Markets are inherently unstable. They exist to transfer risks, and risks are unstable.

If a company sells stock to the public, for example, it isn’t doing that to help the public share in its success.

The founders are usually taking partial profits. By cashing out, the original owners shift risk to public shareholders.

Inherent instability is why prices move so much in markets. Stability is relatively rare.

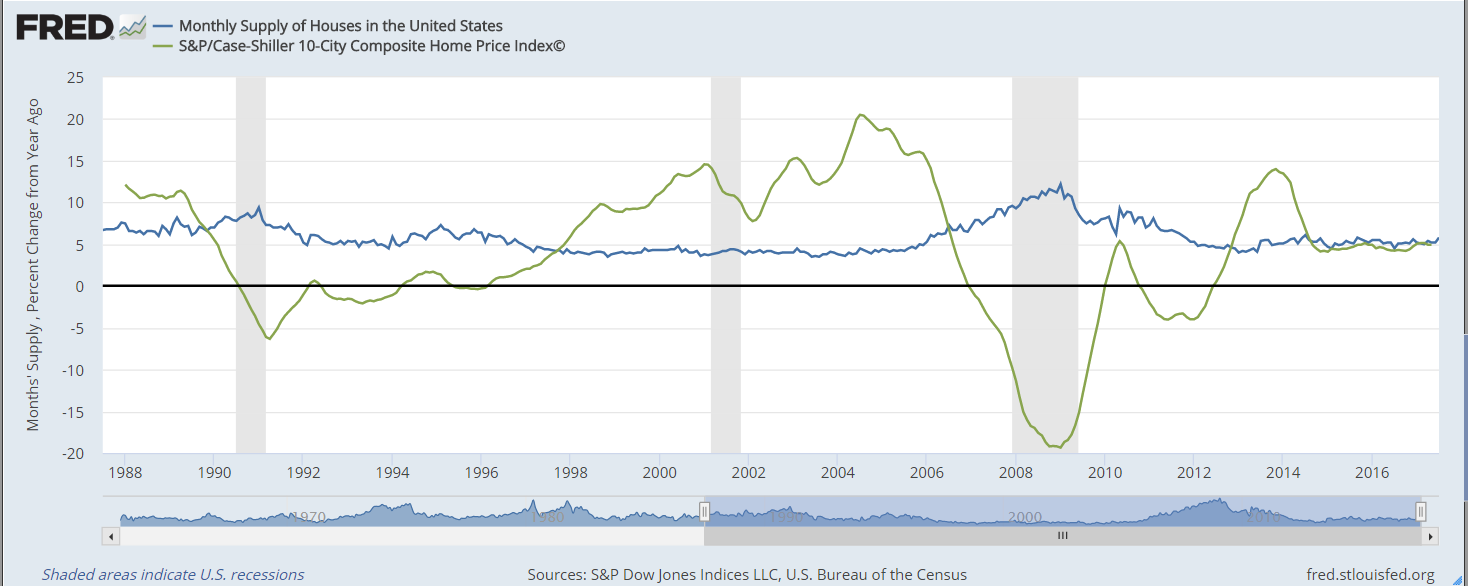

The chart below shows the housing market is in a rare state of equilibrium. This can’t last. And when it ends, I expect home prices to fall.

(Source: Federal Reserve)

The blue line shows the supply of new homes. It measures how many months of inventory builders own, based on recent sales. Right now, builders own 5.8 months’ worth of unsold homes.

The price level is the green line in the chart. That’s the annual rate of change of the S&P/Case-Shiller 10-City Composite Home Price Index.

When the trend in inventory is down, the price index tends to rise, as we saw in the late 1990s and early 2000s. When inventory rises, prices tend to fall, as we saw in the late 2000s.

In the current market, the relative steadiness of prices and inventory confirms the market is stable. That can’t last since one side (either supply or demand) will shift.

The question we face is what will cause the market’s equilibrium to fall out of balance. The answer is that the Federal Reserve will harm the housing market. Remember, it plans to raise interest rates.

When rates rise, home sales will fall. Until supply falls, prices will decline.

It will most likely take builders months to adjust the level of supply to the new dynamics of the market. Prices should stabilize when they do.

Home prices depend on local conditions. If you see a lot of construction in your area, expect a steep sell-off. Otherwise, expect a mild decline in your area.

If you’re planning to sell your home, now is the ideal time. If you want to buy, it’s best to wait a few months. If you are doing both, consider selling now, renting for a while and buying later.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader