Last week, New York state lawmakers legalized marijuana.

The state will allow recreational marijuana sale for people 21 and older when the law goes into effect.

It’s the fifteenth state to take steps like this. New York joins Colorado, California and neighboring New Jersey — which legalized marijuana just last month.

It seems that legalization is gaining steam across the country. Politicians on the national level are getting more comfortable with legal marijuana. And sentiment hit a high in January when the Democratic Party took control of the House of Representatives. Democrats are seen as more favorable to legalized marijuana, though the party does not have an official stance.

More and more states are expected to legalize in the coming years. Marijuana could soon be legal — in some form or another — just about everywhere.

But if this news makes you want to invest in pot stocks … you may want to think again.

New York’s new stance on marijuana may be a huge change for the people of New York.

But it really doesn’t mean a whole lot for the industry.

So, despite this legalization news and all the hubbub surrounding it, we don’t recommend buying into pot today…

Don’t Get Caught Up in the Hype

Here’s the thing: You make money on a stock when you have information that is not yet reflected in the price.

But nowadays, is there anyone who doesn’t know that pot is either legal or becoming legal in most states?

In other words, legalization is no secret — it’s already been priced into pot stocks.

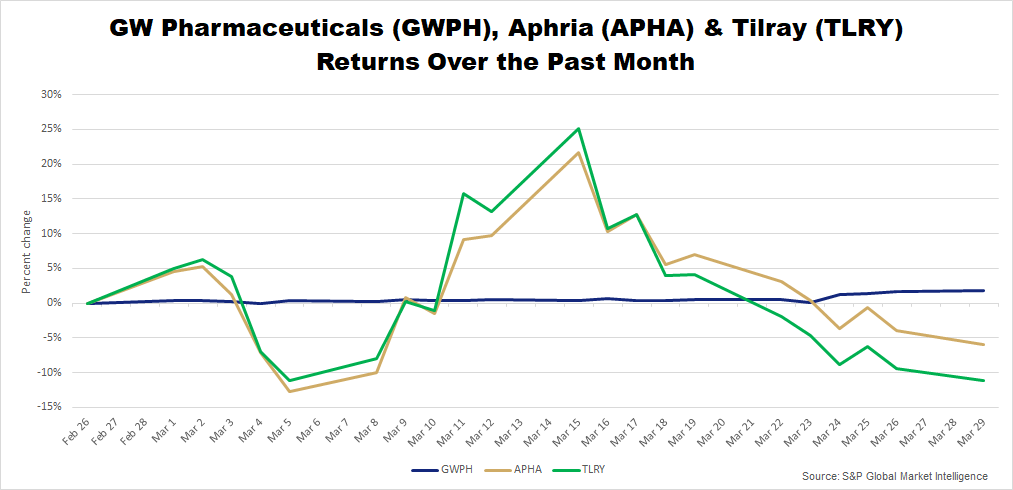

Just take a look at some of the largest ones over the past month…

GW Pharmaceuticals (Nasdaq: GWPH), Aphria (Nasdaq: APHA) and Tilray (Nasdaq: TLRY) haven’t done much.

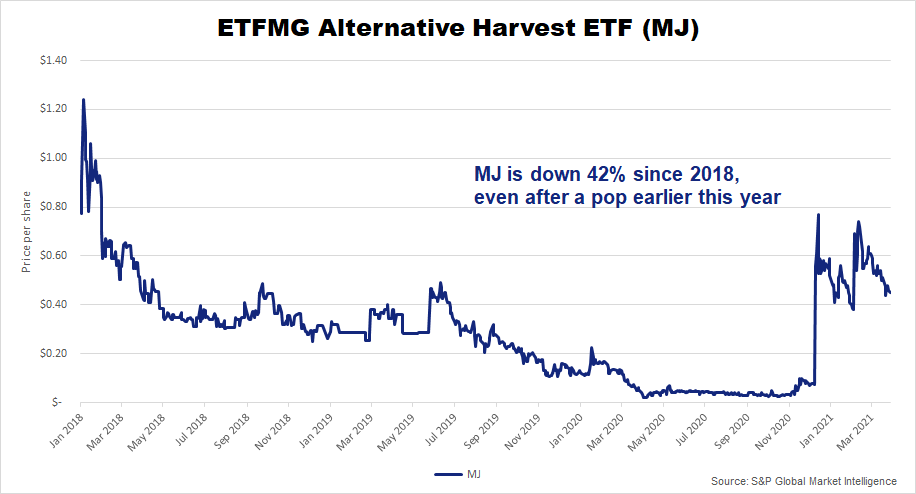

And in the same time, the ETFMG Alternative Harvest ETF (NYSE: MJ) — an exchange-traded fund (ETF) with holdings in some of the top pot companies — has hardly moved at all.

If you bought this ETF at the height of the pot mania in September of 2018, you’d be down by around 40% today…

Does it sound like these stocks are undervalued?

From where we’re sitting, they look overvalued.

You don’t make money by buying stocks that are already at their highs. Situations like this one in the market are exactly where a lot of people go wrong with their investments.

Because even if events play out how you think they will … if you overpay for a hyped-up stock, you can still end up losing money.

As my colleague Charles Mizrahi says: “Paying too much — even for a great company — will produce terrible results.”

Choosing the Right Industries

Instead of investing in hyped-up industries, you want to invest in those that Wall Street is ignoring. That’s where the big money comes from as Wall Street comes to its senses…

Those are exactly the kind of industries that Charles looks to profit from. After nearly 40 years on Wall Street, he’s honed a three-step approach in which finding the right industry is his first priority.

He has used it to select stocks that will benefit from the rise of the pot industry — even if they aren’t in it. See, with all the hype around pot stocks, there’s an opportunity in companies that are adjacent to the marijuana industry, but aren’t totally dependent on it.

One of them is an alcoholic beverage company that participates in — and dominates — an Alpha Industry, measured by trillions of dollars. With its sights set on the cannabis-infused drink market, it could see serious profits from the rise of pot.

Headed by an Alpha CEO, this company’s management team grew its sales 17% over the span of five years — a figure which Charles knew would only increase in the expanding pot market.

Along with the company’s sales projections, he also recognized that it had Alpha Money, or was being undervalued by Wall Street.

Again, right now isn’t the time to be buying actual pot stocks…

But you have the chance to get into Charles’ recommendations for stocks that are outside the hype. Click here to see how you can check out the report where he outlines this stock … plus a few others that are set to benefit.

Don’t miss it!

Regards,

Nicole Zdzieba

Assistant Managing Editor, Alpha Investor