Oil producers are going to have a great year in 2018. We can too … if we buy shares soon.

You see, most investors hate stocks of oil producers today. The steep fall of the last couple of years is still too fresh in their minds.

However, the math is indisputable: Rising oil prices will make these companies a lot of money.

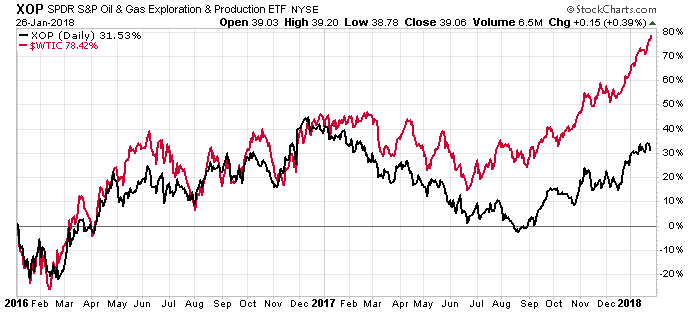

Look at this chart:

The red line shows the price of oil. The black line is the SPDR S&P Oil & Gas Exploration and Production ETF (NYSE: XOP). As you can see, the red line has soared since January 2016, up nearly 80%. The black line is only up 32% over that same period.

Here’s the thing: Oil producers have leverage on the oil price. That means their profit will go up much faster than the actual commodity price. That’s why we love to own producers in a bull market.

Let me show you what I mean…

Owning XOP Today

Let’s say a company produces 1 million barrels of oil per quarter and it cost them $45 per barrel. When the price of oil is $50 per barrel, they make $5 per barrel in profit. That’s $5 million per quarter in earnings.

If the price of oil goes up to $70 per barrel, this same company makes $25 per barrel. Suddenly, their quarterly earnings go to $25 million. That’s an increase of 400% when the oil price goes up just 40%.

That’s something to keep in mind as the U.S. dollar falls and the oil price rises. Owning XOP today could result in a nice profit over the next couple of months.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist