Latest Insights on TSM

Nio’s Surprise Sedan, CrowdStruck and the Apple of Hyundai’s Eye January 11, 2021 Great Stuff High Voltage Move over, Tesla! The new king of growth in the electric vehicle (EV) market just hit high gear. Nio (NYSE: ) put the pedal to the metal — do they even do that in EVs? — and surged roughly 14% on the open this morning. The company is now the No. 2 automaker […]

Nio’s Surprise Sedan, CrowdStruck and the Apple of Hyundai’s Eye January 11, 2021 Great Stuff High Voltage Move over, Tesla! The new king of growth in the electric vehicle (EV) market just hit high gear. Nio (NYSE: ) put the pedal to the metal — do they even do that in EVs? — and surged roughly 14% on the open this morning. The company is now the No. 2 automaker […] Kandi Caught; DoorDash Deals; Options Starters December 3, 2020 Great Stuff Kandi’d Camera Are you ready, kids? Aye, aye captain! Ohhhh, who answers reader feedback down in Kentucky? Mister Great Stuff! Absorbent and yellow and porous is he! Mister … wait. What? Sorry, my kids are distance learning lately, and it’s a bit distracting. Today is Reader Feedback day at Great Stuff! The day we dig […]

Kandi Caught; DoorDash Deals; Options Starters December 3, 2020 Great Stuff Kandi’d Camera Are you ready, kids? Aye, aye captain! Ohhhh, who answers reader feedback down in Kentucky? Mister Great Stuff! Absorbent and yellow and porous is he! Mister … wait. What? Sorry, my kids are distance learning lately, and it’s a bit distracting. Today is Reader Feedback day at Great Stuff! The day we dig […] The Dashing, The Drafted and the Disney+ November 13, 2020 Great Stuff Friday Four Play: The “Slim Shady IPO” Edition Guess who’s back … back again? Great Stuff’s back. Tell a friend. (Tell a friend.) I’ve created a monster, ‘cause nobody wants to see Joseph no more. They want Mr. Great Stuff — I’m chopped liver. Well, if you want Great Stuff, this is what I’ll give […]

The Dashing, The Drafted and the Disney+ November 13, 2020 Great Stuff Friday Four Play: The “Slim Shady IPO” Edition Guess who’s back … back again? Great Stuff’s back. Tell a friend. (Tell a friend.) I’ve created a monster, ‘cause nobody wants to see Joseph no more. They want Mr. Great Stuff — I’m chopped liver. Well, if you want Great Stuff, this is what I’ll give […] AMD Ascends; S&P Double-Plus Bad; Leaving Las Vegas October 27, 2020 Great Stuff House of the Ryzen Sun Great Ones, we’re watching an era end in the semiconductor market. A changing of the guard. A capitalist election of the highest order. No longer does “Intel Inside” rule the roost. Behold AMD’s ascent. Okay, somebody’s got delusions of grandeur. Too much Death Wish coffee this morning? What gives, Mr. […]

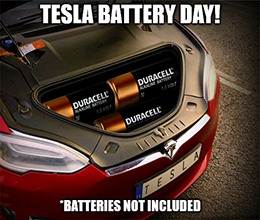

AMD Ascends; S&P Double-Plus Bad; Leaving Las Vegas October 27, 2020 Great Stuff House of the Ryzen Sun Great Ones, we’re watching an era end in the semiconductor market. A changing of the guard. A capitalist election of the highest order. No longer does “Intel Inside” rule the roost. Behold AMD’s ascent. Okay, somebody’s got delusions of grandeur. Too much Death Wish coffee this morning? What gives, Mr. […] Batteries Not Included; Amazon Bikes; Cramer Gripes September 22, 2020 Great Stuff Overpromise, Under Deliver Hey, everybody! It’s “Battery Day!” Yes, the much talked about Tesla Inc. (Nasdaq: ) Battery Day is upon us. That big event that prompted analysts far and wide to upgrade TSLA stock and lift their price targets. In the past week, Deutsche Bank hiked its TSLA price target by 33% to $400, […]

Batteries Not Included; Amazon Bikes; Cramer Gripes September 22, 2020 Great Stuff Overpromise, Under Deliver Hey, everybody! It’s “Battery Day!” Yes, the much talked about Tesla Inc. (Nasdaq: ) Battery Day is upon us. That big event that prompted analysts far and wide to upgrade TSLA stock and lift their price targets. In the past week, Deutsche Bank hiked its TSLA price target by 33% to $400, […]