Is this the beginning of the end?

The pullback in the tech-heavy Nasdaq since mid-February is fanning concerns that an epic meltdown is now underway.

After all, there’s no shortage of metrics showing bubbly valuations.

The Shiller P/E Ratio. The Buffett Indicator. Just take your pick, because all of them suggest the same thing. That is: Stocks are at or near the most expensive levels in history.

But here’s my issue with these indicators — and no, I’m not going down a “this time is different” path. Many valuation metrics look backward, not forward. Do you think the stock market cares about what earnings were last year, or even yesterday?

The market cares about what’s ahead. And that’s why you should start thinking about the next phase of the stock market.

The Next Driver of Gains

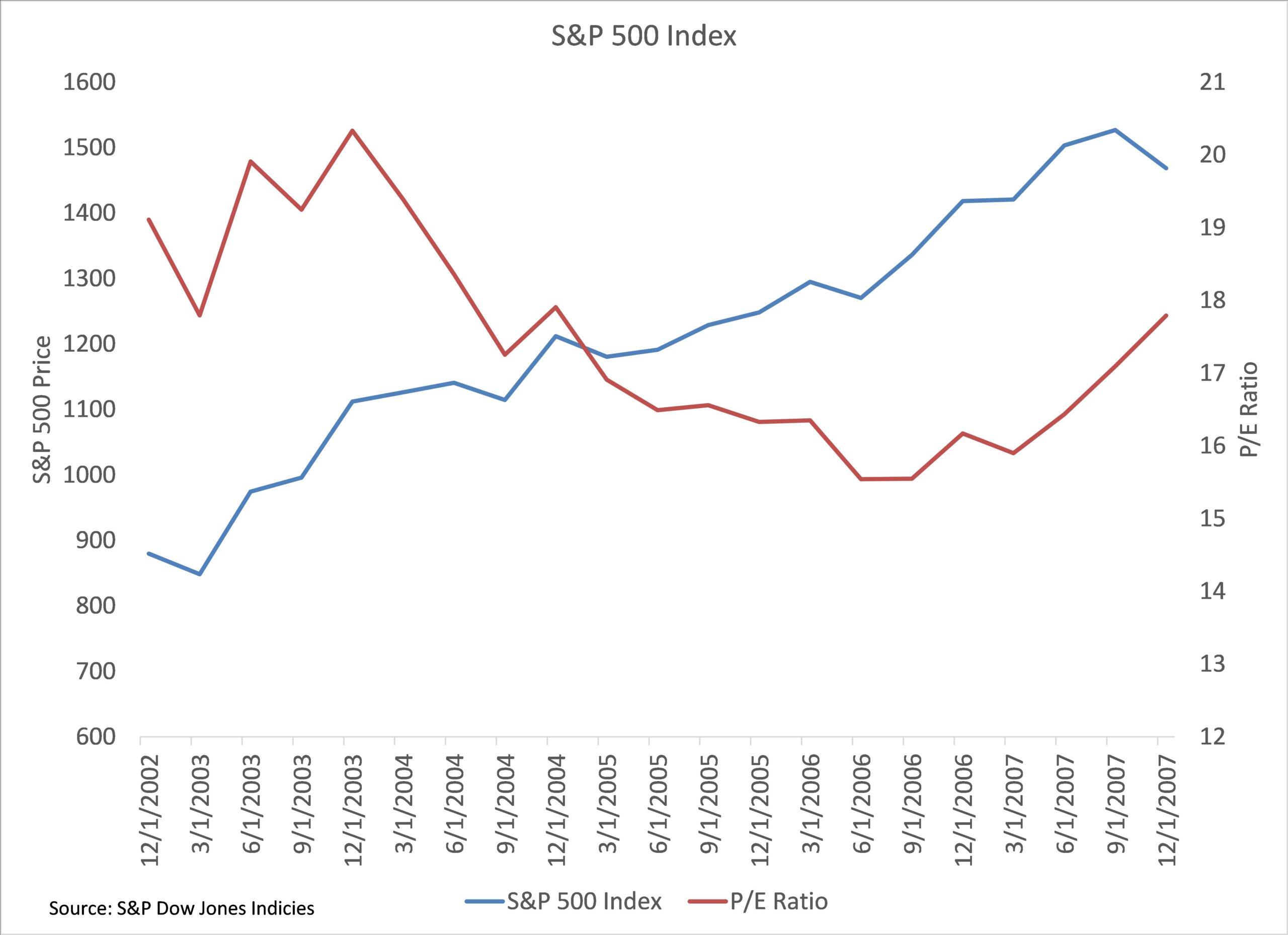

From 2003 to 2007, the S&P 500 Index gained 67%. But the price-to-earnings (P/E) ratio fell from 19.1 to 17.8.

Earnings growth for companies in the Index rose faster than their stock prices. You can see that in the chart below:

Investors seem to forget that there are two components to the P/E ratio. It’s not all about price. Earnings matter as well.

That’s the critical junction where the stock market stands at this moment. Trailing valuations are high, but there is a surge in earnings just around the corner.

That’s why our outlook for equities isn’t as dire as backward-looking valuation multiples would have you believe. We’re now entering the next phase, where earnings growth will be the key driver of market performance.

The big question is: Where do you find it?

Where to Find Earnings Growth

I’ve written recently about the powerful combination of government stimulus and a reopening economy on the horizon.

It’s why economists keep ratcheting their growth projections higher. Goldman Sachs now expects that gross domestic product will expand by 8% this year. That would be the biggest increase since 1951.

That kind of growth will drive a surge in corporate profits, which means the key to investment gains is to find sectors best positioned to leverage economic growth into earnings power.

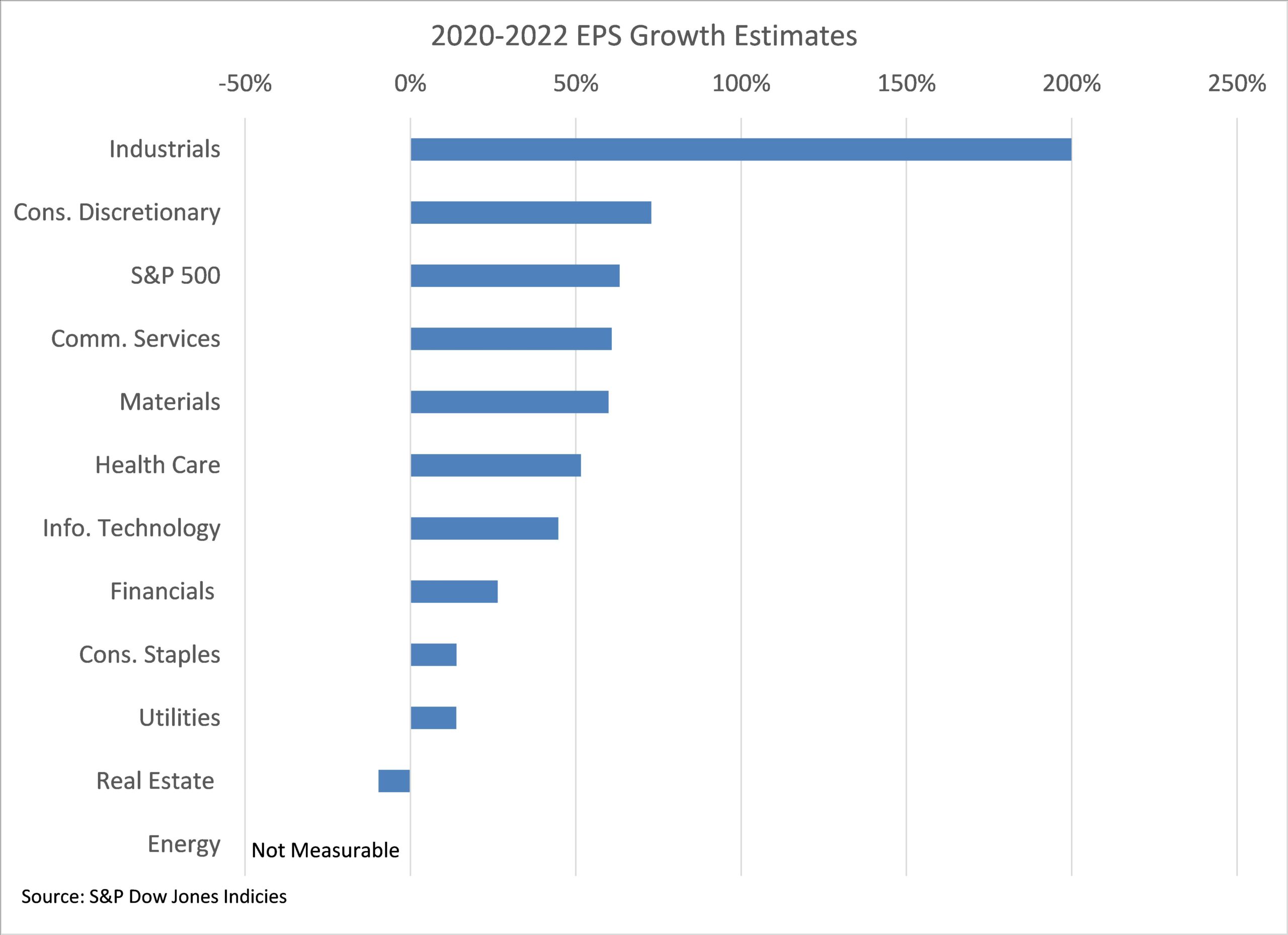

A quick scan of earnings projections through the end of next year shows that S&P 500 earnings are expected to jump by over 60% compared to 2020 levels:

But from a sector standpoint, industrials are a clear standout with a 200% jump in earnings over that time frame.

You can leverage the incredible profit potential of industrials with the Industrial Select Sector SPDR® ETF (NYSE: XLI). And with the strongest expected economic growth rate in 70 years, these estimates may prove conservative.

Best regards,

Clint Lee

Research Analyst, The Bauman Letter