Thoughts have consequences.

How investors think about markets, for example, results in actions that influence the behavior of markets. Once market behavior changes, investors must then think about markets differently.

It’s why everyone is so obsessed with valuations. If something is too expensive or too risky, people don’t want to buy it. They’ll seek alternatives or go without until valuation improves.

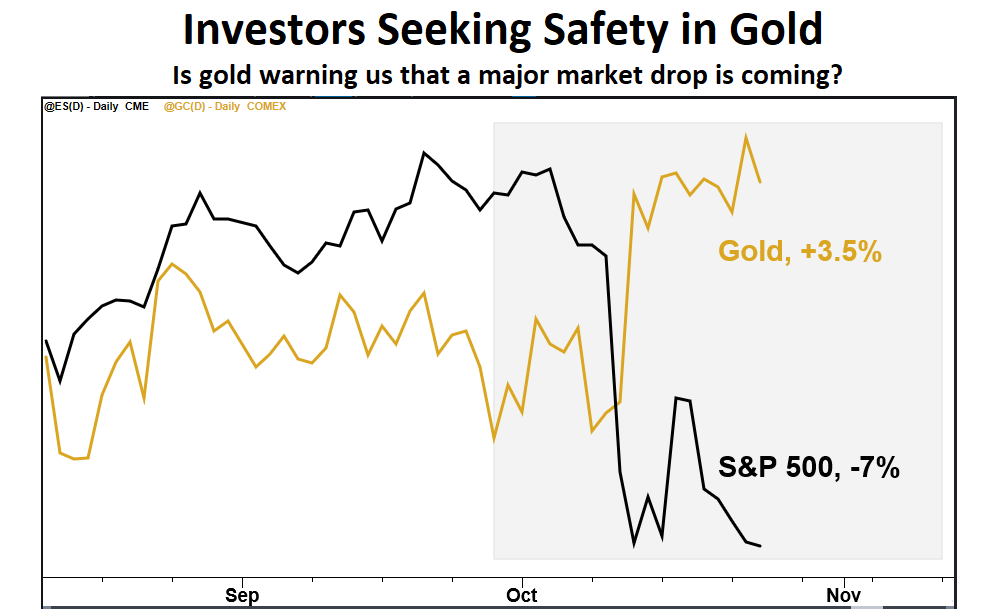

This chart of gold and stocks suggests participants are rethinking the bull market. The longer they doubt, the more likely market behavior gets nasty.

The price of gold rose 3.5% in the last three weeks.

In that time, the U.S. dollar is up less than 1%, and the S&P 500 Index is down 7%.

Gold’s move says a lot about investor sentiment. It remains the preferred safe-haven alternative to U.S. dollars. Since gold is rising when U.S. stocks are falling tells me investors are too worried to take their money anywhere else.

Not Good. Then Gold

After the financial crisis, Federal Reserve policy propped up asset markets.

Easy money created a perception of wealth — the wealth effect. Rising stock markets fed back into economic activity and helped restore growth.

But watch out. The wealth effect may reverse.

Today, U.S. stocks are supported by a solid economy and strong earnings growth. Despite rising interest rates, investors think the U.S. economy will grow fast enough to absorb pressure from rate hikes.

But sentiment is souring. And it’s a potential game-changer.

The S&P 500 is below its 200-day moving average, a vital technical indicator. The rest of the world is slowing, and their markets are already much worse off.

Fed rate hikes might be a ticking time bomb. If investors start thinking that way, they might as well strap on an explosive vest.

When participants start doubting the stability of the financial system, it’s not long before they second-guess the economy. Then things blow up.

Markets are down again this week. But since we’re still in a bull market, you should look for select buying opportunities.

Just don’t get complacent. Conditions can change faster than you think.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing