On Friday night, I was interviewed on i24 news about the fallout from the killing of Saudi journalist Jamal Khashoggi.

You can watch that interview here:

The Kingdom of Saudi Arabia finds itself in a precarious position.

Prince Mohammed bin Salman has grand plans for “Vision 2030,” with a goal to transform the Saudi economy and decrease its reliance on oil exports.

The plans include a $500 billion megacity project, which would open up new tourism and leisure markets.

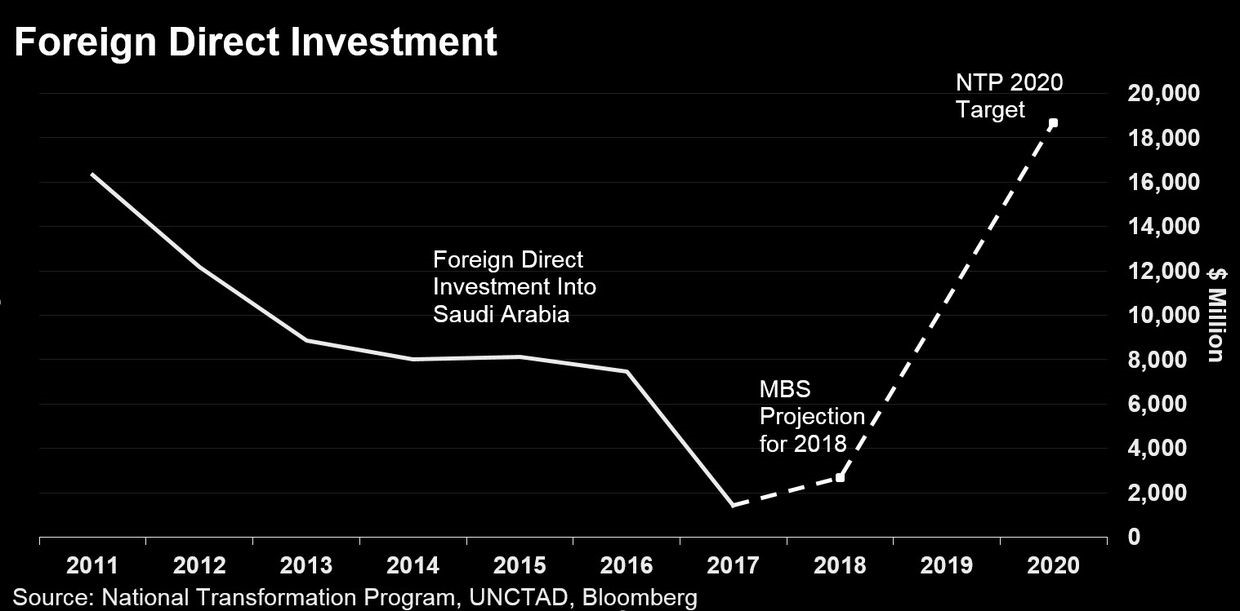

To achieve this lofty goal, the kingdom needs approximately $20 billion annually of foreign direct investment (FDI).

This would include funding and expertise from some of the world’s largest investors and companies.

However, even before Khashoggi’s disappearance, FDI into Saudi Arabia collapsed as investors moved elsewhere.

A Long List of Authoritarian Tendencies

Here’s a chart from Bloomberg illustrating this point:

- In 2017, FDI amounted to only $1.4 billion, down almost 90% from $12.2 billion in 2012.

- Saudi once attracted 25% of the region’s investment, but now that number is only 5%.

- Oman and Jordan (at $1.7 billion each) attracted more foreign capital in 2017 than Saudi Arabia.

Saudi’s problems didn’t start with the most recent event. The Khashoggi killing only adds to a long list of authoritarian tendencies undermining potential investors.

Last November, the kingdom arrested and detained scores of high-profile businessmen.

It recently arrested activists campaigning for women’s equality.

It fueled a civil war in Yemen that left at least 16,000 dead, including bombing a bus of 40 schoolchildren.

And the punishment for breaking Saudi law is barbaric. The kingdom orchestrated 48 public beheadings in the first quarter of 2018.

These are not the qualities of a country looking to modernize. It’s no wonder investors have been investing elsewhere.

Silicon Valley Has Its Own Saudi Problem

On the other end of the spectrum, the Saudis have long deployed their oil earnings back into U.S. companies.

Prince Alwaleed bin Talal was known as the “Warren Buffett of Saudi Arabia” and invested billions in U.S. blue chips, such as Citigroup. He was also a frequent guest on CNBC.

However, the new leadership has gone in a different direction. Mohammed bin Salman has chosen to invest in riskier startups instead.

Through a $45 billion investment in SoftBank’s $100 billion Vision Fund, the kingdom has made investments in Silicon Valley startups, such as Uber, WeWork, Slack and even the innocuous dog-walking app Wag.

Saudi capital has allowed these companies to stay private longer. This has hurt the little guy, as delaying the initial public offering (IPO) means the company finally comes public at a higher valuation.

The retail investor misses out on the huge returns that are realized while Uber and WeWork expand their businesses.

Furthermore, in the current day and age of conscious consumerism, at some point an affiliation with a brutal dictatorship risks reputational harm for these startups.

When will Silicon Valley stand up to the Saudis?

Regards,

Ian King

Editor, Crypto Profit Trader