The Journey To Greatness

Just a small-town investor, trading in a lonely market.

They took the Great Stuff train goin’ anywhere.

Just a country boy, born and raised in north Kentucky.

He writes the Great Stuff e-zine goin’ everywhere…

Great Ones, this ain’t no smoky room … and whether or not the Great Stuff Picks portfolio smells like wine or cheap perfume is entirely up to you.

Smells like whine to me! Ha!

Laugh it up, fuzz ball … cause today, we’re doing a Great Stuff Picks portfolio review!

As usual, some will win, and some will lose. And after looking at the portfolio’s average win rate of 95% and average gain of 90% … anyone not following along will sing the blues.

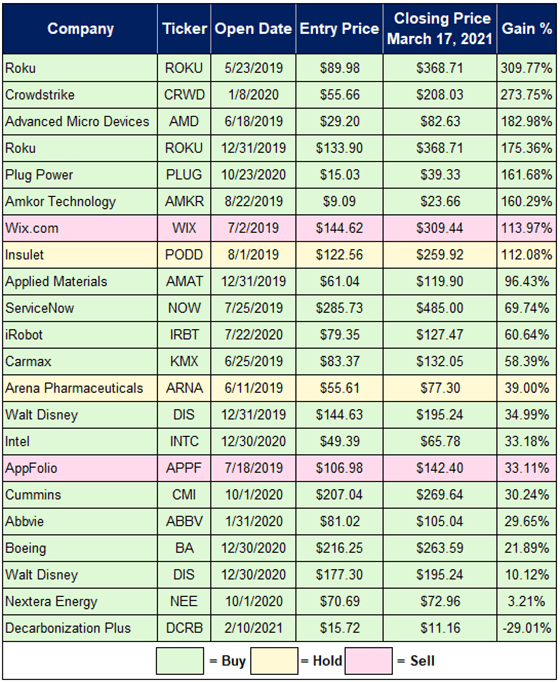

I mean, y’all are killing it! Just look:

A 300% gain on Roku (Nasdaq: ROKU) since May 2019!

A 273% gain on CrowdStrike (Nasdaq: CRWD) since January 2020!

Even our 2021 value plays, Intel (Nasdaq: INTC) and Boeing (NYSE: BA), are shining bright, up 33% and 21%, respectively. We’re talking streetlights, people!

Congratulations!

Speaking of streetlights … what’s with the green, yellow and red highlights?

Right, let’s break down those changes, shall we?

Hold Insulet (Nasdaq: PODD) — I’m putting a technical hold on PODD. The stock continues to stairstep higher, but it’s trading near key price support once again. As such, there could be more downside over the next couple of weeks due to broad-market sector rotation.

The company remains fundamentally solid, and its revolutionary insulin pump is a market staple. What’s more, any actual progress on health care reform in the U.S. could send PODD soaring. So, for the time being, we’re going to hold PODD and wait for this market rough patch to pass.

Hold Arena Pharmaceuticals (Nasdaq: ARNA) — Here’s the thing: Arena is trying to ride the cannabis wave. The company garnered a lot of hype for its cannabis-based pain relief drug, Olorinab, way back in 2017. But the hype surrounding the drug has faded significantly as cannabis legalization draws nearer.

After all, why buy synthetic pot when you can get the real thing?

Still, there’s a market for cannabis drugs since not everyone likes the wacky tobacky. Additionally, the company has an oral ulcerative colitis (UC) drug in its pipeline. The UC market is crowded, but all Arena’s competitors make injectable treatments.

A simple pill treatment could seriously disrupt this market and put ARNA on the path higher once again.

Sell Wix.com (Nasdaq: WIX) — We got in at the right time on Wix … way back in July 2019. That was pre-pandemic, pre-insanity. I never expected much more than a double on the stock, so when WIX soared due to the COVID-19 lockdowns, I let this one ride.

Well, that ride is over. Wix was unable to turn a profit even during the height of the stay-at-home/online-shopping market. Furthermore, WIX shares have rally fatigue, and investors are moving on from growth stocks. WIX may come back, but we’re going to bank that 113% gain and move on for ourselves.

Sell AppFolio (Nasdaq: APPF) — Like Wix, AppFolio is another company that squandered its pandemic opportunities. AppFolio provides app- and cloud-based real estate solutions, a combination that should’ve thrived in the past year as the housing market boomed amid rolling pandemic lockdowns.

And yet, the company has little real sales or earnings growth to show for it. Now, the lockdowns are ending, and the real estate market might be nearing a peak. It’s time to scrape that 33% profit off the table and leave AppFolio behind.

Once again, congratulations on your wins! And remember, these gains aren’t hiding somewhere in the night. They’re right here — for FREE!

Mr. Great Stuff, I’ve been working hard to get my fill. Where’s my investing thrill?

That’s the thing, you see. The Great Stuff Picks portfolio is free, but you must be a daily reader … a true Great One … to really get in on the action.

So, don’t stop believing. Hold on to that feeling … that Great Stuff every day! You never know when the next stock pick is coming. Until then, keep writing in, and keep your eyes glued to Great Stuff!

Though, I get the impression that some of y’all would like a few more trades … more trade updates … more, more, more! I’ve created a monster! You want to get tradey — I’m chopped liver. Well, if you want “free,” this is what free gets you.

But everything else is so complicated! Like when I’m rocking options trades while the market’s tanking!

Let’s keep it simple. Mike Carr has mastered an approach that narrows the market down to One. Single. Trade. Period.

You can make this trade over and over again, every single week, for the chance to make gains of 10%, 50%, even 100% or more. It takes two days on average — in fact, the top position went up 313% in just 24 hours!

Finally! Feedback time — where we cut our chitter-chatter and spotlight your questions, thoughts and earworm-digging lyrical themes. Here’s what’s on the minds of your fellow Great Ones this week:

Peddling PLUG Puts

I didn’t have PLUG in my portfolio, and agree with your long-term assessment of the hydrogen play, so I took the opportunity on the drop to sell May puts… I either get in at an even better price or make 12.5% on my cash in two months. Love using volatility to juice my returns almost as much as perusing your daily pontificating for picks. Keep ’em coming! — Justin

Oof, you’re gonna make our resident wordplay fiends swoon with that alliteration, Justin…

And let me just give the Great Stuff seal of approval to that Plug Power (Nasdaq: PLUG) trade! *Chef’s kiss* Perfect!

What a great way to name your price on PLUG shares and make market volatility work for you. Now, if Justin’s put-selling parade leaves you puzzled and dazed, check out our Options 101 guide to clear up the haze.

The play’s essence is such: You sell a put on a stock that you think has long-term potential. If the stock drops for whatever reason — i.e., PLUG freaks investors out by restating its finances — congrats, you get to buy the stock on the cheap. Obviously, make sure it’s a stock you dig … you dig?

If the stock keeps going up, you pocket the premium like a participation trophy for parking your cash in puts. What’s not to love?

Of course, this ain’t the only way to make volatility work for you with options.

Click here to learn how to use options to make market volatility work for you!

All Stimmied Up

As for the stimulus money, you bet your bottom dollar I am buying some Bitcoin, Ethereum and more America 2.0 stocks because that kind of investing has really been keeping me in the black financially. I may never return to a normal job again, plus my garden looks amazing, and I even make ceramic pots now. Life is good!

While I did see the valuation game correct itself (which we knew would happen), I don’t really know much about inflation and what causes it. I hope that what I am hearing is true and that it is a long way off and won’t affect us until we are ready for it. — Sam F.

Sammy, Sammy quite contrary … how does your garden grow? With crypto coins, Ethereum and American 2.0 stocks all in a row.

There’s lots of money sloshing ‘round the market, fresh off the press and ready to invest … the stimulus stock cycles spin on. And Sam, your plans are some of the better I’ve heard from y’all out there in the newly stimulated world.

Remember, kids, don’t SPAC up your stimulus! Or do … I’m just a virtual voice behind a screen, after all.

Me? Yeah, I’m investing that bread back into the market. Bourbon’s still an investment, right? Better than Funko Pops … or those now-super-totally-100%-official sports video clips backed by NFT, if you ask me. Now, for that inflation question…

There’s A Bathroom On The Right?

I see inflation arising. I see trouble on the way. I see supply chains disrupted. I see goods sitting in the bay (literally). The “relief with a side of extra fatty pork” package that was just passed will undoubtedly provide a Band Aid for many who have suffered way too long (and unnecessarily so cuz politics).

No doubt that this infusion will help many who have sorely been impacted by this pandemic, and their spending will go towards necessities of rents, mortgages, and debt.

But there is also a real problem that exists with our supply chains due to mandates in place that limit the amount of workers at critical points within the chain…

When you combine the supply chain issues with the projected rise in gas prices due to the Biden administration’s initiatives along with the refusal to increase domestic oil output, how can inflation NOT be on the horizon?

Looks like we’re in for nasty inflation. One eye is taken for an eye… — Mike B.

Thanks for writing in, Mike! I personally like fatty pork … and fatty tuna. Mmm … fatty tuna! But I could do without the side of inflation or government mashed potatoes.

That said, in a surprising twist of positivity, I don’t hear the voice of rage and ruin today. When inflation ire’s dire, I consult the Bauman — Ted, that is.

Last week’s Reader Feedback had Great One James asking about the rising inflation inflammation, and we pulled in economist and local bluesman Ted Bauman to give his take on the situation.

Funny you mention those supply chain problems, Mike. Right as Ted expected:

That’s the long and short of it. Short-term, we’re likely to see a jump. But with Powell pushing the pedal and keeping interest rates low, low, low, low like Flo Rida.

As I’ve also said, the “real investment boogeyman” is asset price inflation … and that barbarian is already at the gate. But we’ve already had the valuation conversation. (We’ve also had the inflation investigation, but here we are.) The supply-demand nitty-gritty is what’s catching my fancy lately.

Lemme guess … you’re going to bring up lumber again?

You bet. Any other guesses?

You … you have a way to play the lumber market?

Why, of course. Why woodn’t I? I hope you’ve got your things together, and hope you are quite prepared to thrive. Click right here.

Obligatory Wholesome Ego Booster

As if I didn’t have enough of a problem already with turning virtually every phrase of any given moment into an often-subconscious singing of a song, but also just as often into out-loud singing of a song that contains that phrase or general content.

Now I stumble upon a daily investment letter that I greatly enjoy on almost every level. My only complaint is the repetitive use of the word “anywho,” — which has always driven me nuts for some reason.

And without thinking about it, I instantly “tune in” to the musical references as they are so regularly made over the course of the much-valued learning experience.

Just wanted to be sure you knew that your clever writing efforts are not going unnoticed or unappreciated!

— Ken B.

Ken, thanks for the kind words! I’m glad the noise inside my skull makes sense to someone else. And you save my family a lot of daily pun punishment. Also … what’s the ballyhoo with “anywho?” Do you prefer “anyhoo?”

Do you have strong thoughts on the use of “y’all” like Roger M. from last week?

Why don’t you join the conversation for yourself? Maybe you’d like to see your name in nice bolded virtual print in next week’s Reader Feedback. Maybe you just want to scream about stocks and lumber into the email abyss.

Anywho, whatever’s on your mind, you all can drop us a line at: GreatStuffToday@BanyanHill.com.

And for all those numerous readers writing in saying “Add me!” or “Sign me up!” … first off, how’d you receive this? Second, all you have to do to sign up for Great Stuff is click here!

Once again: Just click here if you want to sign up for Great Stuff!

Finally, remember what Mr. Great Stuff always says: Like Stuff? Share Stuff! So be sure to share ‘Stuff with everyone right down your email list. Send it all!

And don’t forget! If you want to be in next week’s edition of Reader Feedback, drop us a line at GreatStuffToday@BanyanHill.com! But, if that’s still too many virtual hoops to jump through, why not follow along on social media? We’re on Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff