U.S. stocks plunged last week. The S&P 500 Index fell nearly 5%.

There were several reasons for the volatility:

- The Federal Reserve has had a change of heart, dialing back rate-hike expectations for 2019.

- The November jobs report showed that the U.S. added fewer jobs than forecast.

- In the jobs report, wages also rose less than forecast.

As the year comes to a close, investors are again buying gold.

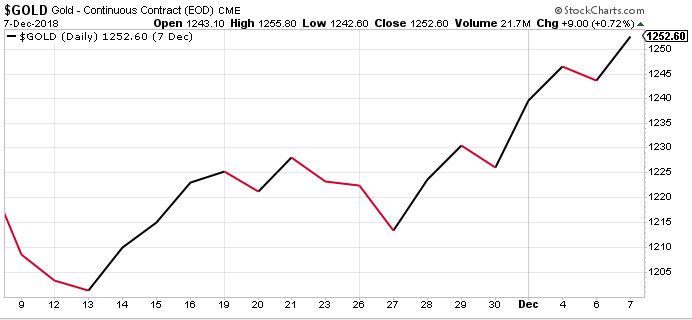

The chart below shows gold’s performance in the past month. While stocks were falling, it gained 2% just last week.

That’s no surprise. The yellow metal is a safe-haven investment — insurance against a market crash.

A Strong Year for Gold

Experts like my colleague John Ross agree that next year is shaping up to be a strong one for traders exposed to gold. To read more about the two indicators that are showing bullish signs for gold, click here.

It’s not too late to jump in. And there are several ways to do that.

I saw that Wired magazine reshared a 2014 article titled “How to extract gold from electronics.” Caveats in the article include:

- Only attempt this if you have a basic knowledge of chemistry.

- Wear protective equipment including goggles, gloves and overalls.

- Have a well-ventilated workspace.

- Learn first aid.

3 Ways to Own Gold If You’re Not a Chemist

For the less adventurous — or less scientifically inclined — there are easier ways to make sure you own gold in the new year.

Buying gold bullion and gold jewelry are options.

Rebalancing your portfolio is another one. You can buy shares of exchange-traded funds (ETFs).

The best gold ETFs tend to have low fees, aka expense ratios, and low bid/ask spreads. Some of them will even let you redeem your shares for gold. (If this is important to you, you’ll want to make sure it’s described as “redeemable.”)

Here are three good options:

- The iShares Gold Trust (NYSE: IAU) holds more than $10 million in assets and has been around since 2005.

- The GraniteShares Gold Trust ETF (NYSE: BAR) is just a year old but already has a reputation thanks to its low fees.

- The Perth Mint Physical Gold ETF (NYSE: AAAU) is a great choice if you want redeemable gold. The Perth Mint backs the fund. Just keep in mind you’ll have to travel to Australia should you choose to redeem it.

As we look to the end of 2018, remember that even in a bear market, some sectors will rise. Gold is a strong bet.

Good investing,

Kristen Barrett

Managing Editor, Banyan Hill Publishing