William McChesney Martin created the modern Federal Reserve. He was the chairman from 1951 to 1970.

Before 1950, the Treasury Department drove monetary policy. Martin separated the policies of the two and created an independent central bank.

Martin said the Fed’s job is “to take away the punch bowl just as the party gets going.”

He meant the Fed raises interest rates as the economy peaks. Before the economy turns down, the Fed tries to “spike the punch.”

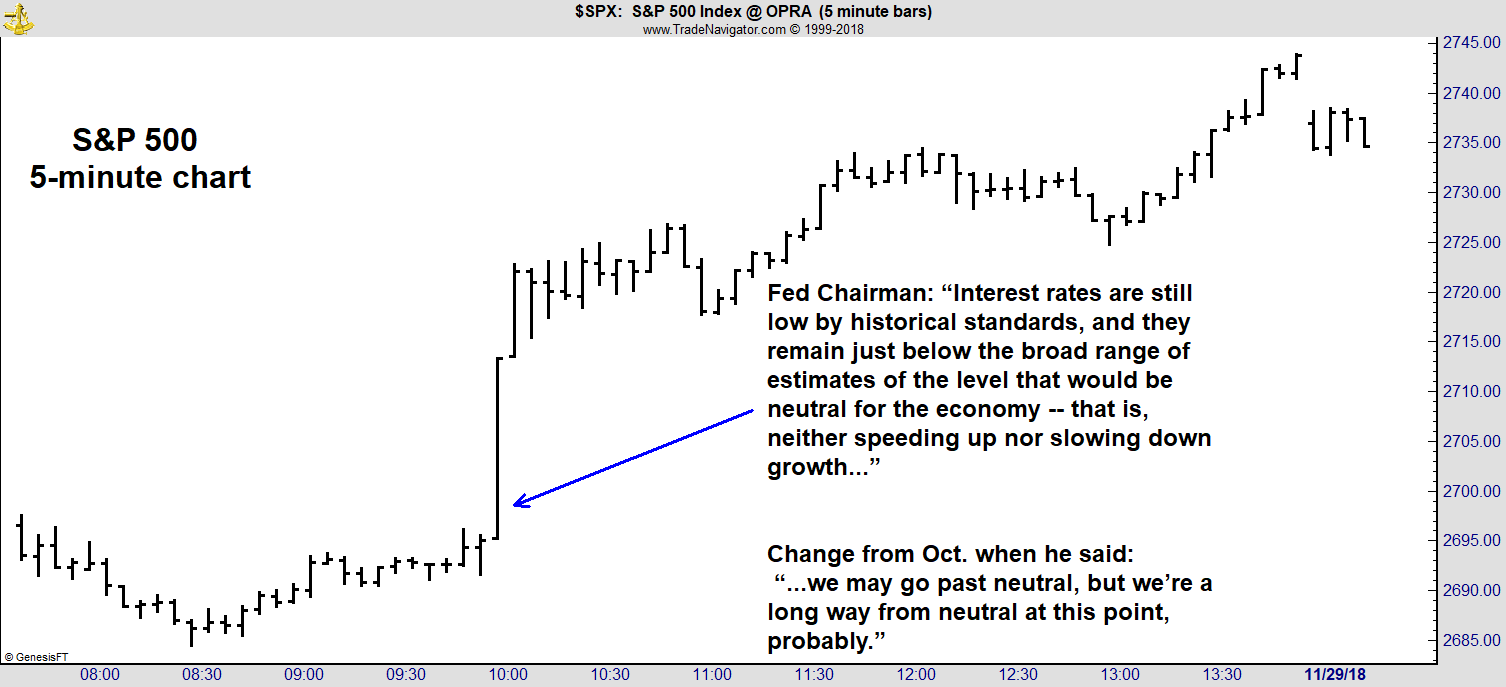

So, when Fed Chairman Jerome Powell recently said interest rates might stop rising, he meant the economy was in trouble.

Somehow traders believed his statement was good news, and they sent stocks soaring.

The S&P 500 Index gained more than 1% in the five minutes after traders read his speech.

They were right that this speech was important. But buying stocks was the wrong reaction.

The Fed Chairman Knows There’s a Problem

Neutral interest rates are the equivalent of the baby bear’s porridge.

In the Goldilocks fairy tale, the heroine tries three bowls of porridge. The first is too hot. The second is too cold. The third one, the baby bear’s bowl, is just right.

When the economy is too hot, the Fed raises rates. It cuts rates when the economy is too cold. Neutral rates are just right.

In theory, neutral is the rate that maximizes growth without inflation.

In October, Powell hinted rates were well below his target. The economy was too hot. By raising rates, the Fed planned to cool the economy.

A little more than a month later, the Fed chairman changed his view.

Interest rates were the same. All that changed was Powell’s opinion. That means new economic data raised concerns that the economy was slowing.

Powell now recognizes there’s a problem. He’s catching up to what business owners already figured out.

The National Federation of Independent Business reported that its Small Business Optimism Index fell in November for the third straight month.

Powell is also recognizing what consumers already know. One sign of the coming economic slowdown is the decline in recreational vehicle (RV) sales.

An Excellent Economic Indicator

RVs are a “good economy” product. They might be the ultimate good economy purchase.

They are expensive to buy. Many RVs cost more than $100,000.

They’re also expensive to maintain and operate. Owners pay storage costs when they don’t use their RV. They pay for fuel when they use the RV.

Every month, in good times and bad, the RV costs them money.

Consumers buy RVs when they’re confident they can afford the maintenance. In a slow economy, they avoid purchases like this.

That makes RV sales an excellent economic indicator. History confirms the value of this data.

Sales dropped in the year before each of the past two recessions.

RV sales are set to end 2018 with the first year-over-year decline since 2009.

Every annual decline in sales since 1990 has been associated with a bear market in stocks.

There’s no reason to believe this time is different.

Declining RV sales, growing pessimism among business owners and homebuilders and Powell’s recent comments all point to a slowing economy.

These factors also tell us the bear market in stocks already started.

It began in October. Rallies now offer opportunities to reduce losses.

Regards,

Michael Carr, CMT, CFTe

Editor, Peak Velocity Trader