The headlines for all the various news agencies continue to be dire.

“Major, major” conflict with North Korea possible.

Government fighting to avert shutdown.

Health care reform put on hold.

And then we’ve still got to contend with Brexit and France’s runoff presidential election and their potential impacts on Europe.

But while one significant headline number released on Friday proved to be less than spectacular, it failed to add to the general market malaise. In fact, it masked an even greater opportunity that many investors could be overlooking right now…

A Lackluster Start to 2017

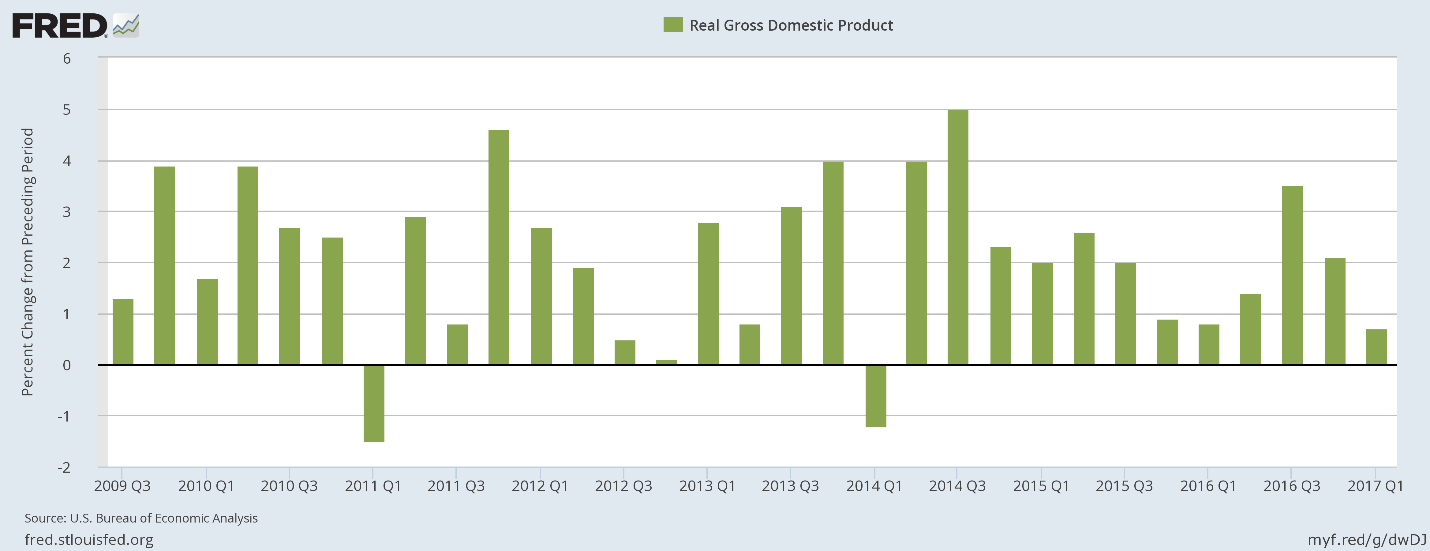

The headline gross domestic product (GDP) number for the first quarter failed to impress Wall Street Friday morning when the Commerce Department announced that the economy grew by only 0.7% — less than the consensus analyst estimate of 0.9% and down from the fourth-quarter GDP growth of 2.1%.

Digging deeper into the numbers, we find that the main culprits behind the weak showing in the first quarter were consumers and the government.

Consumer spending dried up during the first quarter, expanding at a paltry 0.3% compared to the fourth quarter’s growth of 3.5%. Much of the drop can be attributed to low home-heating bills and poor auto sales.

At the same time, government spending dropped 1.7% — the largest decline in four years.

But if economic growth is looking so bleak in the first quarter, why didn’t the market tank on Friday? Why didn’t investors sell everything and stuff their cash back under their mattresses?

Signs of Life and Growth

While first-quarter GDP growth wasn’t exactly pretty, there were a number of April economic reports hitting the wires this week that showed some excellent signs of growth that could carry us forward in 2017.

- Within the GDP report, business investment — which has been incredibly weak for several years now — grew by 10.4% in the first quarter. Companies are at last showing signs of investing in new buildings and oil drilling equipment.

- The Dallas Federal Reserve’s manufacturing report showed strong economic expansion as the general activity reading came in at a higher-than-expected 16.8. Shipments and new orders both improved.

- The Richmond Fed’s manufacturing report showed expansion for the sixth consecutive month, coming in at 20. In fact, this was the first time the Richmond Fed reported back-to-back readings of 20 or higher since 1994. Shipments increased while new orders remained unchanged at a strong reading.

- The New York Fed’s manufacturing report slowed from March’s two-year peak of 16.4, but continued to show signs of manufacturing growth at a reading of 5.2.

- The Kansas City Fed’s manufacturing report slowed from March’s strong reading of 20, but remained in positive territory — an indication of expansion within the region.

- The Institute for Supply Management’s Chicago Purchasing Manager Index report — which examines both manufacturing and nonmanufacturing activity in the region — rose to 58.3 in April from March’s reading of 57.7. Readings above 50 indicate expansion. New orders tagged their highest level since May 2014.

What this list shows is we are seeing some nice glimmers of growth around the nation, and in many cases, it’s for the second (or even sixth) month in a row.

Businesses are finally starting to spend their stockpiles of cash on the business side of things — such as equipment, employees and buildings — rather than just on another round of buybacks. Shipments are up. Orders are increasing.

If we continue to see economic growth humming along throughout the country, we will see a nice rebound in the GDP for the second quarter. And the positive reports are reason enough for investors to keep their money in stocks and not under their mattresses.

Regards,

Jocelynn Smith

Sr. Managing Editor, Sovereign Investor Daily

P.S. Michael Carr has developed four lines of code that help him identify stocks that are poised to become massive winners within the market. If you’re interested in learning how you can lock in triple-digit winners, click here now. You don’t want to miss this unique opportunity.