Despite frequent tweets in recent weeks that sent stocks reeling, overall market volatility has declined to a 10-year low. That means something for stocks, but volatility is one of the least understood ideas in the market.

Most analysts treat volatility like they’re fearful roller coaster riders. You only hear screaming when the roller coaster is falling, and we usually only hear about volatility when stocks are falling. If you ever rode a roller coaster, you know the uphill climb is exciting, with passengers quietly awaiting the downturn they know is coming.

This happens in the stock market, too. Investors always seem to “know” that a crash will follow an uptrend. They look for signs of the downturn, and low volatility is frequently called a warning sign. In the past few weeks, low volatility has led to the appearance of the bears, but as the charts below show, the bears could be wrong…

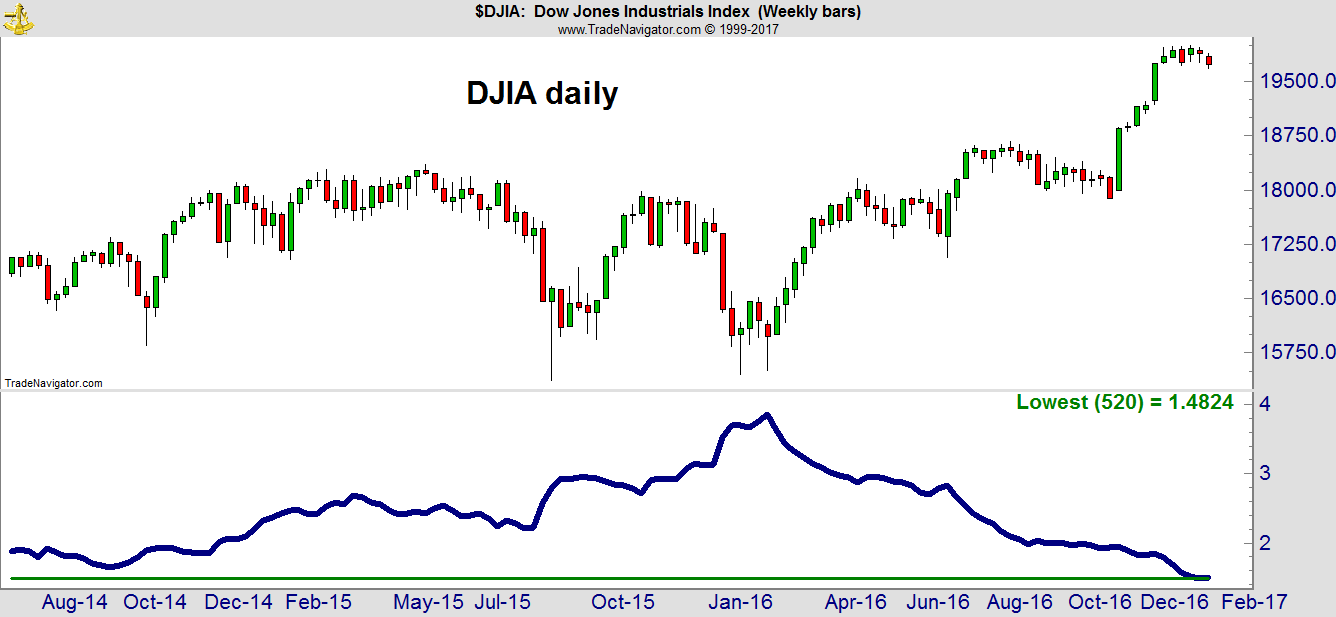

Market volatility, shown in the chart as a blue line, is falling and is now at a 10-year low. Volatility is calculated as the average range of typical market action over the past 26 weeks. The green line marks the Dow’s 520-week low.

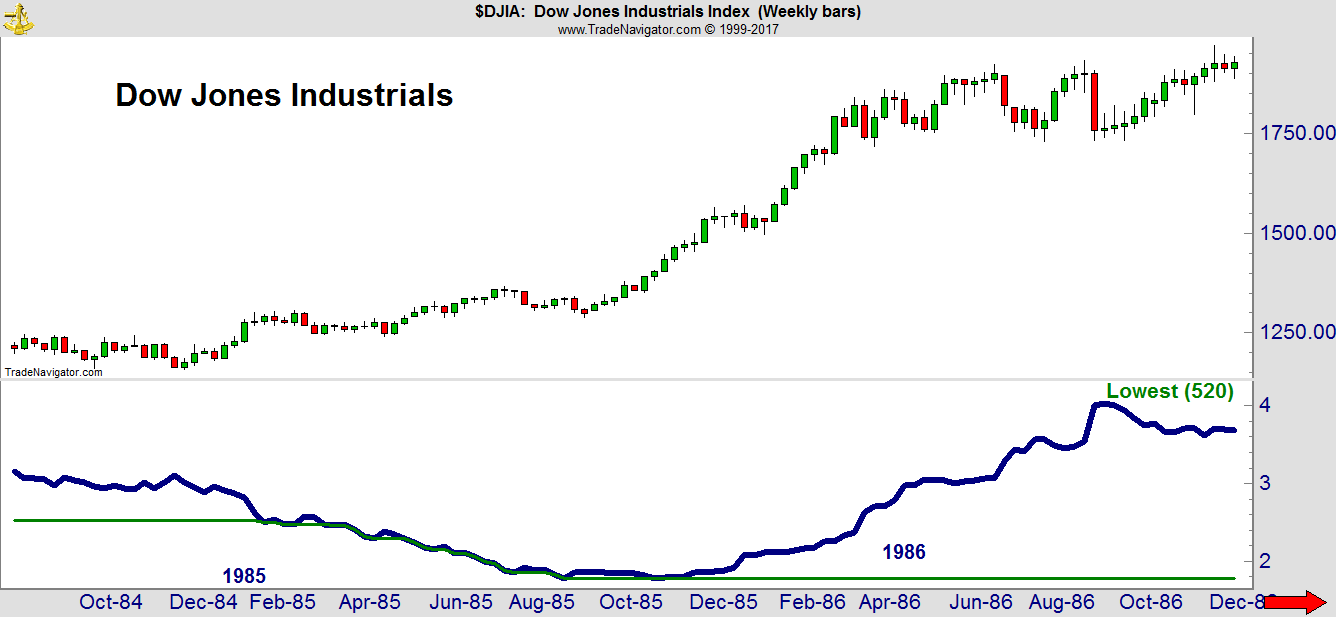

There aren’t many precedents for the current market, but 1985 comes close.

In 1985, stocks had been rallying since Ronald Reagan’s re-election, and volatility collapsed to a 10-year low. In this case, low volatility preceded a gain of nearly 100% over the next couple of years.

Eventually, 32 months later, the bears were right, and the market did crash in October 1987. Investors selling out in 1985 because of low volatility missed a chance to double their money.

While low volatility is widely believed to be a sell signal, it’s really just forecasting that a big move is about to begin. That move can be up or down.

Right now, the weight of the evidence is telling us to expect that move to be higher as earnings improve and economic growth accelerates. A crash is likely at some point, but the crash could be years away.

Regards,

Michael Carr, CMT