Headlines are ominous. They warn that the inverted yield curve signals a bear market.

But there’s a problem with that news: The yield curve is normal, not inverted.

The yield curve is the difference between interest rates. There are a number of ways to calculate it.

The simplest uses just two rates. If, for example, the interest rate on 10-year Treasurys is 2% and the interest rate on two-year Treasurys is 1%, the yield curve is at 1% (2% minus 1%). It’s a simple idea.

Normal yield curves are positive. The more time to maturity usually means a higher interest rate.

Sometimes, the curve “inverts,” which means short-term rates move above long-term rates. Then the yield curve carries a negative value.

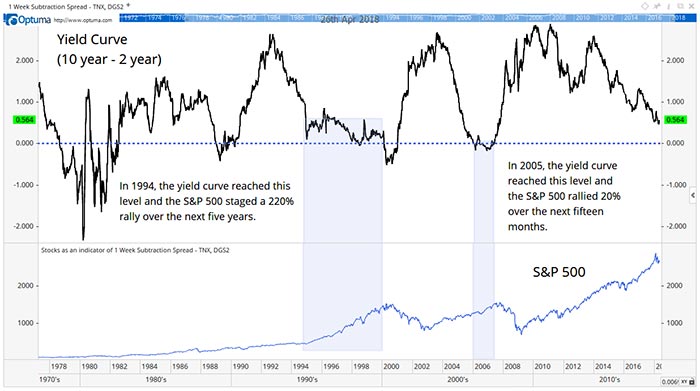

The latest curve is the top line in the chart below.

Right now, the curve is at about 0.52%. Many analysts say it’s on the way to inverting.

In fact, it hasn’t fallen this low since 2005. Back then, the decline in the yield curve signaled the start of a rally in the stock market.

This also happened in 1994. But that was a great time to buy stocks.

After the yield curve fell to 0.52% in 1994, the stock market took off. The S&P 500 Index is at the bottom of the chart. The rally, highlighted in blue, lasted more than five years. The index gained more than 220%.

Could that happen again? It certainly seems unlikely.

Stocks are overvalued. The economy is weakening. Interest rates are rising.

It’s interesting that all those statements were true in 1994. History might actually repeat, and stocks could soar from current levels.

But that’s not the real lesson from the yield curve. When it does invert, a decline in the stock market is almost certain.

The lesson is that coming close to an inversion, the level seen now, is meaningless, according to history.

The truth is that we need to wait for an actual signal instead of jumping the gun and projecting our biases on the data.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader