On September 15, 2022, the biggest event in crypto history kicked off.

Picture it. It was around 2:45 a.m. Eastern.

And hundreds of thousands of viewers were tuned into the Ethereum Foundation’s livestream.

It wasn’t just the community watching their screens either. Ethereum creator Vitalik Buterin was there too.

And over the next 15 minutes, the world’s second-biggest cryptocurrency — Ethereum — got a massive upgrade.

ETH became ETH2.

At 3 a.m., white lines of code on the black screen came together. These codes formed: “POS Activated.”

This event is known as “the Merge.”

Crypto experts around the web celebrated as the Merge finally happened after years of delay.

Sean Ford, interim CEO of blockchain Algorand, said: “Ethereum has a chance now to be a productive, aligned, forward-looking technology.”

Tyler Winklevoss, co-founder and CEO of cryptocurrency exchange Gemini, remarked: “The merge is a big milestone and big step toward Ethereum being able to fulfill its ultimate promise.”

And Ethereum inventor himself — Vitalik Buterin — said: “This is the first step in Ethereum’s big journey toward being a very mature system.”

I’ve been following this Layer-1 crypto for years. (I even recommended it to my Strategic Fortunes readers back in 2020. We’re now sitting on an open gain of 298%!)

I call it the “Next Gen Coin” because I believe it will soon eclipse bitcoin (BTC).

But while crucial, the Merge was only Step 1 in a multi-phase upgrade. Four more are going to follow. They’re scheduled over the next few years.

These upgrades will make Ethereum more scalable, more secure and ultimately more sustainable.

But without starting with the Merge, Ethereum’s inner plumbing would be incompatible with these future upgrades.

So what were the exact effects of the Ethereum Merge? And what can we expect next?

What Was the Point of the Merge?

As I’ve discussed before, the main point of this upgrade was moving the Ethereum network from proof-of-work (PoW) to proof-of-stake (PoS).

As a brief reminder, PoW is the old system, where energy-intensive miners are responsible for validating every transaction on the blockchain. (Bitcoin still uses this type of consensus mechanism.)

PoS is where stakers validate the transactions. (For more on the differences between PoW and PoS, check out the infographic below!)

The Merge upgraded Ethereum’s consensus mechanism from PoW to PoS, which is:

The Merge upgraded Ethereum’s consensus mechanism from PoW to PoS, which is:

- Faster.

- Cheaper.

- More energy-efficient.

While the “faster” and “cheaper” parts of the transformation will take effect with future upgrades, the “energy-efficient” part is already in place.

“That sounds great in theory, Ian,” you might say. “But the Merge didn’t actually do much to ETH’s price.”

I hear you.

At first glance, the Merge seems unremarkable.

Ethereum’s price didn’t move drastically. In fact, it actually dropped after the Merge.

And as far as the average user on the network was concerned, nothing changed.

But this was actually a good thing — it meant the delays were worth it.

The Merge went off exactly as planned, without a hitch.

But behind the scenes, everything changed for Ethereum that day.

The Biggest Effects of the Ethereum Merge

If you thought the Merge was unremarkable, you’re not alone.

Billionaire Mark Cuban has been vocal about the Ethereum Merge being a disappointment.

“It’s a non-event,” he remarked to Fortune.

In this instance, I have to disagree with Mr. Cuban. There were two major effects on Ethereum thanks to the Merge. And they’re crucial to anyone holding this crypto long-term.

- After the Merge, Ethereum’s energy usage dropped 99.99% overnight.

The network went from using over 80 terawatt-hours (TWh) of energy per year to using 0.01 TWh.

To put that in perspective: Under PoW, a single transaction on Ethereum used the same amount of energy it takes to power the average U.S. home for a day.

But under PoS, that same transaction only uses enough energy to power a house for a single minute.

This is enough to reduce global energy consumption by an estimated 0.2% per year.

That also cuts way back on the network’s carbon footprint.

Ethereum couldn’t become more energy-efficient at a better time either.

You see, countries around the world are gearing up to regulate crypto. And one of the areas under consideration? Energy consumption.

For example, the Biden administration may mobilize federal agencies such as the Environmental Protection Agency (EPA) and the Department of Energy to regulate crypto’s environmental impact.

Luckily, even if these regulations come to pass, the Merge puts Ethereum in a good position.

But other than being extremely energy-efficient, ETH has a major advantage in this bear market.

- The inflation rate of ETH fell to 0%.

Why?

Well, before the Merge, Ethereum paid out roughly 13,000 ETH per day to reward miners. It also paid roughly 1,600 ETH per day to reward stakers (under the PoW system).

Since the Merge did away with the PoW system, there are no longer miners on the Ethereum network. That means the network no longer pays out mining rewards. It only needs to pay out the 1,600 ETH staking rewards.

This reduces the inflation of ETH by dropping the amount of newly issued ETH by about 90%.

On the flipside, the mechanism that limits ETH’s potential out-of-control inflation is the “burn.”

Every time a transaction is made on the Ethereum network, a fee is paid in ETH to make that transaction happen. That fee is then burned — or taken out of circulation by the network.

The fee is measured in gwei: one billionth of an ETH token. This fee also fluctuates depending on the transaction volume at any given time on the network.

At the average level of 16 gwei, there are enough transactions happening to burn about 1,600 ETH per day. This is around the same number of ETH being rewarded to stakers.

So the inflation rate of ETH fell to 0%.

What’s potentially even bigger is that the transaction volume could rise above 16 gwei per transaction. There would be more ETH burned than issued on a daily basis.

That would make ETH truly deflationary.

Why ETH Becoming “Deflationary” Is a Good Thing

A crypto becomes deflationary when its tokens are removed from the market over time. This would include when tokens are burned or bought back.

And that is exactly what happened.

At the time I’m writing this, the average fee level is at 17 gwei (it exceeded 16 around October 7).

As a result, ETH became deflationary. Nearly all new ETH tokens issued since the Merge have been wiped out.

That might sound negative, but this is actually great for ETH holders. With a deflationary supply and constant demand, each ETH token could potentially be worth more!

Here’s why:

Even when the overall market cap of ETH is the same, as long as the supply is deflationary, the price of each ETH token will still rise. This is because it’s the same market cap, but now spread across fewer ETH tokens.

As an ETH holder, your tokens are no longer being diluted by the addition of 13,000 new ETH each day (like in the PoW system).

And this also makes ETH more sustainable into the future.

ETH finally has a way of making sure there is no runaway inflation like in other crypto projects (Dogecoin) or even fiat currencies. The buying power of one ETH token will either remain about the same, or it’ll increase over time.

So these may be the biggest effects on Ethereum so far, but the good times just keep on rolling. Because the Merge isn’t the only upgrade this crypto has in its future.

4 More ETH Upgrades Coming After the Ethereum Merge

The Ethereum Merge was only the first of five major steps in its transformation.

According to Vitalik Buterin, before the Merge, Ethereum was only considered 40% complete on its path to its ultimate form.

Post-Merge, Buterin estimates it to be about 55% complete. The next four steps will take the network the rest of the way.

Without getting too technical, here’s what these steps should accomplish:

- The Surge: will happen over several stages starting in 2023. Its goal is to increase the transaction processing capacity of the network — taking it from handling 30 transactions per second to 100,000.

- The Verge: will introduce technical changes like “Verkle trees” and “stateless clients.” These will let stakers verify and add transactions to the network without having to store massive amounts of data on their computers.

- The Purge: involves several upgrades to remove old network history. This will simplify the network over time. Reducing the historical data storage burden will further lower the hard disk and storage requirements on computers used by stakers.

- The Splurge: is a series of smaller upgrades that don’t fit into the same categories as the steps that came before it. These final touches should ensure that the network runs smoothly.

Should You Invest in Ethereum Before It’s Done Upgrading?

But now for the question on most crypto investors’ minds…

With all these steps pending, should you wait until Ethereum completes these steps to invest in it?

I’ll go all-in and say it: Absolutely do not wait.

First, you want to make sure to get in before these changes arrive and the market prices in these steps.

Second, one of the biggest value drivers for ETH is already in play — the deflationary mechanism I talked about earlier.

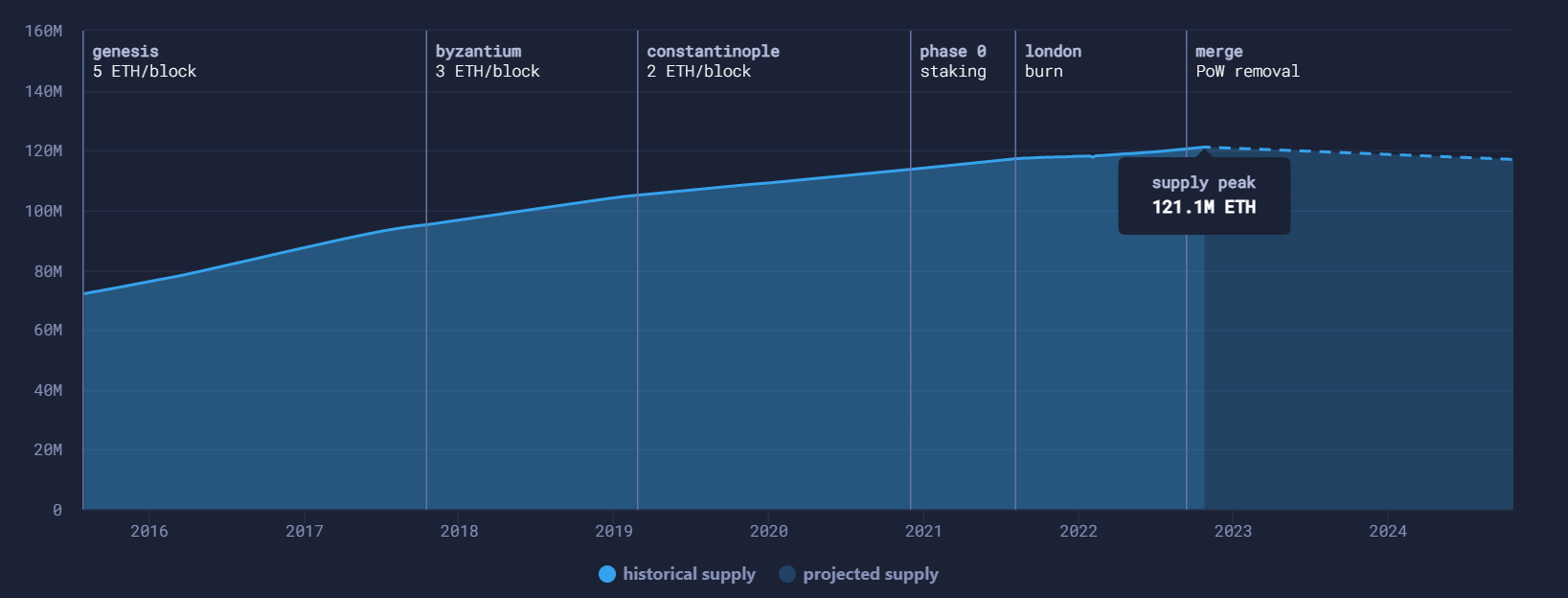

Current projections show ETH supply peaking at 121.1 million before the end of 2022.

From that point on, it’s expected to decline into 2025, down to 117 million ETH.

And with even fewer ETH in circulation by then, the existing ETH will become more valuable.

From a pure value-conservation perspective, it’s a better bet than bitcoin, which is still growing its supply by 1.72% per year.

You can buy ETH tokens on major exchanges like Coinbase or Gemini.

If you have any other questions about the effects of the Ethereum Merge or buying into ETH, let me know!

Feel free to reach out on Twitter (@InvestWithIan).

And in the meantime, for my question of the week, let me know:

Are you buying Ethereum? Why or why not? If not, what’s stopping you?

Send your answers to WinningInvestorDaily@BanyanHill.com.

Learn Even More About Investing in Crypto

If you’re ready for a deeper dive into the world of cryptocurrency, I have a service called Next Wave Crypto Fortunes.

With your subscription, I give you:

- My top crypto picks — I weed out the most volatile ones!

- The best time to buy in (or sell your tokens).

- Tutorials on staking, storing on crypto wallets and more.

- Access to my special reports on Ethereum (and other cryptos).

- The latest crypto research.

Just go here to learn more about this service and all it has to offer!

Regards,

Ian King

Editor, Strategic Fortunes

Disclaimer: We will not track any stocks in Winning Investor Daily. We are just sharing our opinions, not advice. If you want access to the stocks in our model portfolio with tracking, updates and buy/sell guidance, please check out Strategic Fortunes.