How to Lose $5.2 Billion in 3 Months: The Uber Story

My flippant attitude and punny sense of humor are both a blessing and a curse.

Just ask my wife of 20 years. She’ll tell you the same thing.

It appears that you, dear readers, are now in the same boat as my wife — take that how you will.

This weekend, I received a question in the GreatStuffToday@banyanhill.com inbox regarding an offhand remark I made about Uber Technologies Inc. (NYSE: UBER): “How do you lose $5.2 billion? That’s just insane.”

The Stroebes (whom I can only assume are an entire family of investors due to the lack of details in their email) were quite confused. They wrote to Great Stuff asking:

Well, Stroebe family, let me set the record straight. I actually know why Uber lost $5.2 billion … but the reasons still left me wondering: “How?”

It’s like when you see a magician pull a coin out from behind your ear. You know it’s not magic. You know how the trick is done. You can look it up on the internet. But you’re still left wondering: “How?”

But, for the sake of explanation, let’s break down Uber’s magical loss.

It all starts with $3.9 billion in stock-based compensation. The vast majority of Uber’s losses stem from the company’s initial public offering (IPO), when it handed out restricted shares. These shares were used as payment and compensation to early investors, brokerage firms that helped with the IPO, and other parties.

These shares vested once Uber completed its IPO, meaning the company finally had to pony up and provide them.

As a side note, these vested shares are subject to a post-IPO lockup period. Lockup periods keep early investors from potentially manipulating the IPO process and making gobs of money in the process, while screwing over post-IPO investors. This lockup period is ending soon — on September 24 — so there are about to be a lot more UBER shares on the market.

Uber’s losses break down as follows (excluding stock-based compensation):

-

- $460 million for research and development.

- $299 million for driver rewards.

- $832 million for administrative costs.

- $460 million for operations and support.

- $123 million for depreciation and amortization.

- $1 billion for sales and marketing.

So, there you have it.

That’s how Uber lost $5.2 billion in just three months. Even seeing how the trick is done, I’m still left wondering: “How?”

The Takeaway:

Uber executives and analysts played down the massive loss by noting repeatedly that the $3.9 billion in stock-based compensation would trail off considerably in the coming quarters.

For the sake of argument, let’s say it didn’t exist this quarter at all. That still leaves Uber with a loss of roughly $1.3 billion on the quarter … and most of those costs — such as marketing, research and development, and administrative costs — aren’t going anywhere.

By comparison, Lyft Inc. (Nasdaq: LYFT) only lost $644.2 million on the quarter, including IPO-related costs. That loss falls to about $300 million when you exclude stock-based compensation.

Right now, if you’re a financials-based investor, there’s a clear winner.

I’m still holding off on both companies. Let me know when driverless cars roll out. Then I’ll be interested.

If you’re interested in good IPO investment opportunities, and not these record-loss-making messes, check out Banyan Hill expert Paul ’s new IPO Speculator service.

The Good: Mint Condition

Do you still have a copy of the first edition of Great Stuff? I hear if you keep it in the cellophane, it’s worth … well, it’s worth something!

It was published on May 14, and it’s the issue where I made the first Great Stuff pick: Funko Inc. (Nasdaq: FNKO). Since that time, FNKO is up more than 10%! So, I figure the first edition of Great Stuff issue No. 1 is worth at least $2.27 right now (that’s the price gain in FNKO stock). It’s no Amazing Spiderman No. 1, but it will do.

But I’m not just reminiscing about the good ol’ days for the heck of it. Last Thursday, Funko reported second-quarter revenue that blew the doors off Wall Street’s expectations. The company said sales came in at $191.2 million, some $20.51 million above the consensus.

Funko also lifted its full-year sales guidance due to collectables tied to Avengers: Endgame, Stranger Things and Star Wars. “We’re recession-proof,” said CEO Brain Mariotti.

That last statement is a big ol’ red flag to me. I have yet to see any company that’s recession-proof. Mariotti’s enthusiasm aside, Funko is still a solid investment.

The Bad: Catch Up

What’s worse than a $5.2 billion loss? How about a $1.2 billion impairment charge added on to a previous $15.4 billion impairment charge?

The Kraft Heinz Co. (Nasdaq: KHC) not only knows ketchup and mac and cheese, it also knows how to lose money.

Last week, Kraft reported earnings that fell nearly 50% to $0.37 per share on revenue that fell to $6.4 billion.

That’s a lot of condiments, but not enough, it seems. Both figures missed Wall Street’s expectations.

The big setback was Kraft’s $1.2 billion in impairment charges.

The news reopened old wounds for investors, who suffered through a $15.4 billion impairment charge back in February, as well as a dividend cut.

KHC shares are now down more than 46% since February.

The Ugly: Lettuce Fly

This is less “ugly” and more “Whatcha talkin’ ‘bout, Willis?”

Over the weekend, Bank of America analyst Ronald Epstein tried to lay out a bullish case for fixing The Boeing Co. (NYSE: BA).

In laying out his analysis of Boeing, he compared the company’s woes to Chipotle Mexican Grill Inc. (NYSE: CMG) and its E. coli outbreak.

It took CMG three years to overcome the outbreak that sickened hundreds of people, and now the company is doing fine.

“From the point of view that lettuce is a core piece of what Chipotle does, the 737 is a core piece of what Boeing does,” Epstein told CNBC.

On one hand, he’s absurdly comparing lettuce to 737s. On the other hand, he’s callously comparing the deaths of 346 people to a treatable E. coli outbreak.

Too soon, man. Too soon for this comparison, and too soon to be thinking about investing in BA shares.

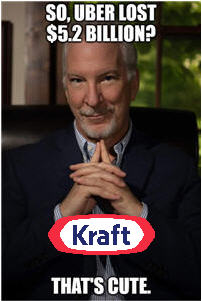

Since were’ on a “losses” kick today, here’s what Uber’s $5.2 billion quarterly loss looks like compared to the past two years. You’ll notice that gross bookings continue to rise, which is a good thing.

However, net revenue has remained essentially flat for the past year. As I noted above, those losses will come down, but whether they come down enough to offset ongoing losses remains to be seen.

Great Stuff’s Greatest Hits

Is it greatest hits time again?

Why yes … yes it is.

If you haven’t checked out Great Stuff on the web, you’re missing out. All the past issues are available 24/7 for your leisurely viewing pleasure.

And the stock picks … you don’t want to miss those!

Insulet Corp. (Nasdaq: PODD) is up more than 26% in less than a month!

Roku Inc. (Nasdaq: ROKU) has surged more than 50% since I recommended it on May 24!

Before I go, don’t hoard all this Great Stuff for yourself! Share and share alike, I always say.

Forward this e-zine to your friends!

And friends, you can sign up for free right here!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing