The Russell 2000 Index is used as a gauge for overall sentiment on growth stocks.

As a result, it tends to be riskier than large-cap indexes such as the S&P 500 and the Dow Jones Industrial Average.

This index is made up of 2,016 small-cap companies. The biggest one is valued at only $6.46 billion.

Small companies in growth mode are inherently risky. But they also have the potential for higher returns.

Since its inception in 1988, the Russell 2000 has had only nine negative years. And so far, it looks like 2018 will be the 10th. As of last Friday’s close, the index is sitting on a loss of 6.02%.

However, that gives us a great opportunity.

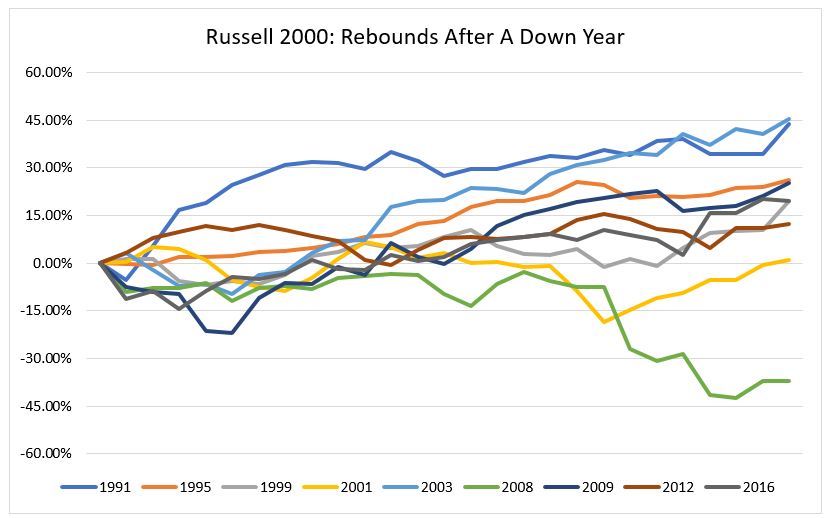

History tells us that buying the Russell 2000 and holding it for the year after it’s down yields excellent results.

For example, the first loss for the Russell 2000 was 1990. That year, the index tumbled 21.46%. Using this simple strategy, you’d have bought and held it for all of 1991.

That year, you would have made an amazing gain of 43.68%!

Since that first drop, the Russell 2000 has gone up by an average of 18.9% the year after a down year.

This strategy has an 89% win rate.

The only losing year was 2008.

But, of course, losses were just about unavoidable in 2008 thanks to the Great Recession and the overall collapse of the market.

To follow this strategy, I’d recommend purchasing shares of the iShares Russell 2000 ETF (NYSE: IWM).

This exchange-traded fund gives you access to the returns of the Russell 2000 with the ease of buying a normal share of stock.

Regards,

Ian Dyer

Editor, Rapid Profit Trader