It’s G-20 weekend!

Aren’t you excited?

World leaders are gathering in Osaka, Japan, to discuss how best to take advantage of each other and you, the investor.

It’s kind of like Family Feud, except on a global scale. For a closer look at this growing kerfuffle, here’s your Friday Four Play:

- Russian President Vladimir Putin taunted G-20 leaders, saying that liberal democracy is obsolete. This prompted a quick round of “Nu uh! You are!” from the European representatives. European Council President Donald Tusk played Putin’s game by retorting: “What I find really obsolete are: authoritarianism, personality cults, the rule of oligarchs. Even if sometimes they may seem effective.” You tell him, Tusk!

- President Donald Trump is scheduled to meet with Putin at the G-20 summit. Trump said he expects a “very good conversation” with Putin, but told reporters that their conversation was “none of your business.” This is the first time the duo has met since the Muller report was released.

- You can’t have a G-20 and not talk about oil. Crude oil prices are slipping ahead of the meeting. With the dysfunction we’ve already seen prior to the meeting, it’s no surprise why. However, after the G-20 comes an OPEC meeting, where the organization is expected to cut output. Oil prices are in for a volatile time next week.

- Finally, the moment we’ve all been waiting for: the meeting between Trump and Chinese President Xi Jinping. The U.S. stock market was hopeful all week that the U.S. and China would reach a trade deal by the weekend.

Reports indicate that a truce could be in the works. Both countries are struggling economically, and senior administration officials believe that it wouldn’t take much for an agreement to be reached. That said, we’ve already been there, done that several times in the past year. So, take this hope with a grain of salt.

The Takeaway:

It’s going to be an interesting weekend, to say the least. Watch out for sound bites from the media trying to push a narrative. Also, be prepared for a Trump tweet that could potentially move the market. If things go well between Trump and Xi, there most definitely will be a tweet.

Finally, if investing on political news is your schtick (or even if it isn’t, for that matter), there’s one major bit of insider investing information that you need to know about right now. And that’s Presidential Memorandum O-2518.

The Good: It’s 5 O’Clock Somewhere

The stars have aligned for Constellation Brands Inc. (NYSE: STZ). The stock blasted off this morning after Constellation beat top- and bottom-line earnings expectations and provided upbeat guidance.

Investors were on edge heading into the report after the company said it would take a $106 million loss related to its Canopy Growth Corp. (NYSE: CGC) investment.

But drinks are still on the menu, as earnings were $2.40 per share excluding the CGC loss. Revenue jumped 2.4% to $2.1 billion. If this market doesn’t have you drinking now, just wait.

Constellation lifted guidance above expectations and forecast a solid year. Beer and cannabis are apparently the way to go for the second half of 2019. And we’re all for it.

The Bad: Tesla’s Pop-and-Drop Problem

It’s all about deliveries. Or is it? The narrative for Tesla Inc. (Nasdaq: TSLA) for the past month has been deliveries.

Leaked emails from Tesla talk about record deliveries and strong demand for the Model 3.

But making those deliveries won’t solve Tesla’s problems, according to analysts at UBS.

“Deliveries may provide a pop, but earnings may cause a drop,” the research and ratings firm said. UBS predicts losses to rise in the second half of the year for Tesla, with the company’s moves on pricing to impact margins.

In other words, Tesla’s push to hit deliveries will eat into earnings. UBS lowered its earnings forecast for the second half of 2019 as a result.

The Ugly: Ive Got Some Bad News

Apple Inc. (Nasdaq: AAPL) iPhones are about to be a little less fashionable. Jony Ive, one of the key designers behind the slick styling of Apple’s iPhones, is leaving the company.

Ive was reportedly the creative center for design on the classic smartphone. What’s more, Ive participated in designing Apple products for more than 30 years.

The design-centric Apple now has a massive hole to fill, and investors are worried. The departure comes at a time when Apple is struggling to deal with declining iPhone sales.

The company shifted to a services-oriented approach, but revenue hasn’t caught up fast enough to offset falling iPhone sales.

AAPL shares are down about 1% on the news.

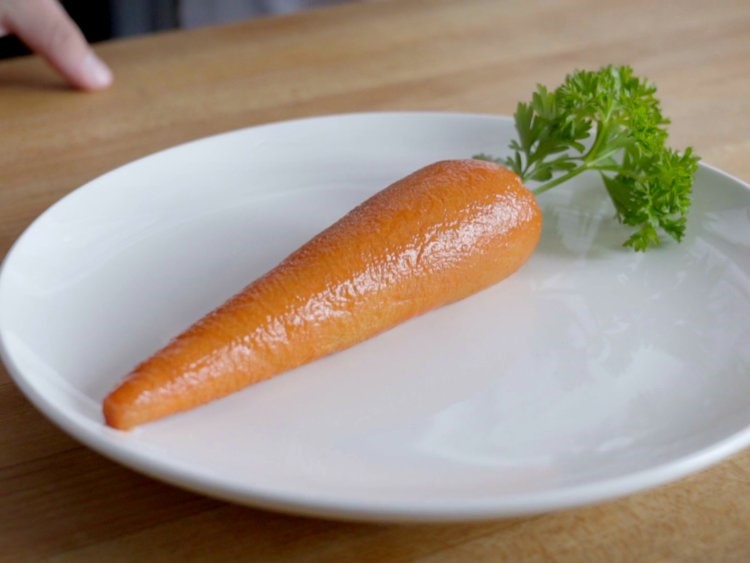

That, dear readers, is a “marrot.” What’s a marrot?

Are you sure you want to know?

Arby’s, the “We have the meats!” restauranteur, took aim at the rise of plant-based meat and created this abomination. A carrot made from turkey meat that reportedly tastes just like a real carrot. The company is calling it a “megetable.”

This is clearly poking fun at Impossible Foods Inc. and Beyond Meat Inc. (Nasdaq: BYND), but did it really have to exist? Arby’s, your scientists were so preoccupied with whether or not they could make a meat carrot, they didn’t stop to think if they should!

Meat carrot … I’m going to be sick now.

Get Great Stuff, Share Great Stuff

Are you hoarding all this Great Stuff for yourself?

Shame on you!

Puff, puff, pass … didn’t you learn anything in college?

Sharing is caring, and Great Stuff cares. It really does!

So, if you have a friend who still gets their daily financial news in that dry, Waspy old format from the major financial publications, forward them today’s copy of Great Stuff.

Liven up their day. They’ll thank you for it.

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing