A Whale of a Good Time

When we consider the recent market sell-off, it’s important to note that suddenly, though not surprisingly, the Nasdaq whale was called into existence several miles above Wall Street — a somewhat alien planet for the whale.

Since this was not a natural position for the whale, it had a very short time to come to terms with its unmasked identity as SoftBank Group Corp. (OTC: SFTBY). Courtesy of The Hitchhiker’s Guide to the Galaxy, this is what it thought as it fell:

SoftBank: Ahhh! Woooh! What’s happening? We have to make up for that $12.7 billion annual operating loss. OK, OK … let’s calm down and get a grip. What are these things?

They give us the option to make more money faster on Wall Street? Let’s call them “options!” Yeah! We can buy a bunch of these … say $4 billion? That sounds like enough. We can control about $50 billion in tech stocks with this.

Now, what’s this “whooshing” sound? There’s an awful lot of it since people found out about the tech options we bought. And what’s that big, flat round thing we’re headed toward? It needs a big sounding name like … ow … ‘ound … round … ground! That’s it! Ground!

I wonder if it’ll be friends with me? Hello, ground!

Curiously, the only thought that went through investors’ minds as the market fell and SoftBank dropped roughly 10% was: “Oh no, not again!”

Wall Street analysts have speculated that, if we knew why investors thought this way, we’d know a lot more about the nature of the market than we do now.

Story time aside, let’s break this down Great Stuff style:

- SoftBank needs cash to make up for the $12.7 billion it lost — thanks WeWork!

- Tech stocks such as Tesla, Amazon, Microsoft and Apple are in rally mode.

- SoftBank buys $4 billion in options on these tech giants, giving it control of about $50 billion in stock. That’s called leverage.

- Hit with $4 billion in options contracts, marketmakers buy tech stocks to sure up their side of the options trade. Where there’s a buyer, there must be a seller (the marketmaker) and that seller needs some stock on hand to cover.

- This marketmaker’s buys send tech stocks even higher.

- Fear of missing out (FOMO) pulls in more investors to chase the rally.

- Tech bubble achieved!

But we’re not done yet!

These massive options bets also helped skew risk assessment by the Chicago Board Options Exchange Volatility Index (VIX). It’s safe to say that SoftBank’s play is also at least partly responsible for the recent disconnect between the VIX and the S&P 500 Index.

Once SoftBank’s activity was uncovered — the company started taking profits or a combination of the two — the market decided it was unhappy with being taken for a ride. Profit-taking set in. Stocks fell and still struggle to find solid footing.

The Nasdaq, in particular, closed down another 3% today, with both the Dow and the S&P 500 off roughly 1%.

Sticking with our Hitchhiker’s theme, there’s one very important thing to remember when you hear that “whooshing” sound in the market: Don’t Panic.

If you panic, you could end up selling off stock in companies well-positioned to come out of this market malaise better than before.

Finally, remember the golden rule: He who has the gold rules.

But what if we’ve got something even better than gold? (Impossible? No, that’s just Great Stuff.)

The Good: Generally Speaking

Great Stuff Picks readers, you’re in for a treat today. Many of you write in about Nikola Corp. (Nasdaq: NKLA) — some in support of this Great Stuff Pick and some questioning my sanity.

First, I’m not crazy. My mother had me tested.

Second, Nikola just announced that General Motors Co. (NYSE: GM) is acquiring an 11% stake in the electric vehicle (EV) maker. That’s right: Old-school manufacturing, parts and distribution combined with new-world power tech. It’s like two great tastes that taste great together.

As part of the deal, GM will also nominate one Nikola board member in exchange for “in-kind” services. GM will also distribute Nikola fuel cells globally for its class 7/8 truck.

7/8 truck?

Think dump truck sized vehicles (and bigger) … all running on fuel cells.

This is exactly the kind of deal we hoped for. What? You didn’t think Nikola would build all its own manufacturing plants itself, did you? This kind of deal was just bound to happen.

Not only does Nikola get to jumpstart production on its Badger electric pickup, but it also gets centuries of manufacturing experience. Plus, GM gets exposure to the EV market without having to spin off its own EV and fuel cell divisions.

This win-win deal boosted NKLA stock by more than 30% today. Your Great Stuff Picks position should also be up by a similar degree. Congratulations!

Keep holding NKLA and look forward to additional gains.

The Bad: Tesla Snubbed

Watch out, Tesla Inc. (Nasdaq: TSLA) bulls. We’re about to see just how much of an S&P 500 premium was baked into TSLA shares.

After the company reported four straight quarters in the black, analysts were all but certain TSLA would get the call. But when S&P 500 managers announced the index’s newest members late Friday … TSLA was nowhere to be found.

Instead, Etsy Inc. (Nasdaq: ETSY), Teradyne Inc. (Nasdaq: TER) and Catalent Inc. (NYSE: CTLT) will join the S&P 500, leaving poor old Tesla out in the cold.

So far, TSLA shares took the news pretty hard, dropping more than 15%.

Speculation has it that the S&P 500 board might’ve shied away from TSLA due to its recent volatility. Tesla recently underwent a five-for-one stock split and sold $5 billion in new shares. It peaked at $501.97 on September 1 and is down roughly 30% since.

Given the potential for additional fallout from S&P 500 exclusion — and the SoftBank whale issues — investors might want to hold off buying this dip in TSLA for now. Wait for the shares to stabilize, and then make your move.

Or … don’t. Just forget Tesla. Leave it all behind. Shh, no need for Tesla when the electrified market has this up its sleeve…

The Ugly: 8 Is Enough?

Did you know that there are eight pharmaceutical and biotech companies working on a COVID-19 vaccine right now?

Pfizer, AstraZeneca, Johnson & Johnson, Merck, Novavax, Sanofi, GlaxoSmithKline and Moderna.

Eight! That’s a lot of research and a lot of moolah. It bodes well for both affordability and availability of any eventual COVID-19 vaccine.

However, as any analyst can tell you, that many suppliers will inevitably drive down profit for those making the vaccines. Along those lines, SVB Leerink Analyst Mani Foroohar has some bad news.

According to Foroohar, Moderna Inc. (Nasdaq: MRNA) “…will likely split market share with multiple competitors fairly early in launch, versus our prior assumption that Moderna would be the only available vaccine or split of market share with only Pfizer/BioNTech.”

Splitting that market eight ways doesn’t bode well for any trumped-up vaccine profit projections. As such, Foroohar cut MRNA to underperform from market perform, setting a price target of $41 on the belief that Moderna’s valuation could be cut by a third.

By comparison, the rest of the brokerage bunch has MRNA at an average price target of $90 with a buy rating.

Foroohar believes his peers miss the fact that, once vaccines start to be approved and distributed, Moderna will be left holding a much smaller portion of the market than originally believed.

“While undoubtedly good for humanity and science, the likely consequence will be a glut of production capacity and rapid commoditization of vaccine candidate technologies,” he wrote in a note.

Great Stuff has consistently warned you, dear reader, that something like this could happen. Be sure to keep a close eye on any COVID-19 vaccine stocks you hold lest you too be left holding the bag.

Now that we’re back from the long weekend, I feel alive and refreshed with boundless energy, set to dominate the day, churn out productivity and…

OK, I couldn’t keep a straight face no matter how much caffeine I’ve quaffed. And, depending on the Full House scenario you find yourself in these days, we may be on the same page.

We’re talking about the whole jam-packed locked-down living situation in today’s feature — specifically, the back-to-home plight currently plaguing the young’uns. And to get a better grasp on the situation, we’ve got all your chart-worthy and quote-worthy needs covered. That’s right — it’s Twofer Tuesday.

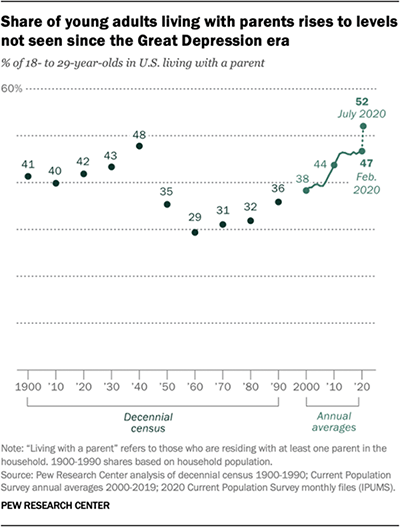

New data from Pew Research puts the percentage of young adults living at home at all-time highs amid the pandemic … furthering a trend on the rise since 1960. Take a look at this week’s chart:

You astute Great Ones out there can spot the percentage jump at the end of the noughties (that’s 2000 to 2010 for anyone still calling them the “00hs”).

You astute Great Ones out there can spot the percentage jump at the end of the noughties (that’s 2000 to 2010 for anyone still calling them the “00hs”).

Hmm, what happened in, say, ‘08 that could’ve caused such a spike? Any guesses?

Now, the financial crisis and its fallout on the average American family pales in comparison to the abrupt wall where the percentages skyrocket between February and July of this year.

You and I both know the factors affecting every move-back-in situation vary, but here are some points to stick in your feathered cap.

It’s the youngest adults who were likelier to lose their jobs or take a pay cut than other age groups. In other words … retail’s shuttering and/or collapse starts right here.

And the typical means of upward mobility for younger adults to get a better job are hamstrung by off-kilter schooling starts and the upended school-life-work balance. As a whole, about one in 10 young adults moved because of the pandemic, either temporarily or permanently.

Today’s Quote of the Week: “The share of 16- to 24-year-olds who are neither enrolled in school nor employed more than doubled from February (11%) to June (28%) due to the pandemic and consequent economic downturn.”

Also, for the sake of all y’all out there ready to email in, young adults who lived in on-campus dorms were already considered to “live at home” … so, when colleges closed up their petri dish housing, these folks weren’t even a part of the increase.

The bottom line: It ain’t just college kids moving back home. And if you’re underestimating the economic power of a generation of mostly home-stuck young adults, you’ve got another thing coming.

Swarm the nest! Swarm the nest!

So Far, So Great Stuff

Thanks for joining us today! Little did you know there’d be homework at the end…

It’s time once again for us to call on you, the loyal and royal Great Stuff readers worldwide, to feed the ever-beckoning beast. Just two days from now, we’ll venture into the dark depths that we call our inboxes.

The objective? Giving each and every one of you a chance to shine. Whether you’ve got thoughts on Tesla’s snub or the sudden Nikola love, we want to hear it all.

Go on, drop us a line at GreatStuffToday@banyanhill.com with your questions, comments and … you know, feedback. And if you don’t want your email featured in our weekly Reader Feedback columns, just let me know. You can always follow us on social media too: Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff