As the sounds echoed through the hallway, everyone rushed to safety.

Ahead of me, I could see people dropping to the floor and crawling into open doors on either side.

There was no mistaking it… The sounds were gunshots.

Worse, they came from within the walls of the Pentagon.

No, this isn’t the start to some action movie. I witnessed an actual shooting in a Pentagon hallway as I went to work on Wednesday, August 5, 1987. Almost 34 years ago.

Calm Within Chaos

Everyone’s response looked chaotic, with people rushing to take cover in the rooms adjacent to the hallway.

But had you looked closely, you would’ve noticed an orderly process unfolding.

Everyone was moving to safe spots and helping anyone around them do the same. Security personnel rushed toward the sounds of the shots to ensure the situation was resolved quickly.

From the outside, it looked like panic. In the middle of the crowd, the view was different. Each individual was acting rationally.

In just a few minutes, there were shouts that it was all clear and everyone went about their business. Just look at this quote from the article I linked above:

“There was no disruption of work,” said Col. Joe Parker, a Pentagon spokesman. “We’re just down the hall. There was a momentary ‘gee whiz,’ but no disruption of our activities.”

As the market sold off on Monday, I couldn’t help but think of this story…

That appearance of chaos from the outside, while the reality is far more organized, is the same general pattern that unfolds when stocks sell off.

From the outside, all we see is panic. The Dow drops hundreds of points. CNBC plays dramatic music. Experts from around the world appear on television. They all say there is no single reason for the decline.

Meanwhile, within the market, many individual traders are behaving rationally.

Hedge fund traders are trying to capture gains from the decline. They may be selling as stocks break below their stop-loss levels. They may be buying as stocks that were overpriced hours ago move toward attractive levels.

Mutual fund managers are talking to their customer service centers and learning about redemptions. They need to sell to ensure they have enough cash to meet the needs of their investors. They are also selling stocks that break stop-loss levels and picking up bargains.

Those individual fund investors who force managers to sell may be acting rationally. If they’re in mutual funds, they may be older investors who saw bear markets in 2000 and 2008 destroy over half their wealth. To keep their retirements on track, they sell on big drops because they know they can buy back in later.

That might not be the best strategy, but it is a strategy that’s rational to the investor.

Leave the Panicking to Irrational Investors

Now, some investors act irrationally in the face of market volatility. They might try to short the market with overleveraged strategies, or just liquidate their whole portfolio ahead of what they think is “the big one.”

There will be irrational investors in good times and bad. But they are a small part of the market.

Rational investors are the ones who create the trends. The two levels of the market — the macro moves and micro motives behind those moves — are always present. To many of us, the moves and motives might seem irrational. But they are really just different than what we expect.

How we react to this reality determines our level of success.

This thought also brings me back to the COVID-19 crash last March…

Back then, as the Dow fell over 10,000 points in just over a month, I used my One Trade system to book gains of 75%, 17% and 67% for my readers.

In the month that followed, we captured gains of 313% and 110%. That’s all from following just one highly predictable market sector using an indicator I invented.

We didn’t panic… We followed the plan that we always follow with One Trade. That was able to protect us and keep our heads cool when investors across the world were in a full-blown panic.

Keep this in mind the next time volatility rocks the market. No matter how chaotic it seems, the market is made up of rational traders making rational trades. Your job is to resist panic, cut through the noise and respond rationally.

Regards,

Michael Carr

Editor, One Trade

P.S. To get content like this in your inbox everyday, subscribe to True Options Masters. Click here and subscribe.

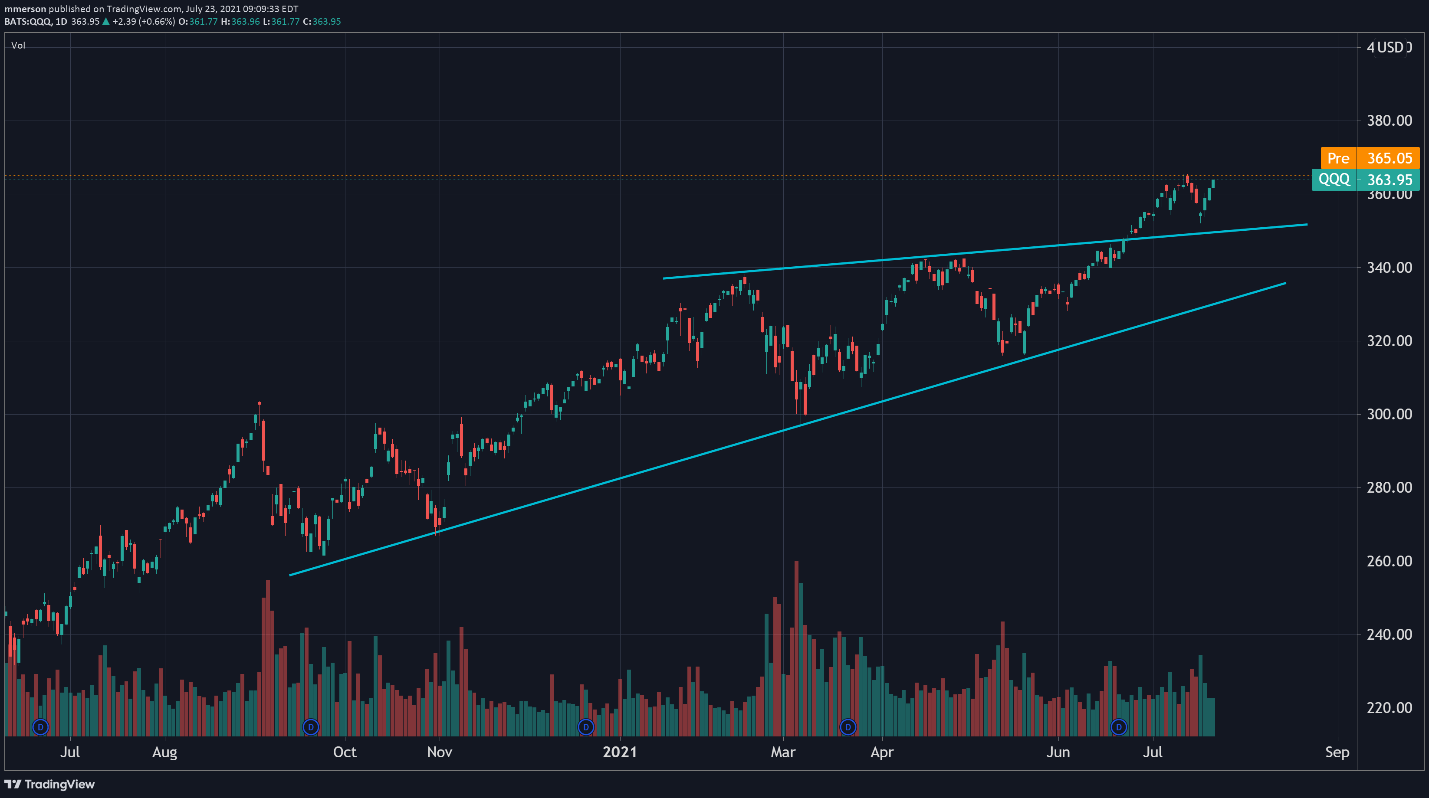

Chart of the Day:

Tech Stocks Poised for New Highs

By Mike Merson, Managing Editor, True Options Masters

(Click here to view larger image.)

Today’s chart is of the Invesco QQQ Fund (NYSE: QQQ), an exchange-traded fund tracking the tech sector.

And I’m showing it to demonstrate a classic technical signal: the resistance/support retest.

Note the two blue lines on the chart. The lower line acts as support for QQQ, which we can draw by connecting two or more low points on the chart.

The higher line acts as resistance — evidenced by the various touches of the line in February and mid-April.

Whenever lines like these break, it indicates that support or resistance has failed — at least temporarily.

But what tends to happen after is the price coming back to test the former line as a new base of support or resistance.

That’s exactly what we’re seeing today with QQQ. The resistance line broke in late June, and the price came back to retest the line early this week. QQQ has since bounced cleanly off this line, and with high volume (another good confirmation signal for breakouts and retests).

That gives us more evidence that QQQ’s former resistance is now acting as support. Now, the price will have to find new overhead resistance — which could mean new highs are ahead for the tech sector.

Best,

Mike Merson

Managing Editor, True Options Masters