Latest Insights on AGN

Angry. Disillusioned. Doomed?

Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing

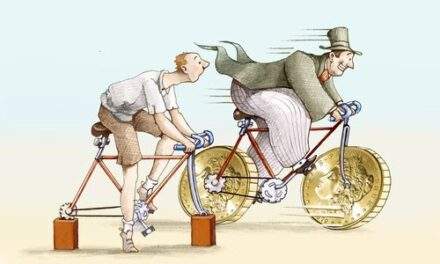

South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on… Don’t Bottom Fish for Speculative Growth Stocks

Don’t Bottom Fish for Speculative Growth Stocks February 7, 2022 Big Picture. Big Profits., Investing, Investment Opportunities, Trading Strategies

In today’s Your Money Matters, Clint Lee gives you the lowdown on areas of the market that are starting to see steep falls from their highs. Does that mean it’s time to go bottom fishing and grab those opportunities? Before you get ahead of yourself, Clint says to take a step back and look at the big picture. Because yes, many speculative areas of the market are tempting and have already seen a 50% peak-to-trough decline, but it’s not what it seems. Clint guides you toward the sectors that have seen true carnage, trade at reasonable valuations and are seeing good expected earnings growth. He also gives you three solid stock picks. Is it Time to Buy Meta?

Is it Time to Buy Meta? February 4, 2022 Stocks, Technology, Winning Investor Daily

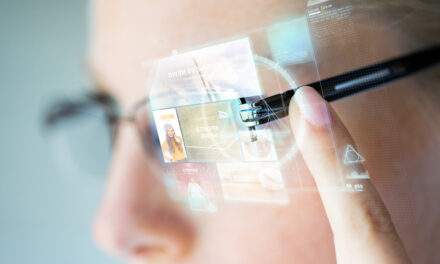

Let’s take a look at Big Tech’s expected growth rates over the next three years. The Next Evolution in Computers Is Almost Here

The Next Evolution in Computers Is Almost Here February 1, 2022 Technology, Winning Investor Daily

A new way to interact with our computers and our world is right around the corner.  The Fed Kills the Momentum Trade

The Fed Kills the Momentum Trade January 28, 2022 Big Picture. Big Profits., Economy, Investing

In June 2020, Barstool Sports founder and wannabe investor Dave Portnoy infamously said that “stocks only go up.” In 2022? Sorry Dave. In today's video, Ted Bauman walks us through the consequences of the Fed's recent hawkish turn. Even after big declines since the beginning of the year, there's plenty of overvaluation in the market still. Ted reviews the history of stock performance in Fed tightening cycles, which is better than you might imagine. But there's one big fear hovering over the market … what if the Fed is tightening into a downturn? That would be bad and not just for momentum stocks.