The company had no business plan and zero revenue.

Yet, a $20 million investment was made after a 45-minute meeting.

Why?

The founder’s “eyes were very strong.” He had “charisma and leadership.”

Masayoshi Son’s investment in Jack Ma’s Alibaba is one of the record books.

At its peak, that $20 million investment was worth more than $150 billion — a 6,500X return!

And many agree that it’s one of “the most successful investments in the history of mankind.”

But if not for this one investment, you would’ve never heard of Son…

The Crash

Because before Son saw those returns, he saw some big losses first.

During the tech bubble, his company — SoftBank — saw its valuation cross the $200 billion mark.

Back then, Son even said he was “richer than Bill Gates for three days.”

Then, the crash hit.

In 2001, SoftBank lost 99% of its market cap.

And Son saw his net worth plunge from $76 billion to just $1 billion in just a few days.

It was one of the quickest and biggest destructions of wealth … ever.

But in Son’s case, his one amazing winner — Alibaba — more than made up for his losses.

So, what’s important isn’t the number of winners you have, but the size of the wins…

Don’t Need to Be Right

When it comes to microcaps — companies with market caps of $500 million or less — seeing returns of 1,000% is more common than you might think.

And successful investing is about magnitude, not frequency. Here’s what I mean…

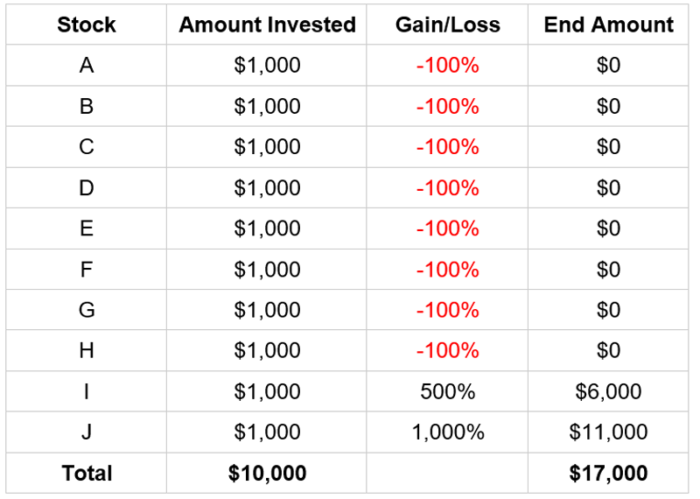

For example, let’s say you had $10,000 and invested $1,000 each into 10 microcap recommendations.

Of those, eight of them went to zero. But two of them did amazingly well. One went up 500% and the other 1,000%.

Here’s what it would look like…

You can see that, on a frequency basis, your record would be 80% losers and just 20% winners.

However, your original investment would now be worth $17,000, for a gain of 70% — all because of two big gains.

The bottom line is that you don’t need to be right every time. Instead, when you’re right, you just need to show big gains … just like Son did with Alibaba.

And when you target the best of the best microcaps — the ones I call Super Stocks — you likely won’t see any losses of 100%.

You see, not all microcaps are created equal…

Real Value

Many microcaps are new companies. Some have no proven track record, assets, operations or revenues. And some have products and services that are still in development or have yet to be tested in the market.

That means the microcap space involves a lot of risk. So, to minimize losses, I recommend never putting more than 2–3% of your portfolio into any single microcap stock.

I also never want you to speculate on companies with no real value, either.

That’s why I put together a few key criteria to make sure Super Stocks have proven track records and real assets. Super Stocks must…

- Be public companies registered with the Securities and Exchange Commission.

- Be in a growing industry and have growing revenue.

- Have a CEO with experience and skin in the game.

Plus, I reach out to the many industry contacts in my Rolodex to make sure these companies are the real deal.

Having this checklist can put you in an even better position to make winners.

And now, I put together a special broadcast with all the details you need to know about Super Stocks — including my No. 1 Super Stock for 2022.

Real Talk here … you know I’m not one for hype.

So, when I say it’s really important for you to learn more about Super Stocks, I’m not kidding. You won’t want to miss my insights.

Regards,

Founder, Alpha Investor