Latest Insights on FOUN

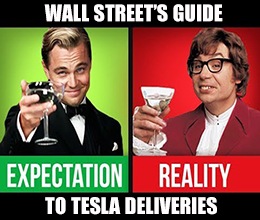

Tesla Struggles With Wall Street’s Lofty Expectations October 3, 2019 Great Stuff Record Deliveries, Record Pessimism When it rains, it pours. What started out as a skirmish for connectivity with my internet service provider has turned into all-out warfare. Charter/Spectrum … we’re going to have words about the area-wide outage today. Some of us have actual work to do. Due to a combination of extenuating circumstances, you’re […]

Tesla Struggles With Wall Street’s Lofty Expectations October 3, 2019 Great Stuff Record Deliveries, Record Pessimism When it rains, it pours. What started out as a skirmish for connectivity with my internet service provider has turned into all-out warfare. Charter/Spectrum … we’re going to have words about the area-wide outage today. Some of us have actual work to do. Due to a combination of extenuating circumstances, you’re […] The Fed’s Biggest Nightmare; Retail Gets Real; WeGiveUp October 1, 2019 Great Stuff Is the U.S. Economy Going Stag? I saw an ugly word pop up over the weekend. No, not that word … or that word, either. Seriously, you kiss your mother with that mouth? The word was “stagflation,” and it’s the word that the U.S. Federal Reserve fears most of all. Now, stagflation is traditionally defined […]

The Fed’s Biggest Nightmare; Retail Gets Real; WeGiveUp October 1, 2019 Great Stuff Is the U.S. Economy Going Stag? I saw an ugly word pop up over the weekend. No, not that word … or that word, either. Seriously, you kiss your mother with that mouth? The word was “stagflation,” and it’s the word that the U.S. Federal Reserve fears most of all. Now, stagflation is traditionally defined […] Your Trade War Trading Strategy; Peloton Hacked; Thor Calls the Thunder September 30, 2019 Great Stuff Trade War Cycle: You Are Here Today marks the end of the third quarter of 2019. How are you all holding up? I hope it’s better than the major market indexes. For the quarter, the Dow is up about 0.7%, the S&P 500 is up a mere 0.3% and the Nasdaq Composite is down 1.5%. […]

Your Trade War Trading Strategy; Peloton Hacked; Thor Calls the Thunder September 30, 2019 Great Stuff Trade War Cycle: You Are Here Today marks the end of the third quarter of 2019. How are you all holding up? I hope it’s better than the major market indexes. For the quarter, the Dow is up about 0.7%, the S&P 500 is up a mere 0.3% and the Nasdaq Composite is down 1.5%. […] WeWork’s Red Flags: Why A Great CEO Matters September 26, 2019 American Investor Today, Investing, Investment Opportunities This week, WeWork’s CEO stepped down ahead of the office leasing company’s initial public offering. WeWork is a great example of why a CEO is so important to a company’s success. Charles Mizrahi talks about the importance of researching the track record of a CEO and his approach to buying stocks. (9-minute video)

WeWork’s Red Flags: Why A Great CEO Matters September 26, 2019 American Investor Today, Investing, Investment Opportunities This week, WeWork’s CEO stepped down ahead of the office leasing company’s initial public offering. WeWork is a great example of why a CEO is so important to a company’s success. Charles Mizrahi talks about the importance of researching the track record of a CEO and his approach to buying stocks. (9-minute video) WeWork IPO: Beware Master Unicorn Wranglers September 25, 2019 Investing, Investment Opportunities, Winning Investor Daily Good investors always want to know what they’re buying. To do that, they must confirm what the company is selling … and in WeWork’s case, it isn’t office space.

WeWork IPO: Beware Master Unicorn Wranglers September 25, 2019 Investing, Investment Opportunities, Winning Investor Daily Good investors always want to know what they’re buying. To do that, they must confirm what the company is selling … and in WeWork’s case, it isn’t office space.