Losing Friends Is Never Easy

It’s never easy to lose friends. And when it comes to Netflix Inc. (Nasdaq: NFLX), it’s even harder to lose the popular TV show Friends.

But starting in 2020, WarnerMedia will launch its new streaming service — HBO Max — and it will have exclusive rights to the show. AT&T bought the U.S. rights for $85 million per year, up from Netflix’s previous purchase price of $80 million.

This news follows NBCUniversal Media’s announcement that it’s pulling The Office from Netflix to stream on its own service starting in 2021.

While this might sound like a minor thing considering all of Netflix’s content, we need to remember that these two series are the two most-watched shows on all of Netflix, according to research firm Jumpshot.

Netflix has been the big dog in the yard for several years now. The company first upset traditional pay TV’s dominance by offering content at a far lower price than cable bundles — about $13 per month versus $100 per month.

Now companies such as Disney, AT&T’s WarnerMedia and Comcast’s NBCUniversal want a piece of the pie. They’re all launching direct-to-consumer streaming services by the first quarter of 2020.

The Takeaway:

I think it’s still early to worry about the battle that’s building on Netflix’s horizon. The company currently has a massive subscriber base of 155 million globally and is working hard to produce solid original content to keep its viewers happy.

WarnerMedia CEO John Stankey is aiming to get 70 million subscribers to sign up for HBO Max, which is double the number of U.S. subscribers for HBO. The new service will likely be between $15 and $18 a month, according to people familiar with the matter.

The Walt Disney Co. (NYSE: DIS) stands as a pretty tempting contender with its Disney+. The service will break down Disney’s family-friendly content into brands — Pixar, Marvel, Disney, Star Wars and National Geographic — and allow users to find programming within those ecosystems.

Disney+ will launch November 12 and cost only $6.99 per month.

Those prices fall in line with Netflix. So, it will be interesting to see which people choose to add or discard the service.

Netflix has a strong base to fight off contenders, but it will need to stay ahead with killer programming and low costs. Keep an eye on subscriber numbers once Disney and WarnerMedia launch their new services.

The Good: The $10 Billion Surprise

Walmart Inc. (NYSE: WMT) received a pleasant surprise after paying $16 billion for India’s e-commerce firm Flipkart Online Services.

The deal included a widely overlooked digital payments subsidiary.

Flipkart recently authorized its PhonePe Pvt. Ltd. unit to become a new entity and to explore raising $1 billion from outside investors at a valuation of as much as $10 billion. That’s a nice, unexpected $10 billion bonus!

The unit would operate independently with its own investor base, but Walmart-owned Flipkart would remain a shareholder.

PhonePe means “on the phone” in Hindi and is pronounced “phone pay.”

The company has become one of India’s leading digital payments companies. Over the past 12 months, the firm’s volume and value of transactions have roughly quadrupled. India’s consumers have adopted the technology to transfer money digitally to businesses and each other.

Edward Yruma, an analyst from KeyBanc Capital Markets, believes PhonePe is an “underappreciated asset.” He estimated the business may be worth $14 billion to $15 billion, separate from Flipkart’s e-commerce operation.

The Takeaway:

India’s market is growing by leaps and bounds. Cheap smartphones and cut-rate wireless data plans have helped millions of Indians get online over the past few years, lifting the whole industry.

The company reported the PhonePe app reached 290 million transactions in June with an aggregate value of $85 billion. That’s up from 71 million transactions at $22 billion a year earlier.

This is a great bonus for Walmart, as it gains a solid foothold in a country seeing massive economic growth.

The Bad: Too Much Heat in Housing

The housing sector is heating up again as existing home sales bounced back in May from spring lows.

But concerns are running high that we could see bidding wars returning this fall as inventories remain tight.

The inventory of homes coming on the market has been growing at just under 3%, way below the 6% rate from the start of the year.

It also doesn’t hurt that mortgage rates are sitting near lows. The national average for a 30-year fixed rate mortgage is now 3.91%, near recent lows.

The Takeaway:

As long as rates are low, homebuyers are still in the game. But rising housing prices are still outpacing income increases. It’s a fine line we’re facing before everything falls apart.

The Ugly: The Piggy Bank Is Empty

We’ve all heard this story before.

The government is broke. Debt is running out of control.

I guess it’s just a story that I haven’t heard recently in the face of tariffs, the Fed and Netflix losing Friends.

But a Washington think tank and advocacy group — Bipartisan Policy Center — estimates that lower-than-expected tax revenue means there’s a “significant risk” that the federal government will run out of borrowing authority in early September.

Tax revenue continues to be weaker than anticipated, growing by 2% to 3%. Estimates had stood at 5% to 6%.

The group believed the government had until at least October before the threat of default.

In addition, the Congressional Budget Office estimated that the government suffered a budget deficit of $746 billion for the first nine months of fiscal year 2019 and is on track to hit around $1 trillion.

Revenue was $69 billion higher, while federal spending was $208 billion higher over that period.

The Takeaway:

Put the credit cards away, America!

OK, I know it’s not as simple as just stopping spending to get our debt under control — and we really do need to get our debt problem under control.

But in the meantime, the government will likely focus on the $22 trillion borrowing cap, or “debt limit” in Washington parlance. They’ll argue and raise the limit so we can keep paying our bills and obligations.

We’re just putting off the problem, but eventually, we’ll have to pay the piper.

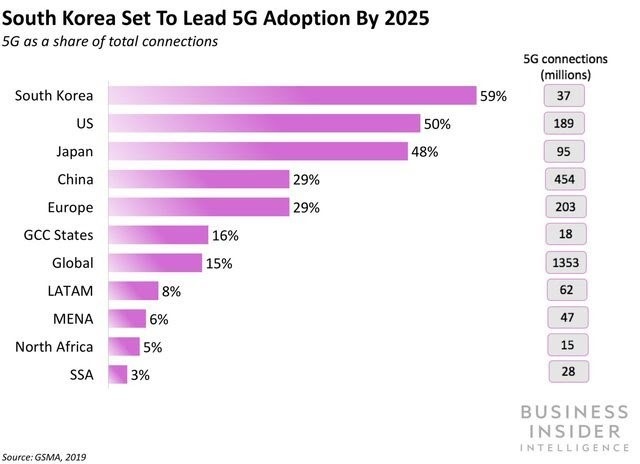

The 5G race is on.

By the end of 2019, telecom companies in 18 countries will launch 5G networks. By 2020, more than 20% of the world’s countries will have launched 5G services.

5G is critical for the world, as it will make massive technical advances possible that will launch the next technological revolution. 5G technologies are forecast to contribute $2.2 trillion to the global economy over the next 15 years.

Right now, South Korea, the U.S. and China are leading the charge.

The U.S. launched the world’s first commercial 5G services in 2018 and will have twice as many commercial 5G deployments as the next leading nation by this year’s end.

South Korea was the second country in the world to deploy a 5G network. Right now, it’s poised to become the global leader in 5G penetration. Its government has taken a hands-on approach in regulating the telecom industry to help speed up deployment.

That’s all for now. But don’t forget to check out all of Great Stuff’s greatest hits. Thanks to the magic of the internet, you can find each past issue of your favorite e-zine right here.

Regards,

Jocelynn Smith

Senior Analyst, Banyan Hill Publishing