Americans are in love with beef — again.

Health implications saw red meat lose favor with the public. In addition, meat prices fell thanks to cheap grains and energy prices. The price of a whole steer hit rock bottom in 2016.

Today, carbs and sugars are the new dietary scapegoat. Beef is back on the menu.

U.S. beef consumption just hit a seven-year high of 58 pounds per person per year. And this trend isn’t just limited to the U.S. Exports of meat generated $6.34 billion in 2016. Japan, Mexico and Canada are some of the biggest buyers.

In 2017, the price of beef hit its highest price in two years. This is great news for more than just ranchers. The entire agriculture sector benefits when beef is on the menu.

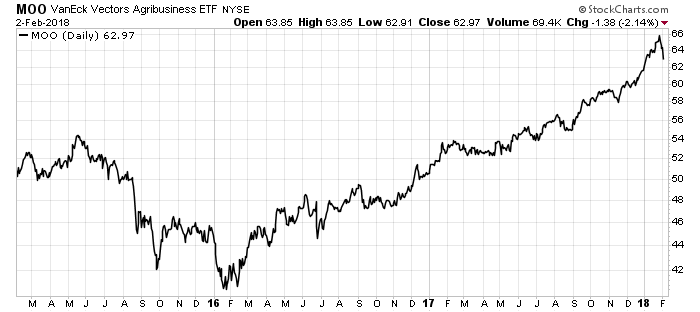

You can see what I mean by the chart below:

The VanEck Vectors Agribusiness ETF (NYSE: MOO) bottomed in 2016 along with most of the natural resource sector. MOO holds 57 agriculture stocks including tractors, seed makers and fertilizer companies, among others. The two-year recovery in agriculture stocks followed in lock step with the recovery of the beef industry.

More cows mean more feed. One pound of beef needs 10 times that amount in grain. That drives demand up for corn, soy and other grains.

Processing and shipping all the grain and cattle is big business for transporters. Finally, food processors benefit from the increase in demand for red meat.

The bull market is rolling in agriculture. MOO is a great way to profit from that trend.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist