Latest Insights on STRO

The Great Convergence Smacks Wall Street February 7, 2018 Bonds The Dow was down over 1,800 points in two trading days. What's next?

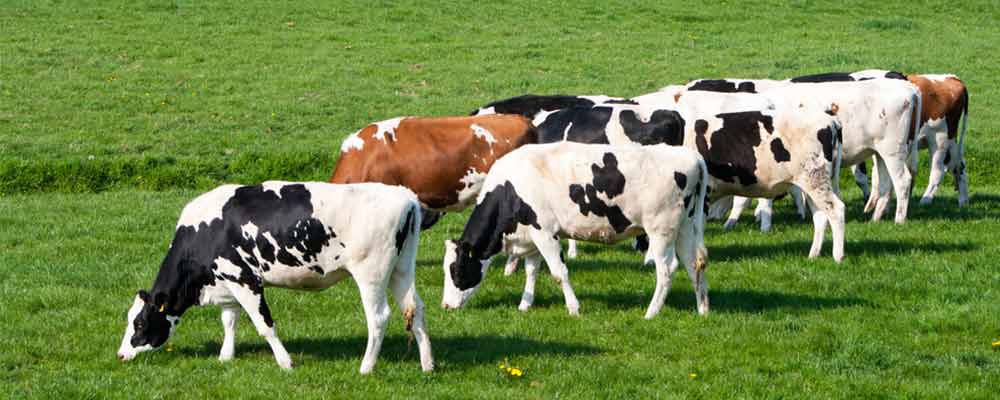

The Great Convergence Smacks Wall Street February 7, 2018 Bonds The Dow was down over 1,800 points in two trading days. What's next? Agriculture Stocks Are Ripping Today February 6, 2018 Investment Opportunities In 2017, the price of beef hit its highest price in two years. And the entire agriculture sector benefits when beef is on the menu.

Agriculture Stocks Are Ripping Today February 6, 2018 Investment Opportunities In 2017, the price of beef hit its highest price in two years. And the entire agriculture sector benefits when beef is on the menu. Measuring Stock Market Momentum Using the Relative Strength Index February 5, 2018 Stocks Sometimes, momentum is a bad thing … too much of it suggests the market may be irrationally optimistic. History suggests this is one of those times.

Measuring Stock Market Momentum Using the Relative Strength Index February 5, 2018 Stocks Sometimes, momentum is a bad thing … too much of it suggests the market may be irrationally optimistic. History suggests this is one of those times. Win Big When This Hated Sector Rebounds February 5, 2018 Investment Opportunities This sector has dropped more than 12% since mid-November. I’ll explain why it looks primed to rally, and the best stock to use so you can benefit.

Win Big When This Hated Sector Rebounds February 5, 2018 Investment Opportunities This sector has dropped more than 12% since mid-November. I’ll explain why it looks primed to rally, and the best stock to use so you can benefit. The Largest Tech IPO of 2018 Is Overhyped February 3, 2018 Investment Opportunities Let’s see why Spotify might not be worth the buzz quite yet…

The Largest Tech IPO of 2018 Is Overhyped February 3, 2018 Investment Opportunities Let’s see why Spotify might not be worth the buzz quite yet…