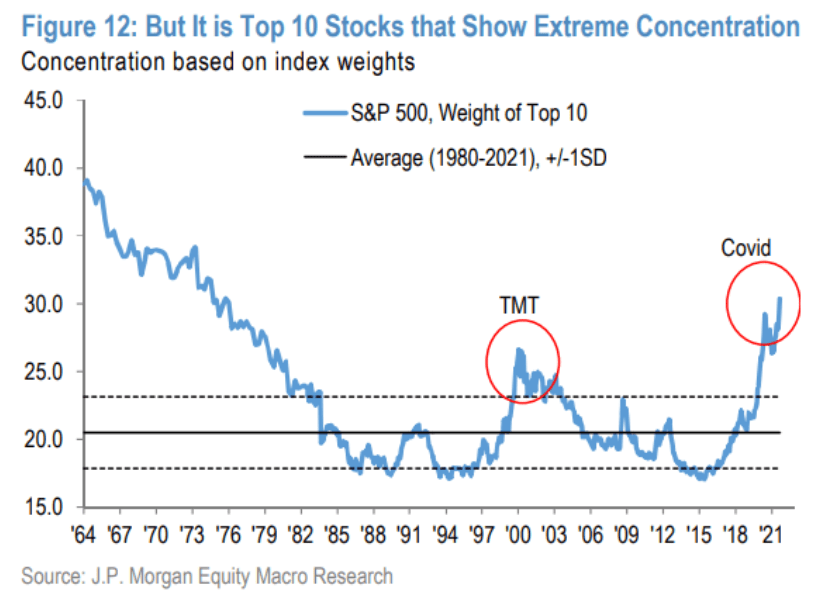

Right now, the concentration of the top 10 stocks in the S&P 500 is at its highest level since the late 1970s. The only time when we’ve seen more concentration in the S&P 500 was during the dot-com bust, or boom and then bust. But otherwise, we’ve tended to see a much more broadly based, more participative market.

All that changed right around 2015, 2016. Really, I think the deciding factor was after the Taper Tantrum, when the Fed tried to pull back on the QE. You can see that in 2012 and 2013. When it abandoned that, then basically the market took off. I think a lot of that had to do with the arrival of just mega, mega amounts of liquidity courtesy of the Fed, even if it’s indirect.

Now, what’s that got to do with the structure of the market?

Well, here’s the thing. What happens when a lot of money goes into index funds, for example? When they go into mutual funds, which are a form of index fund, or ETFs, which are a form of index fund? Well, there’s a certain dynamic that becomes self-reinforcing.

So, let’s look at what has happened with these so-called passive strategies … in other words, where you buy a fund and somebody else picks the stock for it. Here’s a chart that shows passive holdings as a percent of assets under management of all U.S. equity, and then also global in the black line.

What happened to the passive strategies?

In 2021, we passed 50%. We were at 50% in 2019, 2020, but it peaked above that in 2021. Now, what that means in practice is that more than half of the money invested in stocks is not being invested by active investors, but by passive investors who are buying index funds, buying ETFs, buying mutual funds, and other people are doing the picking.

Now, when a stock is added to an index fund or a smart beta fund, in other words, a fund that tries to focus on low volatility as opposed to high volatility, it’s kind of an artificial form of increased popularity of that stock. Right?

I mean, if people who manage these funds, these index funds, adds these positions to their stocks, it basically becomes a more popular stock and its price goes up. That in turn pushes up the value of the index funds that are investing in all of that, and as a result, as they increase in size and more people buy, these managers have to buy more of these stocks. So that becomes a self-fulfilling prophecy, a perpetual-motion machine.

Now, when growth stocks, technology stocks, and low volatility all become basically the same thing, and when people then begin to design index funds and other kinds of products based on those factors, where you’re trying to get growth, you’re trying to get exposure to big tech like Apple, Google, Amazon, etc. … you’re trying to get low volatility, all that ends up into a situation where all those things get a crowded trade.

But the crowded trade is not coming from retail investors. It’s coming from the money managers who are essentially piling money into the same kinds of stocks at the index fund level.

Now, what that’s done is created a long-term trend where the top stocks in these index funds end up really driving markets to 15% to 20%, even 25% returns on an annualized basis. But behind that, the rest of the market hasn’t done all that well.

That’s what’s happened this year.

So effectively, if you look at the performance of the top five or six stocks in the S&P 500 right now, they account for more than 50% of the gains in the market this year. So more than half of the gains in the S&P 500 have come from just those five, or six, or seven top stocks.

Now again, what that means is that if you’re running an index fund that includes, let’s say, the S&P 500, or top stocks, or whatever, then you’re going to buy a lot of those stocks, and that’s going to push their price up even further. And when you have a lot of liquidity coming into markets like we’ve had this year, the result is that you get this perpetual-motion machine that artificially pushes the market up and leaves everything else behind.

Now, the big question is, why were things so different during 2020?

What was different in 2020?

Why did we see such outsized gains beyond those top stocks?

Well, it was simple. Because everything crashed during the COVID crisis. And when the Fed stepped in to basically backstop the market, it led to massive gains if you bought near those bottoms. And people made triple-digit gains hand over fist. It was happening all over the place with all kinds of stocks.

Now, I was skeptical.

A lot of people who’ve been following my channel for a while like to throw the double bottom thing at me.

I get it. Basically, I did not expect the market to react that way. But clearly there were factors like the increased liquidity that came from Federal stimulus payments, the fact that people were bored at home, the so-called bored market hypothesis of Matt Levine at Bloomberg. All these things led to very unusual market situation, which led to big gains.

But then we got to the first quarter of this year, and when we got to February and March, all of a sudden the market decided they’d had enough. Investors decided they’d had enough with these high-growth, at least high-momentum stocks that were seeing just ridiculous valuation metrics. Their multiples were getting out of hand.

So right around the end of the first quarter of this year, all those stocks, the stocks that people had piled into and that had done really well in the previous six, or eight, or nine months, all of a sudden those stocks fell off a cliff.

And as I’ve pointed out quite a few times, as we’ve spoken about on Your Money Matters on Mondays, our videos then, we’ve also seen a big fall in the average stock. The average stock in almost every major index is down by more than 10%. In some cases by more than 20%, depending on the index.

That means that the average stock is in correction or in a bear market in every single index, whereas the indexes themselves have reached multiple highs. In fact, 2021 has the second-highest number of new records for the S&P 500 in history. The only one that was higher was back right before the dot-com bust.

Now, here’s the problem with that. If you’re trying actively to find stocks and to try to beat the market, you’ve got two options. One is that you buy what everybody else is buying, and then use leverage to try to boost your gains. Or you have to go and look for other kinds of stocks, and hope that you get the right ones that are going to beat this market that is growing at this high rate because it’s become a perpetual-motion machine.

Just to recap, when stocks get concentrated, everybody wants those stocks. Everybody buys them as part of a passive investment strategy. As passive investment strategies become more popular and more money goes into those funds, those stocks increase even more, pulling them even further away from the market and making it more and more difficult to beat the average benchmark.

6 out of 10 couldn’t beat the market

Now, here’s a chart that shows the relative performance of active managers.

This is not just people like me who run newsletters, but everybody. We’re talking about hedge funds, we’re talking about all kinds of investment advisors who manage money on behalf of clients.

If you look at the proportion of those who beat the market during 2021, it’s only about 40%. So only about 4 out of 10 active managers actually managed to beat the market this year. That’s actually higher than it was in 2020. The percentage who missed, of course, is over 60%. Those who missed by quite significant amounts range from 40% to 50%.

So the bottom line here is that everybody who has tried to find value, find yield outside of this very, very top of the market, has struggled this year. I’ve struggled this year.

Now, the stocks that we’ve picked that deliver dividends and that deliver strong-quality cash flows, those stocks have done well.

Those that are going to earn most of their profits in the future when they break through, they’re building a new product, they’re building a new market, those are the stocks that have taken a beating.

Now, the big question is, what do you do in a situation like this going forward?

Do you just accept that from now on the only way to invest is to put your money in a passive index fund, and you’re going to guarantee yourself 20% a year as long as these huge stocks keep making money?

Their earnings are growing, and they’re growing rapidly because they’re quasi-monopolies. So even without the PE expansion that we’ve seen in the last couple of years, they’re still going to do well. Right?

So question is, how do you beat that?

I think what it’s going to take is a return to the kind of investigative looking at very, very small-cap companies that are on their way up. That is the traditional preserve of most high-returning investment managers.

Now, Cathie Wood at ARK, for a long time has been seen as the kind of model for that approach. But she’s also struggled this year, because the stocks that she piled into and that she helped to push up by buying loads of them into her funds have also fallen off this year. And she’s had a torrid year, like a lot of other of people.

Now, the big question is: What does it take to turn that around?

Well, the first thing is that those companies that have seen big losses this year are going to have to turn their own profitability and their own margins around. They’re going to have to demonstrate that they are the next big earners, the next quasi-monopolies, if you like, in their areas.

In fact, the two highest gainers for The Bauman Letter, both the two companies that are at the very top of our performance are both what you could call quasi-monopolies. They hold enormous market share, over 50% in their relative markets. That seems to be the secret. But to get there, you’ve got to start somewhere. And the big question is going to be in 2022, what are the stocks that are really going to start turning hype and promise into actual earnings and return?

That’s going to come by having good products that people want, not just by telling good stories. The good-story approach to buying stocks, the SPAC approach? That really fell apart at the beginning of this year and it has yet to recover.

So my big call for next year is that we have to find a way to beat passive investing, and the only way to do that is to find the stocks that are actually performing and ignore those that are just being hyped up.

Because if you get high up in that PE-ratio hype, where multiples are expanding because everybody wants the stock, you’re just as likely to get slaughtered over the next couple of months and quarters as to do well.

That’s been the lessons of 2021.

Well, that’s it for 2021. Happy new year. See you on the other side.

Kind regards,

Ted Bauman

Editor, The Bauman Letter