I called it!

I told my readers six months ago that the U.S. government was getting ready to make a fully traceable digital dollar, otherwise known as a central bank digital currency (CBDC).

The Federal Reserve just announced the first step toward our new digital currency.

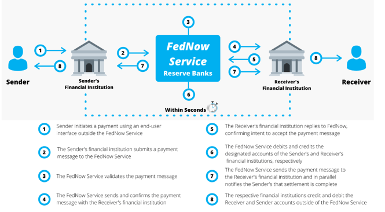

In July, the Fed will officially launch its FedNow Service. According to the press release, this service will “facilitate nationwide reach of instant payment services by financial institutions — regardless of size or geographic location — around the clock, everyday of the year.”

That’s a fancy way of saying that the government will be able to instantly fund — or defund — bank accounts with the click of a mouse.

Under the guise of helping consumers get their tax refunds or future stimulus checks faster, the Federal Reserve is seizing even more power.

As the Fed looks to add participants to this network, it’s gearing up for its ultimate goal.

Moving from a paper dollar … to a digital dollar.

Today, I’m going to lay out just what that means for you…

The Central Bank Digital Currency Is Here

FedNow is the precursor to the central bank digital currency.

The Fed’s newest project creates a system for government-to-consumer and consumer-to-government payments.

(From Klaros Group.)

It also allows for person-to-person payments.

If you think that sounds familiar, it should — because that’s exactly what bitcoin (BTC) was created to do. And yet, FedNow is the exact opposite.

While bitcoin transactions are processed by a decentralized network of computers, FedNow transactions will go through the ultimate centralized control mechanism: the Fed’s own server.

It gives the Fed control of the creation (and destruction) of money. This will allow it to control who pays whom and who pays what.

Ultimately, the Fed wants a digital dollar because it gives them more power to create money. This will give them the ability to monitor every transaction in the financial system.

You see, for the Fed, a digital dollar solves a big problem. It makes negative interest rates possible.

Imagine having money in a savings account that loses a small percentage every year. It’s as if there was an expiration date on your money!

The Fed can’t do this now for one big reason: People would take their money out of the banks and store it elsewhere.

But with a digital dollar, negative interest rates are possible.

And the FedNow system is the beginning of this rollout.

It’s not just happening in America, either.

Twenty-nine countries have already implemented Central bank digital currencies or pilot programs. Among them are China, India, Nigeria, Jamaica, the Bahamas, UAE, Australia, Singapore and Thailand, with 114 more exploring them.

But we all now have an option to fight back.

For the last decade, an alternative monetary system has rapidly grown. It’s one that can keep track of who owns what without needing a centralized intermediary, like a bank or a government.

It’s so powerful that governments are trying to restrict its ownership by suing the exchanges that allow citizens to buy it.

I’m talking about bitcoin.

The Key to Bitcoin’s Future: Fed Fear

The Fed’s most recent move to launch the FedNow system is why bitcoin’s day has come.

As we’ve been discussing here in The Banyan Edge, a banking crisis is unfolding around the world.

Look what’s happened over just the past few weeks:

- Silicon Valley Bank succumbed to a classic bank run, followed by the shutdown of Signature Bank.

- Another regional bank, First Republic Bank, had to be propped up.

- Credit Suisse narrowly avoided a similar fate when it was taken over by UBS.

- All told, these bank rescues have cost more than $400 billion so far.

But the problem we face is different from other financial crises of the past. While history might not repeat itself, it does often rhyme.

Although the government has put out the fire for now, it wouldn’t take much to ignite another run on small banks. In this new digital age, it takes only a few minutes for a depositor to open an account at a larger bank and make the move.

And what this creates is a system where a dollar in a smaller regional bank could effectively be worth less than a dollar at JPMorgan. Simply because the bank is viewed as higher risk.

It’s very similar to the European debt crisis of 2011, where depositors were trying to get their money out of Portugal, Ireland, Greece and Spain and move it to banks in safer countries like Germany and France.

This is why the digital dollar is so important to the Fed. It wants to ensure that a dollar in one bank is worth the same as a dollar in another bank.

A digital dollar would allow depositors to immediately move them to the “Digital Bank of the Fed.”

The Fed can’t afford another financial crisis. That’s why it’s been working on its so-called “Project Hamilton” for years. It wants to control our dollars — and if it has to pretend it’s making life easier for us, it will.

But this time, the central bank’s response will ignite the flame that spreads bitcoin ownership around the world.

Here’s Why Bitcoin Will Revolutionize the World

I’m already starting to see the seeds of a crypto revolution underway.

You see, bitcoin is not controlled by any governments. (Although most wish they could ban it!)

Its supply is capped, and it’s a hedge against excessive monetary printing.

It can perform all the functions of money:

- A store of value.

- A unit of account.

- A means of exchange.

And people are catching on to bitcoin as an alternative to the mainstream.

Bitcoin has run up 20% over the past month.

As of this writing, over 44 million people own bitcoin. That’s up 10 million just a year ago!

It’s all playing into what I see as backlash against government overreach.

With bitcoin, you can truly interact peer-to-peer — without worrying about a centralized entity running in to take their piece of the pie.

It’s the Fed’s greatest fear.

That’s why crypto has reached its “turning point.” I believe it will be the most disruptive force of the decade.

And it doesn’t end with bitcoin. There is a robust decentralized financial system underway that recreates all of traditional finance on the blockchain.

If you’d like to be a part of this revolution, just click here. It’s as simple as clicking a button.

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Curious what subscribers have to say about Strategic Fortunes? Read real Strategic Fortunes reviews here.

Do Banks Ever Actually Make Money?

“No bank ever actually makes money.”

Sometimes you hear a comment that really makes you stop and think. My friend Carlos has a talent for delivering them.

He was in town over the weekend, and we were having a drink in one of the dozen cafes that line Lima’s Avenida Miguel Dasso. It’s always after the second or third Negroni that the conversation gets interesting.

“They never actually earn a profit,” Carlos continued. “Every 10 years, they have a crisis and end up losing everything they made in that time. Then, they start over with fresh capital, and do the exact same thing again.”

You know, Carlos has a point. It’s not necessarily every 10 years on the nose, and some banks clearly do a better job than others in avoiding major blowups. But at least at the industry level, overall, it holds true.

Major Crises in the Financial Sector

The financial sector really has just been one crisis after another. There was the epic savings and loan debacle (1986 to 1995) that wrecked my native Texas economy when I was a kid. Finland and Sweden both had major banking crises in the early ‘90s.

Mexico had a crisis in ‘94 that wiped out several Mexican banks before spreading to Chile and Brazil. Economists, ever the comedians, referred to that one as the “tequila hangover.”

There was a banking crisis in much of developing Asia in ‘97, followed by the Russian crisis in ‘98. That one blew up Long-Term Capital Management, and nearly took down most of Wall Street with it.

I’ve lost count of how many banking crises Argentina has had. If it had a brand-new one next Tuesday, would anyone be surprised?

And then, of course, there was the 2008 meltdown, which caused bank failures around the world and gave us the deepest global recession since the 1930s.

Those are just the ones I remember. Just for fun, I searched for a list of these events, and I found that there really is nothing new under the sun. There was a major banking crisis in 33 A.D., in which banks across the Roman Empire failed.

It seems that we’ve made no real progress in organizing a global banking system in the past 2,000 years.

This begs the question: Do banks ever actually make money?

Or was Carlos right, and the “profits” merely borrow against the next inevitable crisis?

Let’s get a little less philosophical and a little more practical. I’ve been writing for weeks now that in an abundance of caution, it makes sense to keep your checking account balances under the FDIC insured amount of $250,000. I also think it also makes sense to own a small position of physical gold — locked away somewhere safe.

Ian recently wrote about bitcoin, calling it your No. 1 hedge against the Federal Reserve. Even he would agree that you probably don’t want to dump your entire liquid net worth into cryptocurrency.

In his Next Wave Crypto Fortunes service, he recommends a specific allocation amount to his subscribers, along with his top trades in the crypto space.

FTX’s collapse and the recent SEC investigations into Binance and Coinbase have shown that this is still the Wild West in some ways. But as Albert Einstein is alleged to have said, the definition of insanity is doing the same thing again and again and expecting a different result.

Perhaps we should be a little less insane, and not assume our banking system won’t inevitably fail again.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge