Last week, I got my first shot of Pfizer’s COVID-19 vaccine.

My friends, family and co-workers have started getting vaccinated as well. And for those of you reading this article, there’s a good chance you’ve already received one or even two shots.

In fact, the Centers for Disease Control and Prevention reports that, as of Wednesday, 40% of U.S. adults have gotten at least one shot, while nearly 25% of adults are fully vaccinated.

The numbers are even better for seniors. The data shows that 75% of Americans aged 65 and over have received at least one dose, while more than half are fully vaccinated.

This is a huge deal. It means our lives will start going back to normal soon.

It’s also incredible news for the stock market. Read on to see why JPMorgan Chase CEO Jamie Dimon thinks we’re headed for a major economic boom in the years ahead.

A Massive Economic Boom Is Coming

In his annual letter to shareholders, Dimon explains why the economic recovery will be much bigger and faster than what we saw following the 2008 financial crisis.

He points out that financial regulations have made our banking system healthier and more stable than it was in the past.

In addition, the trillions of dollars injected into the economy via multiple stimulus bills have loaded up consumers and businesses with cash that’s just waiting to be spent.

Dimon notes a number of other bullish factors as well, including:

- More quantitative easing and deficit spending ahead to boost the recovery.

- President Joe Biden’s $2 trillion infrastructure plan (which I wrote about last week).

- The speedy rollout of the COVID-19 vaccine and (finally!) the end of the pandemic.

According to Dimon, the coming economic growth could last for years. “This boom could easily run into 2023 because all the spending could extend well into 2023,” he writes.

It’s Time to Invest in the New American Economy

The pandemic isn’t quite over yet, but things are already looking good for the economy.

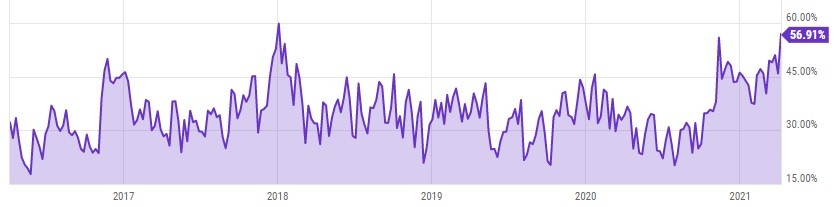

The S&P 500 Index just made a new all-time high. The U.S. added nearly 1 million jobs in March. And investor sentiment is at its most bullish level since January 2018.

U.S. Investor Sentiment: 2016–2021

Dimon also notes in his report that the New American Economy will be driven by technologies such as artificial intelligence, cloud computing and fintech.

He writes: “Maintaining a strong technology infrastructure and adopting new technologies […] could be life-or-death decisions for a company.”

That’s why now is the perfect time to invest in tomorrow’s hottest tech industries.

You can get started today by joining Ian King’s Automatic Fortunes research service. It covers next-generation tech trends, including 5G, blockchain, self-driving vehicles and more.

Click here to learn more about Automatic Fortunes.

Regards,

Assistant Managing Editor, Banyan Hill Publishing