In 2009, I watched one of my colleagues make an enormous mistake. He believed, fervently, that deflation was looming. In spite of the data, he stuck to his philosophy. He kept himself out of the market … and missed a once-in-a-lifetime opportunity.

I took a firm lesson from his mistake: Take the bull markets whenever and wherever you get them. I always follow the data. Philosophy is fine up to a point, but when you ignore big profits from sheer bullheadedness … that’s a problem.

That’s why I’m going to discuss the bull market in lithium.

I’ll admit, I was a lithium skeptic for a long time. I pooh-poohed electric cars for years. Don’t get me wrong, lithium is a useful metal. It’s in polymers, medicine, grease, glass and ceramics. For most of this decade, only about 36% of its production went into batteries.

Lithium comes in several different forms, such as spodumene ore, lithium hydroxide and lithium carbonate, which each have a different price. That makes it difficult to figure out its value … which makes it difficult to value the mining companies that produce it.

The Electric Revolution Is Coming

Lithium is a “problem child” in the metals space. It doesn’t have a futures market. Prices are set between producers and suppliers, so each deal is different.

It’s also a “fad metal” like the rare earths. It’s easy to get caught up in the lithium hype because the story is so good. I once had a guy explain to me why petroleum was obsolete thanks to lithium. (We were driving in his Toyota Tundra at the time. He missed the irony…)

Back then, electric cars had short legs: a 100-mile range and long charging periods. I couldn’t see how a car that had to sit for hours to charge was going to replace conventional vehicles. Now I see chargers in almost every city I visit. So, the guy was right, in part. Electric cars are coming to cities for sure … and that’s why lithium is in a bull market.

You see, lithium offers high-performance batteries. We’ve all owned lithium batteries if we’ve owned any cordless tools. Lithium-ion batteries are among the best-performing batteries available.

However, supplying lithium batteries for cellphones, watches and cordless drills isn’t a huge market. Electric cars, on the other hand, is a massive market. A car uses about 4,500 times the amount of lithium that a cellphone uses. According to analysts at Citigroup, electric vehicles consumed 15,000 tons of lithium in 2015. By 2025, the car industry will consume 136,000 tons.

Tesla’s Gigantic Gigafactory

Battery maker Tesla (I know it makes cars too, but it really makes batteries) is driving this uptrend as well. Its Gigafactory outside Sparks, Nevada, will be a huge new source of lithium demand. In 2018, Tesla plans to double the world’s lithium battery production. And as Profits Unlimited Editor Paul often writes about, Tesla’s Model 3 is going to be the first true mass-market electric car.

That’s a massive change in demand. Mining companies with the capacity to produce more lithium are soaring in value.

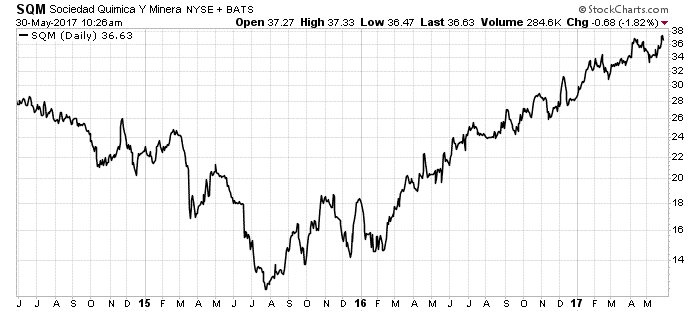

This chart shows the performance of Sociedad Química y Minera de Chile SA (NYSE: SQM). It is best known for mining potassium for fertilizers. However, more recently, it increased its lithium production. As you can see, shares are soaring:

In 2013, SQM generated just 8% of its revenue and 12% of its net income from lithium. That has grown steadily since. In the first quarter of 2017, SQM generated 29% of its revenue and 60% of its net income from lithium. It generated more net income from lithium in the first quarter than it did in all of 2013 or 2014.

SQM is the best lithium play out there. There is also an exchange-traded fund (ETF) that covers the whole lithium battery space — the Global X Lithium & Battery Tech ETF (NYSE Arca: LIT), which holds about 13% of its funds in SQM.

Regardless of how you play it, you should own some lithium. This bull market will continue through 2017 and well into 2018. Regardless of how you feel about electric cars, if you want to make money … get on board.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist