Adam O’Dell believes stocks priced under $5 can deliver the biggest gains in the stock market.

It’s a bold claim, so I’ve been putting it to the test.

Yesterday in Stock Power Daily, I looked at the reasons why that could be true. And they all come back to the SEC’s $5 Rule.

Large investors typically can’t trade stocks trading under $5 a share. They may want to, but different rules can prohibit them from buying. That means individuals can dive into these stocks and expect rapid gains once the price crosses $5.

Adam’s logic is sound. So, I turned to a search for proof. And I realized the last three years offered a great testing platform.

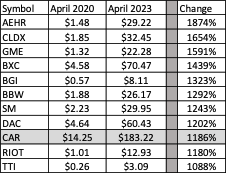

The 10 Top Performing Stocks of the 2020s Were All Less than $5

Over the past three years, most stocks delivered big gains. The S&P 500 gained an average of 13% a year since April 2020. The tech-heavy Nasdaq 100 did slightly better, gaining an average of 14% a year.

Of course, some stocks did much better than average. I was surprised to see that 15 stocks gained more than 900% a year over that time.

That number surprised me. First, let’s look at what it means to gain 900% a year for three years.

Let’s say the stock starts at $5 a share. The next year, it’s $50. That’s a 900% gain.

The next year, after another 900% gain, the stock reaches $500.

The third year, the stock closes at $5,000. That’s a third year of 900% gains.

Cumulatively, the stock price moved from $5 to $5,000, a 1,000% gain.

The size of that price move is shocking. Equally shocking is the fact that 11 stocks gained at least 1,000% over the past three years. The table below shows the stocks.

Of the 11, just 1 had a price over $5 in April 2020. The other 10 meet Adam’s criteria of being under $5.

Two of the stocks are meme stocks — GameStop Corp. (GME) and Avis Budget Group Inc. (CAR). No analyst could have anticipated those developments. But they support the idea that tomorrow’s biggest winners could be trading under $5 right now, no matter how they make those gains.

Breaking the $5 Line

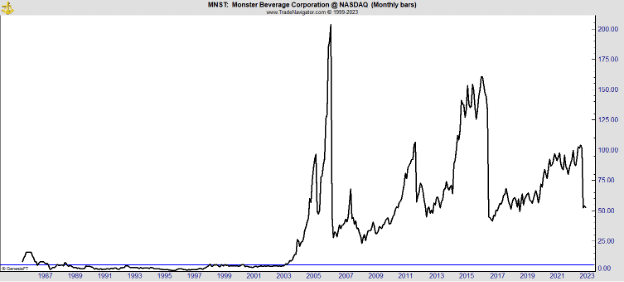

When I explained why large traders don’t touch stocks under $5, I showed the example of Monster Beverage Corporation (MNST).

This is one of the biggest winners in stock market history. And here again, the chart showed an interesting pattern.

When the stock price moved above $5, a rapid advance began.

It looks like large traders were waiting for that price so they could buy and their buying fueled an almost immediate rally.

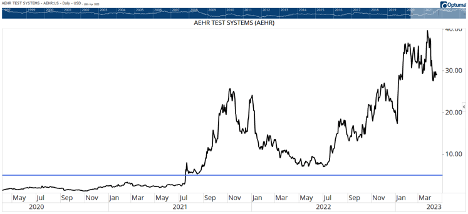

Aehr Test Systems (AEHR) is another example of that same pattern. The blue line in the chart below is at $5. A rapid rally followed the initial breakout in July of 2021.

After a 100% gain in less than a month, the stock pulled back — but it held above $5. A new breakout sent the stock up by 433% in less than three months.

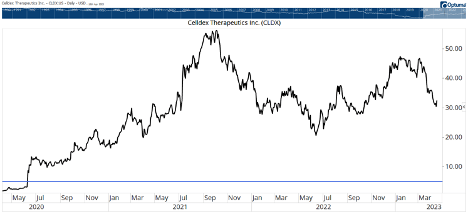

The next chart shows Celldex Therapeutics, Inc. (CLDX). There’s that exact same pattern. A nearly vertical move after breaking through $5.

I could go on, but this pattern is seen consistently in big winners. Crossing $5 opens the door for institutional traders. Their buying sparks a rapid rally.

The charts don’t lie. Adam is on to something big with his latest research. He’s found a way to identify quality stocks trading below $5 that can trigger this pattern.

Last week, Adam released a report containing hundreds of stocks that currently trade under $5 per share. Today, he slashed 171 stocks from the list that aren’t likely to be winners. The ones that remain are substantially lower risk.

Tomorrow, he’ll explain a bit about how he decided to remove those stocks. But you can access the latest version of the $5 Stock Watchlist right here, so you can follow along.

And next Thursday, Adam’s cutting down the list even further — to only the top stocks he believes could deliver market-beating gains this year. And he’ll share those tickers for free.

Buying quality $5 stocks, many of which are in the small-cap sector, is a sound strategy for investing during a bear market. Stocks of this size that can navigate the bear market will inevitably attract a lot of capital from the big money once they’re able to buy in.

That’s why it’s hard to recommend buying something like the Russell 2000 ETF (IWM) right now. Many of the stocks in the index aren’t high-quality, and that will hold back the few that are.

I urge you to instead follow along with Adam as he highlights the best stocks in this sector. That’s the smart way to find the small-caps of today that could turn into the big winners of tomorrow.

Regards, Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

How Americans Feel About This Market

I’m usually an optimistic guy.

Unless you catch me fighting traffic in Lima, Peru. In that case, I could be accused of being a homicidal lunatic.

Though I assure you, no juror who’s ever experienced the terror of driving in Lima would ever vote to convict me of breaking any traffic laws. They’d likely just nod in understanding from the jury box.

But the current sour attitude among Americans can’t be explained by third-world traffic jams. Most would struggle to find Lima on a map, let alone attempt to operate a motor vehicle there.

Yet they are about as negative today as they’ve ever been in the country’s history — at least about this market.

The latest CNBC All-America Economic Survey found that a record 69% of people have a negative outlook about the economy — both today and looking to the future. That’s the highest percentage in the 17-year history of the survey.

Most of this has to do with inflation. Few people younger than 70 would have experienced the inflation of the 1970s as a bill-paying adult. And not surprisingly, two-thirds of the Americans surveyed said that they were falling behind due to inflation.

Here’s where it gets more interesting for us. Only 24% believed it was a good time to invest in stocks — another historic low. That’s even lower than the worst of the 2008 financial crisis.

Now, I don’t like to cherry-pick data. It’s lazy and leads to bad decision making. But the data from the American Association of Individual Investors (AAII) tells a similar story.

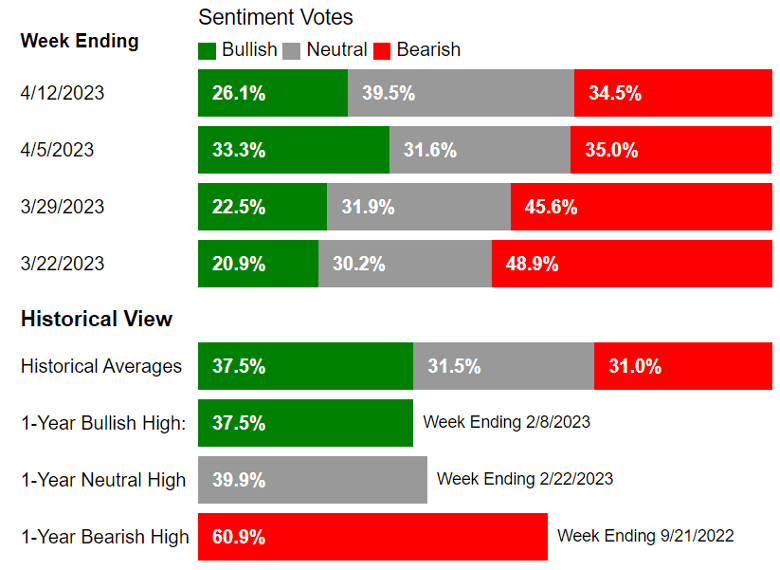

AAII Sentiment Survey

About 74% of the AAII survey recipients were bearish or neutral, whereas only 26% were bullish. Last month, it was even more extreme.

Nearly 80% were bearish or neutral. Historically, about 37.5% of the respondents were bullish at any given time.

So, yes, Americans are downright sour about the market these days.

That might make watercooler discussions depressing. But it’s actually good news for us as investors.

When sentiment is down, it often creates great entry points for investors looking to bet the other way.

This is because the crowd is generally wrong. That’s not to say that the crowd is “stupid.” A lot of individual investors are brilliant people. It’s merely a reflection of market dynamics.

Hear me out. When “everyone” is bearish, it’s safe to assume that they are underallocated to stocks.

In plain English, it means “there is no one left to sell.” And the trade has become one-sided.

This doesn’t mean that buyers will materialize instantly and push stock prices higher today. But it does suggest that this is a good time to start averaging in to good stocks you’ve been itching to buy.

That’s why Adam O’Dell’s upcoming presentation is so interesting. He’s shining a spotlight on a severely underestimated sector of the market and cultivated a list of 200 stocks all trading under $5 per share.

And the best part? These investments could earn up to 500% or more gains in the coming year.

On April 27, he’s sharing this list along with a handful of his top recommendations. To reserve your spot for his free webinar, go here to sign up today!

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge