As we wrap up the month of May, I can’t help but notice that the phenomenon of “sell in May and go away” didn’t have an impact.

The S&P 500 finished the month with a 1.16% gain.

What I wanted to know is, what does this mean about selling in May, and is it time to “go away” now, or is it time to buy?

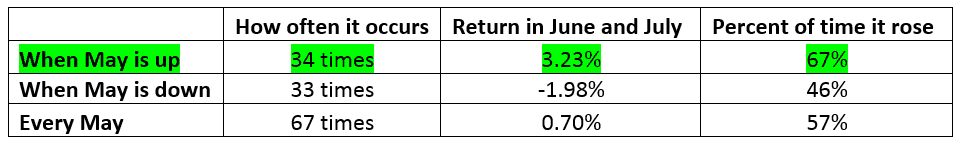

I ran data on the S&P 500 going back 67 years, and here’s what I discovered.

You can see this is clearly a bullish sign, as the months following a May uptrend outperformed other years by more than three times the average returns.

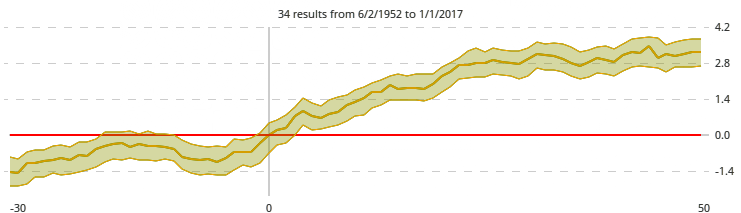

Here’s what it looks like on a graph:

The line represents the average return over the time frame, and the shaded area around it is one standard deviation of that average.

Clearly the momentum we see in May is generally carried through the summer. That tells us the odds of seeing the “sell in May and go away” phenomenon are not likely this year.

Instead, we should remain bullish.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert