Economists spend a lot of time looking for data that helps them make forecasts.

This leads to indicators like the Chicago Fed National Activity Index, which requires 85 different data series to calculate, or the New York Fed’s Underlying Inflation Gauge that uses 223 different data points.

Traders generally prefer simplicity. They like glancing at a chart with one or two lines instead of performing complex mathematical calculations.

This makes sense. Traders pursue profits. Economists pursue graduate degrees.

For traders, lumber prices are an important economic indicator. This is an idea first written about by Tom McClellan, a well-known market analyst.

When demand for lumber is high, it’s likely that homebuilders are driving demand. They are building houses, which creates jobs and boosts economic activity. When the economy is growing, stock prices are usually rising.

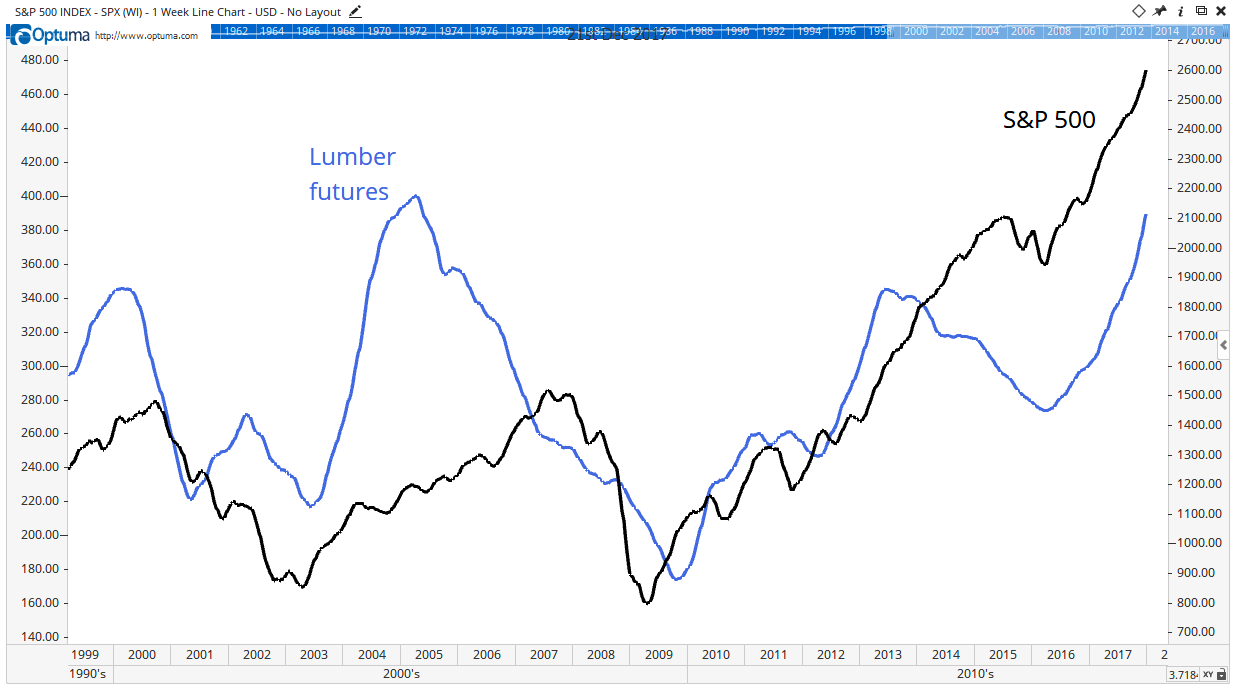

The chart below shows the relationship. Lumber prices tend to peak ahead of stock prices. That means with lumber prices rising right now, stocks should keep going up.

This isn’t a perfect indicator. Lumber signaled a downturn in 2013 and stocks continued higher. But stocks haven’t suffered a decline while lumber is in an uptrend, as it is now.

Lumber is another indicator showing that the bull market in stocks has more room to run. That’s good news for many sectors.

For example, new homes need new things. Many of those things will be smart appliances, pushing the tech sector and stocks of companies that make the Internet of Things to new all-time highs.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader