Welcome to the new year!

Now, don’t worry. I’m not pulling out my crystal ball today.

I’ve got something even better — a calendar.

This dusty, 100-year-old calendar will do better than throwing out a best guess for 2018.

That’s because the stock market has a tendency to repeat itself in cycles, over years at a time.

In the early 1900s, this calendar was the first of its kind — it predicted a stock market cycle that would occur repeatedly over the next 100 years, and for years still to come.

It’s a pretty remarkable tool to have in your arsenal.

It tells us when to expect the major market moves, and what direction they will be in.

One thing’s for sure: 2018 will not look like the past couple of years. Here’s what to expect.

A Bold Year

I have written previously about 2017’s historically low drawdown of just 3%, and how that tells us we can expect a much larger drawdown, or correction, in the market in 2018.

I’ve also mentioned that 2018 is a year volatility likely bounces back.

Well, at the root of those two predictions is this simple but concise calendar.

And it tells us 2018 is going to be a bold year.

2017 was actually marked to experience market panics, but we saw nothing that resembled a panic. This could easily have been pushed into 2018, as the calendar can fluctuate by six to 12 months.

This stock market cycle is 18.5 years. It isn’t precise clockwork, but it’s about as good as you can get.

Even if a market panic is miraculously avoided, which I don’t think will be the case, 2018 is marked to see low stock prices, meaning this could be the first negative year, including dividends, for the S&P 500 since 2008.

Here’s how it should play out over the next year or two.

The Stock Market Cycle and the Next Rally

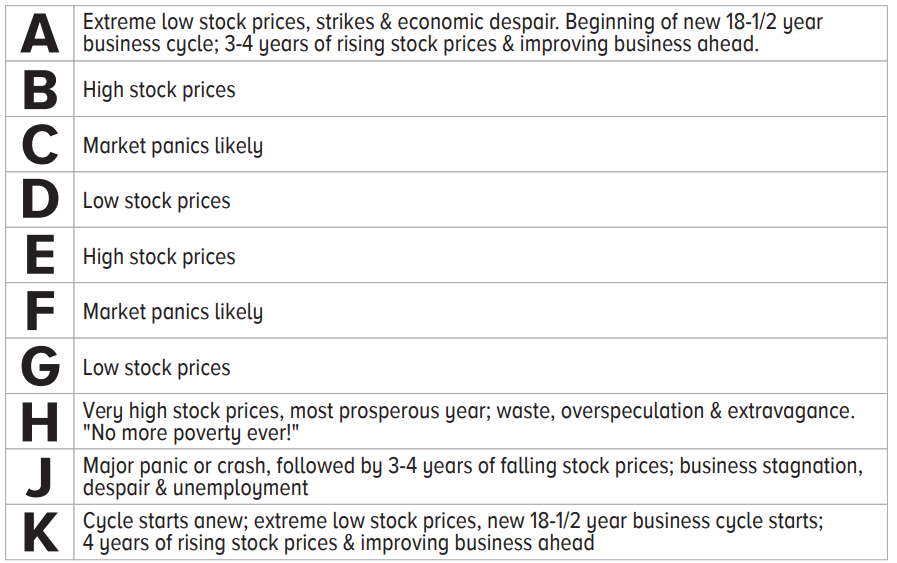

To help give you a better understanding of the flow of the 18.5-year stock market cycle, take a look at what each letter represents.

2017 was an F year, and 2018 is listed as a G year. But 2019 isn’t an H year. Instead, that is out to 2020.

And this is where the cycle has some wiggle room on being accurate — there is a year or so in between there that the years can shift.

That’s what is happening right now.

This year, 2018, will likely see the market panics that play into a larger drawdown, as I mentioned before, and a rise in volatility. Then the low stock prices will bottom in late 2018 or 2019 before we head toward very high stock prices by 2020 and 2021.

That tells us 2018 is going to give you an excellent opportunity to buy into the next rally.

The next correction in the market, representing a decline of 5% to 10%, will spark panic amongst investors. You’ll see talking heads claim this is the start of the next bear market and you should sell everything. Once those headlines start making the rounds, you’ll know it’s time to jump in.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert